EX-99.2

Published on November 24, 2025

MOUNT LOGAN CAPITAL INC.

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (UNAUDITED)

| (in thousands, except per share data) | June 30, 2025 | December 31, 2024 | |||||||||

| ASSETS | |||||||||||

| Asset Management | |||||||||||

| Cash and cash equivalents | $ | 2,748 | $ | 8,933 | |||||||

| Investments (including related party amounts of $24,966 and $20,871 at June 30, 2025 and December 31, 2024, respectively) | 25,417 | 21,370 | |||||||||

| Intangible assets | 23,141 | 25,940 | |||||||||

| Other assets (including related party amounts of $2,937 and $2,657 at June 30, 2025 and December 31, 2024, respectively) | 10,146 | 9,179 | |||||||||

| 61,452 | 65,422 | ||||||||||

| Insurance Solutions | |||||||||||

| Cash and cash equivalents | 97,533 | 51,999 | |||||||||

| Restricted cash | 11,258 | 15,716 | |||||||||

| Investments (including related party amounts of $21,990 and $23,659 at June 30, 2025 and December 31, 2024, respectively) | 926,276 | 915,556 | |||||||||

| Assets of consolidated variable interest entities | |||||||||||

| Cash and cash equivalents | 22,233 | 25,056 | |||||||||

| Investments | 129,053 | 125,898 | |||||||||

| Other assets | 1,144 | 1,048 | |||||||||

| Reinsurance recoverable | 267,068 | 259,454 | |||||||||

| Intangible assets | 2,444 | 2,444 | |||||||||

| Deferred acquisition costs | 8,457 | 6,524 | |||||||||

| Goodwill | 55,697 | 55,697 | |||||||||

| Other assets | 20,453 | 37,135 | |||||||||

| 1,541,616 | 1,496,527 | ||||||||||

| Total assets | $ | 1,603,068 | $ | 1,561,949 | |||||||

| LIABILITIES | |||||||||||

| Asset Management | |||||||||||

| Due to related parties | $ | 13,567 | $ | 10,470 | |||||||

| Debt obligations | 73,995 | 74,963 | |||||||||

| Accrued expenses and other liabilities | 10,423 | 5,669 | |||||||||

| 97,985 | 91,102 | ||||||||||

| Insurance Solutions | |||||||||||

| Future policy benefits | 779,860 | 769,533 | |||||||||

| Interest sensitive contract liabilities | 363,284 | 334,876 | |||||||||

| Funds held under reinsurance contracts | 237,281 | 239,918 | |||||||||

| Debt obligations | 17,250 | 14,250 | |||||||||

| Derivatives | 457 | 5,192 | |||||||||

| Accrued expenses and other liabilities | 7,243 | 2,995 | |||||||||

| 1,405,375 | 1,366,764 | ||||||||||

| Total liabilities | 1,503,360 | 1,457,866 | |||||||||

| Commitments and Contingencies (See Note 23) | |||||||||||

| EQUITY | |||||||||||

| Common shares | 121,372 | 116,118 | |||||||||

| Warrants | 1,426 | 1,426 | |||||||||

| Additional paid-in-capital | 8,166 | 7,777 | |||||||||

| Retained earnings (accumulated deficit) | (66,727) | (58,279) | |||||||||

| Accumulated other comprehensive income (loss) | 35,471 | 37,041 | |||||||||

| Total equity | 99,708 | 104,083 | |||||||||

| Total liabilities and equity | $ | 1,603,068 | $ | 1,561,949 | |||||||

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements (Unaudited).

F-1

MOUNT LOGAN CAPITAL INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

| Three months ended June, 30 | Six months ended June, 30 | ||||||||||||||||||||||

| (in thousands, except per share data) | 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||

| REVENUES | |||||||||||||||||||||||

| Asset Management | |||||||||||||||||||||||

| Management fees | $ | 2,809 | $ | 2,825 | $ | 6,049 | $ | 5,416 | |||||||||||||||

| Incentive fees | 478 | 1,008 | 777 | 1,911 | |||||||||||||||||||

| Equity investment earning | 42 | (57) | 324 | 167 | |||||||||||||||||||

| 3,329 | 3,776 | 7,150 | 7,494 | ||||||||||||||||||||

| Insurance Solutions | |||||||||||||||||||||||

| Net premiums | (4,238) | (3,717) | (8,251) | (7,330) | |||||||||||||||||||

| Product charges | 722 | 73 | 1,582 | 107 | |||||||||||||||||||

| Net investment income | 16,678 | 19,023 | 31,629 | 36,400 | |||||||||||||||||||

| Net gains (losses) from investment activities | 3,838 | (1,293) | 5,310 | (2,067) | |||||||||||||||||||

| Net revenues of consolidated variable interest entities | 3,549 | 3,964 | 7,182 | 8,643 | |||||||||||||||||||

| Net investment income (loss) on funds withheld | (6,826) | (7,926) | (12,576) | (15,312) | |||||||||||||||||||

| Other income | 78 | 76 | 154 | 158 | |||||||||||||||||||

| 13,801 | 10,200 | 25,030 | 20,599 | ||||||||||||||||||||

| Total revenues | 17,130 | 13,976 | 32,180 | 28,093 | |||||||||||||||||||

| EXPENSES | |||||||||||||||||||||||

| Asset Management | |||||||||||||||||||||||

| Administration and servicing fees | 1,812 | 1,952 | 3,049 | 3,375 | |||||||||||||||||||

| Transaction costs | 2,753 | (198) | 7,298 | 53 | |||||||||||||||||||

| Compensation and benefits | 1,836 | 1,873 | 4,216 | 3,576 | |||||||||||||||||||

| Amortization and impairment of intangible assets | 1,889 | 482 | 2,799 | 964 | |||||||||||||||||||

| Interest and other credit facility expenses | 1,960 | 1,661 | 3,906 | 3,363 | |||||||||||||||||||

| General, administrative and other | 1,258 | 1,042 | 2,981 | 3,274 | |||||||||||||||||||

| 11,508 | 6,812 | 24,249 | 14,605 | ||||||||||||||||||||

| Insurance Solutions | |||||||||||||||||||||||

| Net policy benefit and claims (remeasurement gain on policy liabilities of $2,945 and $3,025 and $1,881 and $7,306 for the three and six months ended June 30, 2025 and 2024, respectively) | (1,064) | (887) | 729 | (5,148) | |||||||||||||||||||

| Interest sensitive contract benefits | 3,997 | 3,733 | 7,815 | 7,138 | |||||||||||||||||||

| Amortization of deferred acquisition costs | 905 | 550 | 1,460 | 1,037 | |||||||||||||||||||

