Published on May 16, 2008

Venture

Capital for Tiny Technology

FIRST

QUARTER REPORT 2008

FELLOW

SHAREHOLDERS:

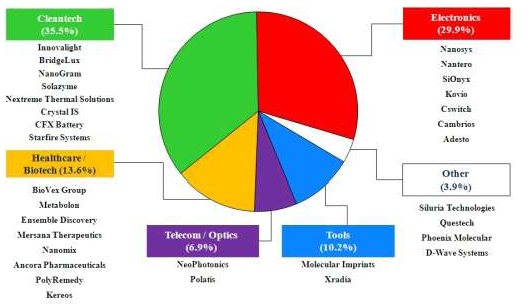

Although

all of our 31 active portfolio companies are enabled by tiny technology, and

most of them can be said to be enabled by nanotechnology per

se,

there

are various ways of categorizing the markets that our portfolio companies

address. All of our portfolio companies have products under development or

in

production that are based on proprietary technology. But for analytical

purposes, they can also be grouped. One such grouping that we find useful is

the

portfolio snapshot below, reported as a percentage of value of the total active

portfolio companies.

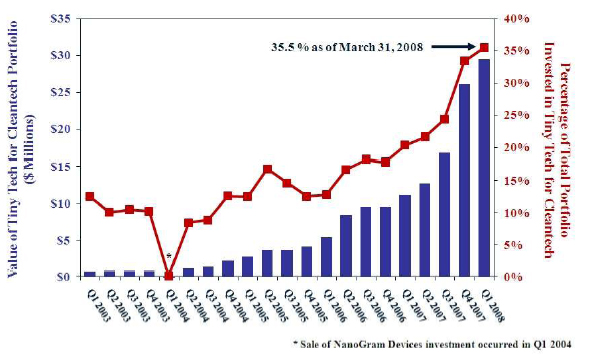

As

of

March 31, 2008, Tiny Tech for Cleantech has grown to 35.5 percent of our

portfolio. The widening gap between capabilities of existing energy solutions

and global demand has created a rare vacuum that venture-capital-funded,

entrepreneurial companies are rushing to fill. Although energy inventions come

in different shapes and forms, materials for energy are in the forefront of

changes in energy generation, storage, and utilization, and nanotechnology

is in

the forefront of materials innovation. Below is a graph showing the growth

in

the value of the "Tiny Tech for Cleantech" portion of our portfolio, updated

to

March 31, 2008, from a similar graph with earlier data in our Letter to

Shareholders in our 2007 annual report.

At

our

recent annual meeting of shareholders, we gave brief presentations on each

of

the eight companies in the Tiny Tech for Cleantech portion of our portfolio.

As

most of you were not able to attend the shareholders' meeting, you may find

the

brief sketches of these companies in the paragraphs that follow, similar to

the

presentations that we gave at the shareholders' meeting, to be of interest.

For

more information, the websites of these companies provide varying amounts of

information, depending on how much each of these private companies has chosen

to

reveal of itself at its stage of commercialization. Both Innovalight, Inc.,

and

Nanogram Corporation are developing solar-cell technologies; Solazyme, Inc.,

is

developing algal biodiesel; Nextreme Thermal Solutions, Inc., is developing

micro-scale thermal and power-management products; Starfire Systems, Inc.,

is

using its ceramic-forming polymers to produce lightweight, fuel-saving, brakes

and brake rotors for the automotive industry; CFX Battery, Inc., is developing

energy-storage solutions; and both Crystal IS, Inc., and BridgeLux, Inc., are

developing technologies and applications for light-emitting diodes

(LEDs).

Innovalight

(www.innovalight.com) is developing renewable energy products, including

ultra-low-cost, thin-film, solar panels. The company is using a proprietary,

silicon nanocrystalline ink process to print thin-film solar panels, which

may

enable more affordable solar-energy solutions for residential and commercial

applications. Because the cost of solar energy has been a major factor limiting

its adoption, Innovalight's technology, if successful, could revolutionize

the

solar market. Instead of using traditional manufacturing methods, Innovalight's

process is solvent based, lending itself to low-cost production and

high-throughput manufacturing. The company was recognized as a 2006 Technology

Pioneer winner at the World Economic Forum, and has been profiled in Time

Magazine, The Economist, Red Herring, and other major publications as a

technology leader.