| Compensation and benefits | 223 | 465 | 467 | 649 | |||||||||||||||||||

| Interest expense | 407 | 328 | 735 | 656 | |||||||||||||||||||

| General, administrative and other (including related party amounts of $1,753 and $3,485 and $1,802 and $3,569 for the three and six months ended June 30, 2025 and 2024, respectively) | 3,270 | 4,272 | 6,956 | 8,606 | |||||||||||||||||||

| 7,738 | 8,461 | 18,162 | 12,938 | ||||||||||||||||||||

| Total expenses | 19,246 | 15,273 | 42,411 | 27,543 | |||||||||||||||||||

| Investment and other income (loss) - Asset Management | |||||||||||||||||||||||

| Net gains (losses) from investment activities | 867 | (896) | 1,708 | (1,114) | |||||||||||||||||||

| Dividend income | 29 | 113 | 67 | 225 | |||||||||||||||||||

| Interest income | 271 | 272 | 539 | 543 | |||||||||||||||||||

| Other income (loss), net | 6 | — | 305 | — | |||||||||||||||||||

| Total investment and other income (loss) | 1,173 | (511) | 2,619 | (346) | |||||||||||||||||||

| Income (loss) before taxes | (943) | (1,808) | (7,612) | 204 | |||||||||||||||||||

| Income tax (expense) benefit — Asset Management | 9 | (189) | (27) | (184) | |||||||||||||||||||

| Net income (loss) | $ | (934) | $ | (1,997) | $ | (7,639) | $ | 20 | |||||||||||||||

| Earnings per share | |||||||||||||||||||||||

| Net income (loss) attributable to common shareholders - Basic | $ | (0.03) | $ | (0.08) | $ | (0.27) | NM | ||||||||||||||||

| Net income (loss) attributable to common shareholders - Diluted | (0.03) | (0.08) | (0.27) | NM | |||||||||||||||||||

| Weighted average shares outstanding – Basic | 28,666,080 | 25,797,739 | 28,215,408 | 25,771,715 | |||||||||||||||||||

| Weighted average shares outstanding – Diluted | 28,666,080 | 25,797,739 | 28,215,408 | 26,003,327 | |||||||||||||||||||

Note: “NM” denotes not meaningful

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements (Unaudited).

F-2

MOUNT LOGAN CAPITAL INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

| Three months ended June 30, | Six months ended June 30, | |||||||||||||||||||||||||

| (in thousands, except per share data) | 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||||

| Net income (loss) | $ | (934) | $ | (1,997) | $ | (7,639) | $ | 20 | ||||||||||||||||||

| Other comprehensive income (loss), before tax: | ||||||||||||||||||||||||||

| Unrealized investment gains (losses) on available-for-sale securities | (917) | 955 | 1,687 | 4,179 | ||||||||||||||||||||||

| Unrealized gains (losses) on hedging instruments | 1,407 | (1,787) | 4,735 | (2,458) | ||||||||||||||||||||||

| Remeasurement gains (losses) on future policy benefits related to discount rate | (2,849) | 4,597 | (7,992) | 10,817 | ||||||||||||||||||||||

| Other comprehensive income (loss), before tax | (2,359) | 3,765 | (1,570) | 12,538 | ||||||||||||||||||||||

| Income tax expense (benefit) related to other comprehensive income (loss) | — | — | — | — | ||||||||||||||||||||||

| Other comprehensive income (loss) | (2,359) | 3,765 | (1,570) | 12,538 | ||||||||||||||||||||||

| Comprehensive income (loss) | $ | (3,293) | $ | 1,768 | $ | (9,209) | $ | 12,558 | ||||||||||||||||||

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements (Unaudited).

F-3

MOUNT LOGAN CAPITAL INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY (UNAUDITED)

(in thousands, except for number of shares)

| Three and Six Months Ended June 30, 2025 | Number of Voting Common Shares | Common Shares | Warrants | Additional Paid in Capital | Retained Earnings (Accumulated Deficit) | Accumulated Other Comprehensive Income (loss) | Total Equity | |||||||||||||||||||||||||||||||||||||

| Balance at April 1, 2025 | 28,666,080 | $ | 121,372 | $ | 1,426 | $ | 7,825 | $ | (65,383) | $ | 37,830 | $ | 103,070 | |||||||||||||||||||||||||||||||

| Share issuance | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| Equity based compensation | — | — | — | 341 | — | — | 341 | |||||||||||||||||||||||||||||||||||||

| Restricted stock release | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| Shareholder dividends | — | — | — | — | (410) | — | (410) | |||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | (934) | — | (934) | |||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | — | — | — | — | — | (2,359) | (2,359) | |||||||||||||||||||||||||||||||||||||

| Balance at June 30, 2025 | 28,666,080 | $ | 121,372 | $ | 1,426 | $ | 8,166 | $ | (66,727) | $ | 35,471 | $ | 99,708 | |||||||||||||||||||||||||||||||

| Balance at January 1, 2025 | 25,895,612 | $ | 116,118 | $ | 1,426 | $ | 7,777 | $ | (58,279) | $ | 37,041 | $ | 104,083 | |||||||||||||||||||||||||||||||

| Share issuance | 2,693,071 | 5,000 | — | — | — | — | 5,000 | |||||||||||||||||||||||||||||||||||||

| Equity based compensation | 17,315 | 45 | — | 674 | — | — | 719 | |||||||||||||||||||||||||||||||||||||

| Restricted stock release | 60,082 | 209 | — | (285) | — | — | (76) | |||||||||||||||||||||||||||||||||||||

| Shareholder dividends | — | — | — | — | (809) | — | (809) | |||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | (7,639) | — | (7,639) | |||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | — | — | — | — | — | (1,570) | (1,570) | |||||||||||||||||||||||||||||||||||||

| Balance at June 30, 2025 | 28,666,080 | $ | 121,372 | $ | 1,426 | $ | 8,166 | $ | (66,727) | $ | 35,471 | $ | 99,708 | |||||||||||||||||||||||||||||||

| Three and Six Months Ended June 30, 2024 | Number of Voting Common Shares | Common Shares | Warrants | Additional Paid in Capital | Retained Earnings (Accumulated Deficit) | Accumulated Other Comprehensive Income (Loss) | Total Equity | |||||||||||||||||||||||||||||||||||||

| Balance at April 1, 2024 | 25,797,739 | $ | 115,845 | $ | 1,426 | $ | 7,605 | $ | (44,752) | $ | 35,859 | $ | 115,983 | |||||||||||||||||||||||||||||||

| Issuance of warrants | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| Equity based compensation | — | — | — | 67 | — | — | 67 | |||||||||||||||||||||||||||||||||||||

| Restricted stock release | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| Shareholder dividends | — | — | — | — | (375) | — | (375) | |||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | (1,997) | — | (1,997) | |||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | — | — | — | — | — | 3,765 | 3,765 | |||||||||||||||||||||||||||||||||||||

| Balance at June 30, 2024 | 25,797,739 | $ | 115,845 | $ | 1,426 | $ | 7,672 | $ | (47,124) | $ | 39,624 | $ | 117,443 | |||||||||||||||||||||||||||||||

| Balance at January 1, 2024 | 25,733,735 | $ | 115,607 | $ | 1,129 | $ | 7,820 | $ | (46,386) | $ | 27,086 | $ | 105,256 | |||||||||||||||||||||||||||||||

| Issuance of warrants | — | — | 297 | — | — | — | 297 | |||||||||||||||||||||||||||||||||||||

| Equity based compensation | — | — | — | 142 | — | — | 142 | |||||||||||||||||||||||||||||||||||||

| Restricted stock release | 64,004 | 238 | — | (290) | — | — | (52) | |||||||||||||||||||||||||||||||||||||

| Shareholder dividends | — | — | — | — | (758) | — | (758) | |||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | 20 | — | 20 | |||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | — | — | — | — | — | 12,538 | 12,538 | |||||||||||||||||||||||||||||||||||||

| Balance at June 30, 2024 | 25,797,739 | $ | 115,845 | $ | 1,426 | $ | 7,672 | $ | (47,124) | $ | 39,624 | $ | 117,443 | |||||||||||||||||||||||||||||||

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements (Unaudited).

F-4

MOUNT LOGAN CAPITAL INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| Six months ended June 30, | |||||||||||

| (in thousands) | 2025 | 2024 | |||||||||

| Cash Flows from Operating Activities | |||||||||||

| Net income (loss) | $ | (7,639) | $ | 20 | |||||||

| Adjustments to reconcile net income (loss) to net cash used in operating activities: | |||||||||||

| Net realized (gains) losses on investments | 1,996 | (840) | |||||||||

| Net realized (gains) losses on foreign currency | 11 | 2 | |||||||||

| Net change in unrealized (gains) losses on investments | (7,316) | 3,300 | |||||||||

| Net change in (gain) loss on foreign currency | (36) | 26 | |||||||||

| Change in fair value of debt obligation | (1,339) | 261 | |||||||||

| Payment in-kind interest | 144 | (418) | |||||||||

| Equity investment earnings | (324) | (167) | |||||||||

| Amortization of debt issuance costs | 251 | 177 | |||||||||

| Amortization of deferred acquisition costs | 1,460 | 1,037 | |||||||||

| Amortization of intangible assets | 2,799 | 964 | |||||||||

| Net amortization of premiums and accretion of discounts on investments | 177 | (524) | |||||||||

| Equity based compensation | 643 | 90 | |||||||||

| Increase (decrease) in estimated credit losses | 218 | 861 | |||||||||

| (Increase) decrease in operating assets: | |||||||||||

| Reinsurance recoverable | 3,623 | 18,378 | |||||||||

| Change in deferred acquisition costs | (3,393) | (2,179) | |||||||||

| Distributions from equity method investments | 892 | 1,051 | |||||||||

| Other assets | (1,024) | 2,788 | |||||||||

| Other assets of consolidated VIEs | (96) | (199) | |||||||||

| Purchases of investments by consolidated VIEs | (33,952) | (58,580) | |||||||||

| Proceeds from sale of investments by consolidated VIEs | 30,932 | 48,366 | |||||||||

| Increase (decrease) in operating liabilities: | |||||||||||

| Due to affiliates | 3,086 | 509 | |||||||||

| Future policy benefits | (8,903) | (27,049) | |||||||||

| Interest sensitive contract liabilities | 7,815 | 7,138 | |||||||||

| Funds held under reinsurance contracts | (2,637) | 1,869 | |||||||||

| Accrued expenses and other liabilities | 5,619 | (18,938) | |||||||||

| Net cash used in operating activities | $ | (6,993) | $ | (22,057) | |||||||

| Investing Activities | |||||||||||

| Purchases of investments | $ | (130,680) | $ | (152,127) | |||||||

| Proceeds from sales and repayments of investments | 147,725 | 114,869 | |||||||||

| Net cash provided by (used in) investing activities | $ | 17,045 | $ | (37,258) | |||||||

| Financing Activities | |||||||||||

| Shareholder dividends | $ | (809) | $ | (758) | |||||||

| Proceeds from borrowings of asset management business | — | 18,752 | |||||||||

| Repayments of borrowings of asset management business | (768) | (15,063) | |||||||||

| Proceeds from borrowings of insurance business | 3,000 | — | |||||||||

| Deposits on investment-type policies and contracts | 42,996 | 75,933 | |||||||||

| Withdrawals on investment-type policies and contracts | (22,403) | (8,743) | |||||||||

| Net cash provided by (used in) financing activities | $ | 22,016 | $ | 70,121 | |||||||

| Net increase (decrease) in cash, cash equivalents and restricted cash, and cash and cash equivalents of consolidated VIEs | 32,068 | 10,806 | |||||||||

| Cash, cash equivalents and restricted cash, and cash and cash equivalents of consolidated VIEs, beginning of the period | 101,704 | 90,220 | |||||||||

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements (Unaudited).

F-5

| Six months ended June 30, | |||||||||||

| (in thousands) | 2025 | 2024 | |||||||||

| Cash Flows from Operating Activities | |||||||||||

| Cash, cash equivalents and restricted cash, and cash and cash equivalents of consolidated VIEs, end of period | $ | 133,772 | $ | 101,026 | |||||||

| Cash, cash equivalents, restricted cash and cash and cash equivalents of consolidated VIEs | |||||||||||

| Asset Management | |||||||||||

| Cash and cash equivalents | 2,748 | 2,869 | |||||||||

| Total Asset Management | 2,748 | 2,869 | |||||||||

| Insurance Solutions | |||||||||||

| Cash and cash equivalents | 97,533 | 67,704 | |||||||||

| Restricted cash | 11,258 | 13,324 | |||||||||

| Cash and cash equivalents of consolidated VIEs | 22,233 | 17,129 | |||||||||

| Total Insurance Solutions | 131,024 | 98,157 | |||||||||

| Total cash, cash equivalents and restricted cash, and cash and cash equivalents of consolidated VIEs | $ | 133,772 | $ | 101,026 | |||||||

| Supplemental disclosures of cash flow information | |||||||||||

| Interest received | $ | 44,178 | $ | 43,487 | |||||||

| Interest paid | 3,431 | 1,862 | |||||||||

| Dividends received | 742 | 999 | |||||||||

| Income taxes paid | 243 | 178 | |||||||||

| Supplemental Disclosures of Non-Cash Investing and Financing Activities | |||||||||||

| Cashless repayment on borrowings | — | 13,636 | |||||||||

| Issuance of common shares for vested Restricted Share Units | 209 | 238 | |||||||||

| Issuance of common shares for investment purchases | 5,000 | — | |||||||||

| Issuance of common shares for share based compensation | 45 | — | |||||||||

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements (Unaudited).