NanoGram

(www.nanogram.com) utilizes its proprietary laser pyrolysis and

laser-reaction-deposition (LRD) technologies to synthesize and deposit

inorganic nanocrystals on a variety of substrates. Currently, a focus of

Nanogram is the development of silicon-based solar cells. In addition to

photovoltaics, Nanogram is exploring applications of LRD technology in

solid-state lighting, advanced batteries, and other energy applications.

Solazyme

(www.solazyme.com) is developing algal biodiesel, industrial chemicals and

special ingredients based on synthetic biology. Solazyme engineers marine

algae to create clean and scalable solutions for renewable energy. Algae

reproduces faster than plants and animals from which oils are derived, has

a

high starting oil content, and contains no sulfur. Solazyme engineers the algae

to increase its oil production and to be grown on waste-sugar sources.

This use of waste-sugar sources permits Solazyme to produce algal-based oil

at

lower cost and without replacing land historically used for feedstock crops.

The

oil is catalytically reacted with methanol in a process called

transesterification to produce biodiesel.

Nextreme

(www.nextremethermal.com) develops micro-scale thermal and power-management

products for the semiconductor, photonics, consumer, automotive, and

defense/aerospace industries. One application of Nextreme’s thermoelectric

products is the generation of electricity via the Seebeck Effect, which produces

electricity from a temperature differential applied across a device. Nextreme's

miniature, thin-film, thermoelectric generators (eTEGs) enable recycling of

heat

to electricity. eTEGs are ideal for waste-heat conversion applications, in

which the solid-state eTEG delivers power-generation densities in excess of

those achieved using bulk materials. The solid-state eTEG can be optimized

to

provide power in a form factor as much as 20x thinner than bulk-material

alternatives.

Starfire

Systems (www.starfiresystems.com) is utilizing its proprietary, nanostructured,

ceramic-forming polymers to manufacture silicon-carbide (SiC) ceramic brakes

and

brake rotors for the automotive industry. These brakes could replace standard

cast-iron or drum brakes. Starfire's brakes would reduce the weight of a

standard SUV's brakes from approximately 28 pounds to approximately eight

pounds. The lightweight SiC ceramic reduces the amount of energy needed to

accelerate a vehicle, permitting faster acceleration while reducing fuel

consumption. This fuel economy is most notable in city driving, where vehicles

utilizing Starfire's SiC brakes have shown four percent improvement in fuel

economy. Additionally, Starfire’s SiC ceramic brakes dampen rather than amplify

noise, perform better for longer periods of time than standard brakes, and

make

it easier to turn a vehicle's wheels, providing improved handling at high

speeds.

CFX

Battery (www.cfxbattery.com) is a 2007 spin-out of Caltech. CFX Battery’s

objective is to provide unique, cost-effective, state-of-the-art energy storage

solutions for a wide variety of applications. Over

the

next several years, CFX Battery envisions the development and rollout of a

family of primary (non-rechargeable) and secondary (rechargeable) batteries

that

use proprietary, advanced technology to deliver superior performance, safety,

and weight- and cost-reduction.

Crystal

IS (www.crystal-is.com) is addressing the need for efficient, chemical-free

water purification by enabling solid-state, ultraviolet (UV), light-emitting

diodes (LEDs). The company has a proprietary method for producing

single-crystal, aluminum-nitride (AlN) wafers that are the basis for making

UV

LEDs and other devices. UV devices rely on nitride-semiconducting layers, such

as GaN and AlxGa1-xN alloys. Because there has not been an ideal substrate

for

UV devices, manufacturers have had to rely on less than ideal sapphire

substrates. Sapphire suffers from numerous crystal-scale defects,

thermal-expansion problems, and poor thermal conductivity. AlN is not only

superior in all of these areas, but also has 10 times greater thermal

conductivity than sapphire, leading to higher efficiency and more reliable

devices. Products that would benefit from AlN wafers include: UV LEDs; UV lasers

for next-generation optical data storage; high-temperature electronics;

high-power RF and microwave devices; and other nitride-based

semiconductors.