F-6

MOUNT LOGAN CAPITAL INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(All amounts in thousands, except share and per share data, and except where noted)

Note 1. Organization

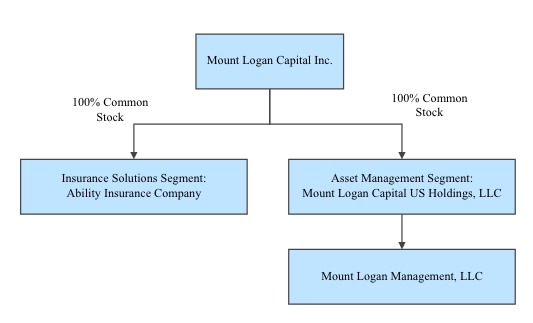

Mount Logan ("MLC," the "Company" or "we"), together with its consolidated subsidiaries is a diversified alternative asset management and insurance solutions platform. Our mission is to provide our investors access to a diversified and differentiated set of private market investment solutions to address their capital needs. Mount Logan conducts its business primarily in the United States through its two business segments: Asset Management and Insurance Solutions. Our Asset Management segment is conducted by Mount Logan Management LLC (“ML Management”), our SEC-registered investment adviser, manages a significant portion of our Assets Under Management (“AUM”) across our various managed funds supported by permanent and semi-permanent capital bases. Management also directly manages the capital of our wholly-owned insurance company, Ability Insurance Company (“Ability”), for the benefit of policyholders. The Company’s Insurance Solutions segment is conducted by Ability, a Nebraska domiciled insurer, specializes in reinsuring annuity products for the increasing number of individuals seeking to fund retirement needs and represents all of our insurance solutions operations.

Note 2. Summary of significant accounting policies

Basis of presentation

The accompanying unaudited Condensed Consolidated Financial Statements ("Condensed Consolidated Financial Statements") have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). Certain disclosures included in the annual audited Consolidated Financial Statements have been condensed or omitted as they are not required for interim Consolidated Financial Statements. The operating results presented for interim periods are not necessarily indicative of the results that may be expected for any other interim period or for the entire year. These Condensed Consolidated Financial Statements should be read in conjunction with the annual audited Consolidated Financial Statements.

The condensed consolidated financial statements reflect all adjustments, both normal and recurring which, in the opinion of management, are necessary for the fair presentation of the Company’s condensed consolidated statements of operations and condensed consolidated statements of financial position for the periods presented.

The results of the Company and its subsidiaries are presented on a consolidated basis. All intercompany transactions and balances are eliminated on consolidation.

The Company's Asset Management and Insurance Solutions segments possess distinct characteristics, and as a result are presented separately from each other. The Company believes that separate presentation provides a more informative view of the Company’s consolidated financial position and results of operations than an aggregated presentation and that reporting insurance solutions separately is appropriate given, among other factors, the relative significance of Ability's policy liabilities, which do not provide recourse to the remaining assets of MLC.

The summary of the significant accounting policies includes a section for common accounting policies and an accounting policy section for each of the two operating segments when a policy is specific to one operating segment and not the other. Unless otherwise specified, the significant accounting policy applies to both segments.

Due to rounding, numbers presented throughout these Condensed Consolidated Financial Statements may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.

Recently adopted accounting pronouncements

In March 2024, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2024-01, Compensation-Stock Compensation (Topic 718): Scope Application of Profits Interest and Similar Awards, which clarifies how an entity determines whether a profits interest or similar award (hereafter a “profits interest award”) is (1) within the scope of FASB ASC 718, Share-Based Payments, or (2) not a share-based payment arrangement and therefore within the scope of other guidance. This ASU is effective for annual periods beginning after December 15,

F-7

2024, and interim periods within those annual periods. The Company adopted this accounting standard effective January 1, 2025 and its adoption on a prospective basis did not have an impact on the Condensed Consolidated Financial Statements.

Recently issued accounting pronouncements

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures. This ASU requires additional quantitative and qualitative income tax disclosures to allow readers of the financial statements to assess how the Company’s operations, related tax risks and tax planning affect its tax rate and prospects for future cash flows. For public business entities, ASU 2023-09 is effective for annual periods beginning after December 15, 2024. The Company is currently evaluating the impact that the adoption of this ASU will have on its Condensed Consolidated Financial Statements.

In March 2024, the FASB issued ASU 2024-02, Codification Improvements-Amendments to Remove References to the Concepts Statements. This ASU contains amendments to the Codification that remove references to various FASB Concepts Statements. The effort facilitates Codification updates for technical corrections such as conforming amendments, clarifications to guidance, simplifications to wording or the structure of guidance and other minor improvements. While the amendments are not expected to result in significant changes for most entities, the FASB provided transition guidance since some entities could be affected. This ASU will be effective for fiscal years beginning after December 15, 2024, with early adoption permitted. The Company has determined that the ASU will not have a material impact on its Condensed Consolidated Financial Statements.

In November 2024, the FASB issued ASU 2024-03, Income Statement – Reporting Comprehensive Income – Expense Disaggregation Disclosures. This ASU requires disaggregation of certain expense captions into specified categories in disclosures within the footnotes to the financial statements. The ASU requires presentation in a tabular format of each pertinent expense category on the face of the income statement, such as employee compensation, depreciation, amortization of intangible assets, and other applicable expenses. This ASU will be effective for fiscal years beginning after December 15, 2026, and interim reporting periods beginning after December 15, 2027. Early adoption of the ASU is permitted, including adoption in any interim period for which financial statements have not been issued. The Company is currently evaluating the impact of adopting this ASU on its Condensed Consolidated Financial Statements.

In May 2025, the FASB issued ASU 2025–03, “Business Combinations (Topic 805) and Consolidation (Topic 810): Determining the Accounting Acquirer in the Acquisition of a Variable Interest Entity” (“ASU 2025–03”). ASU 2025–03 requires an entity involved in an acquisition transaction effected primarily by exchanging equity interests when the legal acquiree is a variable interest entity (“VIE”) that meets the definition of a business to consider factors to determine which entity is the accounting acquirer. When considering those factors, the reporting entity may determine that a transaction in which the legal acquiree is a VIE represents a reverse acquisition. The update will be effective for annual periods (and interim periods in annual reporting periods) beginning after December 15, 2026. The Company is currently evaluating the impact of adopting this ASU on its Condensed Consolidated Financial Statements.

Note 3. Net gains (losses) from investment activities

The table below summarizes the net gains (losses) from investment activities:

| For the three months ended June 30, | 2025 | 2024 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Net realized gains (losses) | Net unrealized gains (losses) | Credit releases (losses) | Total | Net realized gains (losses) | Net unrealized gains (losses) | Credit releases (losses) | Total | |||||||||||||||||||||||||||||||||||||||||||

| Asset Management | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity securities | $ | 22 | $ | 474 | $ | — | $ | 496 | $ | 146 | $ | (928) | $ | — | $ | (782) | ||||||||||||||||||||||||||||||||||

| Debt obligation | — | 371 | — | 371 | — | (114) | — | (114) | ||||||||||||||||||||||||||||||||||||||||||

| Net gains (losses) from investment activities — Asset Management | 22 | 845 | — | 867 | 146 | (1,042) | — | (896) | ||||||||||||||||||||||||||||||||||||||||||

| Insurance Solutions | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Debt securities: | ||||||||||||||||||||||||||||||||||||||||||||||||||

F-8

| For the three months ended June 30, | 2025 | 2024 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Net realized gains (losses) | Net unrealized gains (losses) | Credit releases (losses) | Total | Net realized gains (losses) | Net unrealized gains (losses) | Credit releases (losses) | Total | |||||||||||||||||||||||||||||||||||||||||||

| U.S. state, territories and municipalities | $ | — | $ | 5 | $ | — | $ | 5 | $ | — | $ | 21 | $ | — | $ | 21 | ||||||||||||||||||||||||||||||||||

| Other government and agency | — | (1) | — | (1) | — | (68) | — | (68) | ||||||||||||||||||||||||||||||||||||||||||

| Corporate | (1,057) | 1,049 | — | (8) | — | (2,210) | — | (2,210) | ||||||||||||||||||||||||||||||||||||||||||

| Asset and mortgage- backed securities | (94) | (299) | — | (393) | (8) | 1,807 | — | 1,799 | ||||||||||||||||||||||||||||||||||||||||||

| Corporate loans | (2) | 637 | — | 635 | (4) | (117) | — | (121) | ||||||||||||||||||||||||||||||||||||||||||

| Mortgage loans | — | — | (296) | (296) | — | — | (457) | (457) | ||||||||||||||||||||||||||||||||||||||||||

| Equity securities | — | 8 | — | 8 | — | 7 | — | 7 | ||||||||||||||||||||||||||||||||||||||||||

| Other invested assets | (755) | 4,607 | 36 | 3,888 | — | (12) | (252) | (264) | ||||||||||||||||||||||||||||||||||||||||||

| Net gains (losses) from investment activities — Insurance Solutions | (1,908) | 6,006 | (260) | 3,838 | (12) | (572) | (709) | (1,293) | ||||||||||||||||||||||||||||||||||||||||||

| Investments of consolidated VIEs | 177 | (464) | — | (287) | 416 | (974) | — | (558) | ||||||||||||||||||||||||||||||||||||||||||

| Net gains (losses) from investment activities — Insurance Solutions including consolidated VIEs | $ | (1,731) | $ | 5,542 | $ | (260) | $ | 3,551 | $ | 404 | $ | (1,546) | $ | (709) | $ | (1,851) | ||||||||||||||||||||||||||||||||||

| For the six months ended June 30, | 2025 | 2024 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Net realized gains (losses) | Net unrealized gains (losses) | Credit releases (losses) | Total | Net realized gains (losses) | Net unrealized gains (losses) | Credit releases (losses) | Total | |||||||||||||||||||||||||||||||||||||||||||

| Asset Management | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity securities | $ | 81 | $ | 288 | $ | — | $ | 369 | $ | 146 | $ | (999) | $ | — | $ | (853) | ||||||||||||||||||||||||||||||||||

| Debt obligation | — | 1,339 | — | 1,339 | — | (261) | — | (261) | ||||||||||||||||||||||||||||||||||||||||||

| Net gains (losses) from investment activities — Asset Management | 81 | 1,627 | — | 1,708 | 146 | (1,260) | — | (1,114) | ||||||||||||||||||||||||||||||||||||||||||

| Insurance Solutions | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Debt securities: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. state, territories and municipalities | $ | (4) | $ | 62 | $ | — | $ | 58 | $ | (5) | $ | 29 | $ | — | $ | 24 | ||||||||||||||||||||||||||||||||||

| Other government and agency | — | (2) | — | (2) | — | (39) | — | (39) | ||||||||||||||||||||||||||||||||||||||||||

| Corporate | (1,068) | 2,236 | — | 1,168 | (1) | (4,099) | — | (4,100) | ||||||||||||||||||||||||||||||||||||||||||

| Asset and mortgage- backed securities | (252) | (184) | — | (436) | 80 | 3,272 | — | 3,352 | ||||||||||||||||||||||||||||||||||||||||||

| Corporate loans | — | 1,426 | — | 1,426 | 22 | (719) | — | (697) | ||||||||||||||||||||||||||||||||||||||||||

| Mortgage loans | — | — | (284) | (284) | — | — | (916) | (916) | ||||||||||||||||||||||||||||||||||||||||||

| Equity securities | (246) | 98 | — | (148) | (3) | 312 | — | 309 | ||||||||||||||||||||||||||||||||||||||||||

| Other invested assets | (755) | 4,217 | 66 | 3,528 | — | (56) | 56 | — | ||||||||||||||||||||||||||||||||||||||||||

| Net gains (losses) from investment activities — Insurance Solutions | (2,325) | 7,853 | (218) | 5,310 | 93 | (1,300) | (860) | (2,067) | ||||||||||||||||||||||||||||||||||||||||||

F-9

| For the six months ended June 30, | 2025 | 2024 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Net realized gains (losses) | Net unrealized gains (losses) | Credit releases (losses) | Total | Net realized gains (losses) | Net unrealized gains (losses) | Credit releases (losses) | Total | |||||||||||||||||||||||||||||||||||||||||||

| Investments of consolidated VIEs | 237 | (789) | — | (552) | 599 | (1,027) | — | (428) | ||||||||||||||||||||||||||||||||||||||||||

| Net gains (losses) from investment activities — Insurance Solutions including consolidated VIEs | $ | (2,088) | $ | 7,064 | $ | (218) | $ | 4,758 | $ | 692 | $ | (2,327) | $ | (860) | $ | (2,495) | ||||||||||||||||||||||||||||||||||