BridgeLux

(www.bridgelux.com) manufactures light-emitting diodes (LEDs) that enable

energy-saving, solid-state lighting. LED-based lighting is more energy efficient

than incandescent lighting and even rivals the energy efficiency of fluorescent

lighting. Moreover, as compared with fluorescent lights, LEDs are more reliable,

provide better color quality, and do not contain harmful chemicals. Presently,

LEDs are found in mobile devices, backlights for computer displays, and signage.

As LED efficiencies have increased, they have begun to be utilized in general

lighting applications as well. BridgeLux is advancing the efficiency of

solid-state lighting through its proprietary epitaxy process and novel chip

design. In addition to LED chips, BridgeLux is developing a variety of white

and

blue LED arrays. BridgeLux's LED solutions are expected to help advance the

performance of solid-state lighting, open new markets, and hasten the adoption

of LEDs as an energy-saving technology.

The

growth in the Tiny Tech for Cleantech portion of our portfolio is the result

of

additional investment by us as well as increases in valuations reflecting

investments in these eight companies by sophisticated, third-party investors.

We

now value our Tiny Tech for Cleantech holdings at $29,482,246, versus our cost

of $19,169,612. We would not be surprised if continued growth of cleantech

and

its increasing reliance on nano-structured advanced materials result in Tiny

Tech for Cleantech continuing to grow as a percentage of our

portfolio.

|

|

|

|

Charles

E. Harris

|

Douglas

W. Jamison

|

Daniel

B. Wolfe

|

|

Chairman

and Chief Executive Officer

|

President

and Chief Operating Officer

|

Chief

Financial Officer

|

|

Managing

Director

|

Managing

Director

|

Managing

Director

|

|

|

|

|

Michael

A. Janse

|

Alexei

A. Andreev

|

|

|

Executive

Vice President

|

Executive

Vice President

|

|

|

Managing

Director

|

Managing

Director

|

|

May

16,

2008

This

letter may contain statements of a forward-looking nature relating to future

events. These forward-looking statements are subject to the inherent

uncertainties in predicting future results and conditions. These statements

reflect the Company's current beliefs, and a number of important factors could

cause actual results to differ materially from those expressed in this letter.

Please see the Company's Annual Report on Form 10-K for the fiscal year ended

December 31, 2007, the Company's Registration Statement on Form N-2, the

Company's report on Form 10-Q for the quarter ended March 31, 2008 and

subsequent filings, filed with the Securities and Exchange Commission, for

a

more detailed discussion of the risks and uncertainties associated with the

Company's business, including but not limited to the risks and uncertainties

associated with venture capital investing and other significant factors that

could affect the Company's actual results. Except as otherwise required by

Federal securities laws, Harris & Harris Group, Inc.®,

undertakes no obligation to update or revise these forward-looking statements

to

reflect new events or uncertainties. The reference to the website

www.TinyTechVC.com and to the websites of all portfolio companies have been

provided as a convenience, and the information contained on such websites is

not

incorporated by reference into this letter. Harris & Harris Group,

Inc.®,

is not

responsible for the contents of third party websites.

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

STATEMENTS OF ASSETS AND

LIABILITIES*

|

ASSETS

|

March

31, 2008

|

December

31, 2007

|

||||||

|

(Unaudited)

|

|||||||

|

Investments,

in portfolio securities at value

|

|||||||

|

(cost:

$84,013,804 and $82,677,528, respectively)

|

$

|

83,097,863

|

$

|

78,110,384

|

|||

|

Investments,

in U.S. Treasury obligations at value

|

|||||||

|

(cost:

$52,346,992 and $59,552,933, respectively)

|

53,589,100

|

60,193,593

|

|||||

|

Cash

and cash equivalents

|

210,154

|

330,009

|

|||||

|

Restricted

funds

|

2,520,310

|

2,667,020

|

|||||

|

Receivable

from portfolio company

|

0

|

524

|

|||||

|

Interest

receivable

|

497,488

|

647,337

|

|||||

|

Prepaid

expenses

|

412,589

|

488,667

|

|||||

|

Other

assets

|

445,135

|

455,798

|

|||||

|

Total

assets

|

$

|

140,772,639

|

$

|

142,893,332

|

|||

|

LIABILITIES

& NET ASSETS

|

|||||||

|

Accounts

payable and accrued liabilities

|

$

|

4,218,484

|

$

|

4,515,463

|

|||

|

Deferred

rent

|

12,866

|

14,525

|

|||||

|

Total

liabilities

|

4,231,350

|

4,529,988

|

|||||

|

Net

assets

|

$

|

136,541,289

|

$

|

138,363,344

|

|||

|

Net

assets are comprised of:

|

|||||||

|

Preferred

stock, $0.10 par value, 2,000,000 shares authorized; none

issued

|

$

|

0

|

$

|

0

|

|||

|

Common

stock, $0.01 par value, 45,000,000 shares authorized at

|

|||||||

|

3/31/08

and 12/31/07; 25,143,313 issued at 3/31/08 and 12/31/07

|

251,434

|

251,434

|

|||||

|

Additional

paid in capital

|

162,394,671

|

160,927,691

|

|||||

|

Accumulated

net realized loss

|

(23,025,452

|

)

|

(15,483,766

|

)

|

|||

|

Accumulated

unrealized appreciation (depreciation) of investments

|

326,167

|

(3,926,484

|

)

|

||||

|

Treasury

stock, at cost (1,828,740 shares at 3/31/08 and 12/31/07)

|

(3,405,531

|

)

|

(3,405,531

|

)

|

|||

|

Net

assets

|

$

|

136,541,289

|

$

|

138,363,344

|

|||

|

Shares

outstanding

|

23,314,573

|

23,314,573

|

|||||

|

Net

asset value per outstanding share

|

$

|

5.86

|

$

|

5.93

|

|||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

STATEMENTS OF OPERATIONS*

(Unaudited)

|

|

Three

Months Ended

|

Three

Months Ended

|

||||||

|

March

31, 2008

|

March

31, 2007

|

||||||

|

Investment

income:

|

|||||||

|

Interest

from:

|

|||||||

|

Fixed

income securities

|

$

|

576,302

|

$

|

652,498

|

|||

|

Total

investment income

|

576,302

|

652,498

|

|||||

|

Expenses:

|

|||||||

|

Salaries,

benefits and stock-based compensation

|

2,433,295

|

2,534,766

|

|||||

|

Administration

and operations

|

301,855

|

380,865

|

|||||

|

Professional

fees

|

138,232

|

182,195

|

|||||

|

Rent

|

57,854

|

59,507

|

|||||

|

Directors'

fees and expenses

|

105,146

|

141,196

|

|||||

|

Depreciation

|

13,985

|

15,313

|

|||||

|

Custodian

fees

|

6,553

|

5,774

|

|||||

|

Total

expenses

|

3,056,920

|

3,319,616

|

|||||

|

Net

operating loss

|

(2,480,618

|

)

|

(2,667,118

|

)

|

|||

|

Net

realized loss from investments:

|

|||||||

|

Realized

(loss) from investments

|

(5,014,870

|

)

|

(674

|

)

|

|||

|

Income

tax expense

|

46,198

|

84,905

|

|||||

|

Net

realized (loss) from investments

|

(5,061,068

|

)

|

(85,579

|

)

|

|||

|

Net

decrease (increase) in unrealized

|

|||||||

|

depreciation

on investments:

|

|||||||

|

Change

as a result of investment sales

|

5,014,653

|

0

|

|||||

|

Change

on investments held

|

(762,002

|

)

|

(3,637,463

|

)

|

|||

|

Change

in unrealized depreciation on investments

|

4,252,651

|

(3,637,463

|

)

|

||||

|

Net

decrease (increase) in unrealized depreciation on

investments

|

4,252,651

|

(3,637,463

|

)

|

||||

|

Net

decrease in net assets resulting from operations:

|

|||||||

|

Total

|

$

|

(3,289,035

|

)

|

$

|

(6,390,160

|

)

|

|

|

Per

average basic and diluted outstanding share

|

$

|

(0.14

|

)

|

$

|

(0.30

|

)

|

|

|

Average

outstanding shares

|

23,314,573

|

21,277,576

|

|||||

*Selected

quarterly financial information. The information contained herein does not

include the full unaudited quarterly financial information. Please see the

Company's report on Form 10-Q for the quarter ended March 31, 2008 for the

unaudited financial information and notes thereto.