Note 4. Net investment income

Net investment income for the Insurance Solutions segment is comprised primarily of Interest income and Dividend income from common and preferred stock. The table below summarizes Net investment income:

| Three months ended June 30, | Six months ended June 30, | |||||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||||||

| Debt securities | $ | 9,571 | $ | 11,999 | $ | 22,605 | $ | 24,558 | ||||||||||||||||||

| Corporate loans | (2,481) | 3,546 | (782) | 6,320 | ||||||||||||||||||||||

| Derivatives | 7,216 | — | 6,780 | — | ||||||||||||||||||||||

| Mortgage loans | 1,908 | 2,411 | 4,734 | 4,413 | ||||||||||||||||||||||

| Equity securities | 217 | 390 | 393 | 1,279 | ||||||||||||||||||||||

| Other | 277 | 998 | 737 | 1,555 | ||||||||||||||||||||||

| Gross investment income: | 16,708 | 19,344 | 34,467 | 38,125 | ||||||||||||||||||||||

| Less: | ||||||||||||||||||||||||||

| Investment expenses | (30) | (321) | (2,838) | (1,725) | ||||||||||||||||||||||

| Net investment income | $ | 16,678 | $ | 19,023 | $ | 31,629 | $ | 36,400 | ||||||||||||||||||

| Investment income of consolidated VIEs | 3,836 | 4,522 | 7,734 | 9,071 | ||||||||||||||||||||||

| Net investment income — Insurance Solutions, including consolidated VIEs | $ | 20,514 | $ | 23,545 | $ | 39,363 | $ | 45,471 | ||||||||||||||||||

F-10

Note 5. Investments

The following table outlines the carrying value of the Company’s investments:

| As of | June 30, 2025 | December 31, 2024 | ||||||||||||

| Asset Management | ||||||||||||||

| Corporate loans | $ | 13,287 | $ | 13,287 | ||||||||||

| Equity securities | 6,891 | 2,276 | ||||||||||||

| Equity method | 5,239 | 5,807 | ||||||||||||

| Total investments - Asset Management | $ | 25,417 | $ | 21,370 | ||||||||||

| Insurance Solutions | ||||||||||||||

| Debt securities | $ | 590,860 | $ | 615,460 | ||||||||||

| Corporate loans | 162,716 | 114,735 | ||||||||||||

| Mortgage loans | 143,662 | 147,640 | ||||||||||||

| Equity securities | 7,776 | 16,404 | ||||||||||||

| Other invested assets | 21,262 | 21,317 | ||||||||||||

| Total investments - Insurance Solutions | $ | 926,276 | $ | 915,556 | ||||||||||

| Corporate loans of consolidated VIEs | 128,806 | 125,757 | ||||||||||||

| Equity securities of consolidated VIEs | 247 | 141 | ||||||||||||

| Total investments - Insurance Solutions, including consolidated VIEs | 1,055,329 | 1,041,454 | ||||||||||||

| Total investments | $ | 1,080,746 | $ | 1,062,824 | ||||||||||

F-11

Financial assets

The following tables summarize the measurement categories of financial assets held by the Company as of June 30, 2025, and December 31, 2024:

| As of June 30, 2025 | Fair value | Amortized cost | Fair value option | Total | ||||||||||||||||||||||

| Financial assets | ||||||||||||||||||||||||||

| Asset Management | ||||||||||||||||||||||||||

| Corporate loans | $ | — | $ | 13,287 | $ | — | $ | 13,287 | ||||||||||||||||||

| Equity securities | 6,891 | — | — | 6,891 | ||||||||||||||||||||||

| Total financial assets — Asset Management¹ | $ | 6,891 | $ | 13,287 | $ | — | $ | 20,178 | ||||||||||||||||||

| Insurance Solutions | ||||||||||||||||||||||||||

| Debt securities: | ||||||||||||||||||||||||||

| U.S. government and agency | $ | 6,135 | $ | — | $ | — | $ | 6,135 | ||||||||||||||||||

| U.S. state, territories and municipalities | 3,399 | — | 1,935 | 5,334 | ||||||||||||||||||||||

| Other government and agency | — | — | 2,363 | 2,363 | ||||||||||||||||||||||

| Corporate | 116,873 | — | 104,474 | 221,347 | ||||||||||||||||||||||

| Asset and mortgage-backed securities | 234,709 | — | 120,972 | 355,681 | ||||||||||||||||||||||

| Corporate loans | (1) | — | 162,717 | 162,716 | ||||||||||||||||||||||

| Mortgage loans | — | 143,662 | — | 143,662 | ||||||||||||||||||||||

| Equity securities | 7,776 | — | — | 7,776 | ||||||||||||||||||||||

| Other invested assets² | 3,162 | 16,910 | 1,190 | 21,262 | ||||||||||||||||||||||

| Total financial assets — Insurance Solutions | $ | 372,053 | $ | 160,572 | $ | 393,651 | $ | 926,276 | ||||||||||||||||||

| Corporate loans of consolidated VIEs | — | — | 128,806 | 128,806 | ||||||||||||||||||||||

| Equity securities of consolidated VIEs | 247 | — | — | 247 | ||||||||||||||||||||||

| Total financial assets — Insurance Solutions, including consolidated VIEs | 372,300 | 160,572 | 522,457 | 1,055,329 | ||||||||||||||||||||||

| Total financial assets | $ | 379,191 | $ | 173,859 | $ | 522,457 | $ | 1,075,507 | ||||||||||||||||||

(1)The MLC US Holdings Credit Facility (as hereinafter defined) is collateralized by assets held by MLC US Holdings, including assets totaling $28.5 million as of June 30, 2025.

(2)Other invested assets primarily include structured securities and loan receivables.

F-12

| As of December 31, 2024 | Fair value | Amortized cost | Fair value option | Total | ||||||||||||||||||||||

| Financial assets | ||||||||||||||||||||||||||

| Asset Management | ||||||||||||||||||||||||||

| Corporate loans | $ | — | $ | 13,287 | $ | — | $ | 13,287 | ||||||||||||||||||

| Equity securities | 2,276 | — | — | 2,276 | ||||||||||||||||||||||

| Total financial assets — Asset Management¹ | $ | 2,276 | $ | 13,287 | $ | — | $ | 15,563 | ||||||||||||||||||

| Insurance Solutions | ||||||||||||||||||||||||||

| Debt securities: | ||||||||||||||||||||||||||

| U.S. government and agency | 8,075 | $ | — | $ | — | $8,075 | ||||||||||||||||||||

| U.S. state, territories and municipalities | $ | 3,370 | $ | — | $ | 1,882 | $ | 5,252 | ||||||||||||||||||

| Other government and agency | — | — | 2,369 | 2,369 | ||||||||||||||||||||||

| Corporate | 119,895 | — | 106,354 | 226,249 | ||||||||||||||||||||||

| Asset and mortgage-backed securities | 253,935 | — | 119,581 | 373,516 | ||||||||||||||||||||||

| Corporate loans | — | — | 114,734 | 114,734 | ||||||||||||||||||||||

| Mortgage loans | — | 147,640 | — | 147,640 | ||||||||||||||||||||||

| Equity securities | 16,404 | — | — | 16,404 | ||||||||||||||||||||||

| Other invested assets² | 3,632 | 16,742 | 943 | 21,317 | ||||||||||||||||||||||

| Total financial assets — Insurance Solutions | $ | 405,311 | $ | 164,382 | $ | 345,863 | $ | 915,556 | ||||||||||||||||||

| Corporate loans of consolidated VIEs | — | — | 125,757 | 125,757 | ||||||||||||||||||||||

| Equity securities of consolidated VIEs | 141 | — | — | 141 | ||||||||||||||||||||||

| Total financial assets — Insurance Solutions, including consolidated VIEs | 405,452 | 164,382 | 471,620 | 1,041,454 | ||||||||||||||||||||||

| Total financial assets | $ | 407,728 | $ | 177,669 | $ | 471,620 | $ | 1,057,017 | ||||||||||||||||||

(1)The MLC US Holdings Credit Facility (as hereinafter defined) is collateralized by assets held by MLC US Holdings, including assets totaling $31.2 million as of December 31, 2024.

(2)Other invested assets primarily include structured securities and loan receivables.

Available-for-sale – Insurance Solutions

The following table represents the cost or amortized cost, gross unrealized gains, gross unrealized losses, and fair value of AFS investments by asset type:

| As of June 30, 2025 | Cost or amortized cost | Gross unrealized gains | Gross unrealized losses | Fair value(1) | ||||||||||||||||||||||

| Financial assets | ||||||||||||||||||||||||||

| Insurance Solutions | ||||||||||||||||||||||||||

| Debt securities: | ||||||||||||||||||||||||||

| U.S. government and agency | $ | 6,546 | $ | 3 | $ | (414) | $ | 6,135 | ||||||||||||||||||

| U.S. state, territories and municipalities | 4,192 | — | (793) | 3,399 | ||||||||||||||||||||||

| Corporate | 129,132 | 1,346 | (13,607) | 116,871 | ||||||||||||||||||||||

| Asset and mortgage-backed securities | 238,691 | 2,220 | (6,202) | 234,709 | ||||||||||||||||||||||

| Other invested assets | 5,347 | — | (2,184) | 3,163 | ||||||||||||||||||||||

| Total AFS — Insurance Solutions | $ | 383,908 | $ | 3,569 | $ | (23,200) | $ | 364,277 | ||||||||||||||||||

F-13

| As of December 31, 2024 | Cost or amortized cost | Gross unrealized gains | Gross unrealized losses | Fair value(1) | ||||||||||||||||||||||

| Financial assets | ||||||||||||||||||||||||||

| Insurance Solutions | ||||||||||||||||||||||||||

| Debt securities: | ||||||||||||||||||||||||||

| U.S. government and agency | $ | 8,627 | $ | 13 | $ | (565) | $ | 8,075 | ||||||||||||||||||

| U.S. state, territories and municipalities | 4,268 | — | (898) | 3,370 | ||||||||||||||||||||||

| Corporate | 133,527 | 1,196 | (14,827) | 119,895 | ||||||||||||||||||||||

| Asset and mortgage-backed securities | 258,483 | 2,089 | (6,637) | 253,935 | ||||||||||||||||||||||

| Other invested assets | 5,321 | — | (1,689) | 3,632 | ||||||||||||||||||||||

| Total AFS — Insurance Solutions | $ | 410,226 | $ | 3,298 | $ | (24,616) | $ | 388,907 | ||||||||||||||||||

(1)There is no allowance for credit losses for AFS investments as of June 30, 2025 and December 31, 2024.

The maturity distribution for AFS securities is as follows:

| June 30, 2025 | ||||||||||||||

| Cost or amortized cost | Fair value | |||||||||||||

| Due in one year or less | $ | 432 | $ | 421 | ||||||||||

| Due after one year through five years | 87,265 | 87,902 | ||||||||||||

| Due after five years through ten years | 136,581 | 132,875 | ||||||||||||

| Due after ten years | 159,630 | 143,079 | ||||||||||||

| Total AFS securities | $ | 383,908 | $ | 364,277 | ||||||||||

Actual maturities can differ from contractual maturities as borrowers may have the right to call or prepay obligations with or without call or prepayment penalties.

The following table provides information about AFS securities for which an allowance for credit losses has not been recorded aggregated by category and length of time that securities have been continuously in an unrealized loss position:

| Less than 12 months | 12 months or more | Total | |||||||||||||||||||||||||||

| As of June 30, 2025 | Fair value | Unrealized losses | Fair value | Unrealized losses | Fair value | Unrealized losses | |||||||||||||||||||||||

| Insurance Solutions | |||||||||||||||||||||||||||||

| Debt securities: | |||||||||||||||||||||||||||||

| U.S. government and agency | $ | 995 | $ | (49) | $ | 4,878 | $ | (365) | $ | 5,873 | $ | (414) | |||||||||||||||||

| U.S. state, territories and municipalities | — | — | 3,399 | (793) | 3,399 | (793) | |||||||||||||||||||||||

| Corporate | 12,790 | (503) | 45,458 | (13,104) | 58,248 | (13,607) | |||||||||||||||||||||||

| Asset and mortgage-backed securities | 45,594 | (614) | 87,423 | (5,588) | 133,017 | (6,202) | |||||||||||||||||||||||

| Other invested assets | — | — | 3,163 | (2,184) | 3,163 | (2,184) | |||||||||||||||||||||||

| Total AFS securities in a continuous loss position | $ | 59,379 | $ | (1,166) | $ | 144,321 | $ | (22,034) | $ | 203,700 | $ | (23,200) | |||||||||||||||||

F-14

| Less than 12 months | 12 months or more | Total | |||||||||||||||||||||||||||

| As of December 31, 2024 | Fair value | Unrealized losses | Fair value | Unrealized losses | Fair value | Unrealized losses | |||||||||||||||||||||||

| Insurance Solutions | |||||||||||||||||||||||||||||

| Debt securities: | |||||||||||||||||||||||||||||

| U.S. government and agency | $ | 983 | $ | (50) | $ | 4,725 | $ | (515) | $ | 5,708 | $ | (565) | |||||||||||||||||

| U.S. state, territories and municipalities | — | — | 3,370 | (898) | 3,370 | (898) | |||||||||||||||||||||||

| Corporate | 31,867 | (629) | 48,706 | (14,199) | 80,573 | (14,828) | |||||||||||||||||||||||

| Asset and mortgage-backed securities | 50,961 | (1,405) | 91,990 | (5,231) | 142,951 | (6,636) | |||||||||||||||||||||||

| Other invested assets | — | — | 3,632 | (1,689) | 3,632 | (1,689) | |||||||||||||||||||||||

| Total AFS securities in a continuous loss position | $ | 83,811 | $ | (2,084) | $ | 152,423 | $ | (22,532) | $ | 236,234 | $ | (24,616) | |||||||||||||||||

Unrealized gains and losses can be created by changing interest rates or several other factors, including changing credit spreads. The Company had gross unrealized losses on below investment grade AFS securities of $4.6 million and $4.5 million as of June 30, 2025 and December 31, 2024, respectively. The single largest unrealized loss on AFS securities was $1.4 million and $1.2 million as of June 30, 2025 and December 31, 2024, respectively. The Company had 340 and 359 positions in an unrealized loss position as of June 30, 2025 and December 31, 2024, respectively.

As of June 30, 2025 and December 31, 2024, AFS securities in an unrealized loss position for 12 months or more consisted of 206 and 216 debt securities. These debt securities primarily relate to Corporate, and U.S. state, municipal and political subdivisions securities, which have depressed values due primarily to an increase in interest rates since the purchase of these securities. Unrealized losses were not recognized in net income on these debt securities since the Company neither intends to sell the securities nor does it believe that it is more likely than not that it will be required to sell these securities before recovery of their cost or amortized cost basis. For securities with significant declines in value, individual security level analysis was performed utilizing underlying collateral default expectations, market data, and industry analyst reports.

Mortgage and corporate loans carried at amortized cost

Mortgage and corporate loans consist of the following:

| June 30, 2025 | December 31, 2024 | |||||||||||||

| Asset Management | ||||||||||||||

| Corporate loans | $ | 13,586 | $ | 13,586 | ||||||||||

| Total corporate loans | 13,586 | 13,586 | ||||||||||||

| Allowance for credit losses | (299) | (299) | ||||||||||||

| Total corporate loans, net of allowance for credit losses | $ | 13,287 | $ | 13,287 | ||||||||||

| Insurance Solutions | ||||||||||||||

| Commercial real estate mortgage loans | $ | 64,959 | $ | 60,429 | ||||||||||

| Multi-family mortgage loans | 84,921 | 93,186 | ||||||||||||

| Other invested assets - corporate loans | 17,922 | 17,820 | ||||||||||||

| Total mortgage and corporate loans | 167,802 | 171,435 | ||||||||||||

| Allowance for credit losses | (7,230) | (7,053) | ||||||||||||

| Total mortgage and other invested assets - corporate loans, net of allowance for credit losses | $ | 160,572 | $ | 164,382 | ||||||||||

F-15

The maturity distribution for commercial real estate, multi-family mortgage loans and corporate loans were as follows as of June 30, 2025:

| Asset Management | Corporate loans | |||||||

| Remainder of 2025 | $ | — | ||||||

| 2026 | — | |||||||

| 2027 | — | |||||||

| 2028 | — | |||||||

| 2029 | — | |||||||

| 2030 and thereafter | 13,586 | |||||||

| Total | $ | 13,586 | ||||||

| Insurance Solutions | Commercial real estate mortgage loans | Multi-family mortgage loans | Other invested assets - corporate loans | Total loans | ||||||||||||||||||||||

| Remainder of 2025 | $ | 10,168 | $ | 22,539 | $ | — | $ | 32,707 | ||||||||||||||||||

| 2026 | 40,616 | 42,101 | — | 82,717 | ||||||||||||||||||||||

| 2027 | 9,299 | 8,299 | — | 17,598 | ||||||||||||||||||||||

| 2028 | 4,876 | 11,982 | — | 16,858 | ||||||||||||||||||||||

| 2029 | — | — | — | — | ||||||||||||||||||||||

| 2030 and thereafter | — | — | 17,922 | 17,922 | ||||||||||||||||||||||

| Total | $ | 64,959 | $ | 84,921 | $ | 17,922 | $ | 167,802 | ||||||||||||||||||

Actual maturities could differ from contractual maturities, because borrowers may have the right to prepay (with or without prepayment penalties) and loans may be refinanced.

The carrying value by credit risk and loan type were as follows:

| Asset Management | ||||||||||||||||||||||||||

| Loans – carrying value by credit risk | June 30, 2025 | December 31, 2024 | ||||||||||||||||||||||||

| Level 1 | $13,586 | 100 | % | $13,586 | 100 | % | ||||||||||||||||||||

| Level 2 | — | — | % | — | — | % | ||||||||||||||||||||

| Level 3 | — | — | % | — | — | % | ||||||||||||||||||||

| Level 4 | — | — | % | — | — | % | ||||||||||||||||||||

| Level 5 | — | — | % | — | — | % | ||||||||||||||||||||

| Total by credit risk | $13,586 | 100 | % | $13,586 | 100 | % | ||||||||||||||||||||

| Asset Management | ||||||||||||||||||||||||||

| Loans – carrying value by loan type | June 30, 2025 | December 31, 2024 | ||||||||||||||||||||||||

| Corporate loans | $ | 13,586 | 100 | % | $ | 13,586 | 100 | % | ||||||||||||||||||

| Total by loan type | $ | 13,586 | 100 | % | $ | 13,586 | 100 | % | ||||||||||||||||||

| Insurance Solutions | ||||||||||||||||||||||||||

| Loans – carrying value by credit risk | June 30, 2025 | December 31, 2024 | ||||||||||||||||||||||||

| Level 1 | $ | 22,799 | 13.6 | % | $ | 22,731 | 13.3 | % | ||||||||||||||||||

| Level 2 | 79,264 | 47.2 | % | 83,448 | 48.6 | % | ||||||||||||||||||||

| Level 3 | 4,482 | 2.7 | % | 6,997 | 4.1 | % | ||||||||||||||||||||

| Level 4 | — | — | % | — | — | % | ||||||||||||||||||||

| Level 5 | 61,257 | 36.5 | % | 58,259 | 34.0 | % | ||||||||||||||||||||

| Total by credit risk | $ | 167,802 | 100 | % | $ | 171,435 | 100 | % | ||||||||||||||||||

F-16

| Insurance Solutions | ||||||||||||||||||||||||||

| Loans – carrying value by loan type | June 30, 2025 | December 31, 2024 | ||||||||||||||||||||||||

| Commercial real estate mortgage loans | $ | 64,959 | 38.7 | % | $ | 60,429 | 35.2 | % | ||||||||||||||||||

| Multi-family mortgage loans | 84,921 | 50.5 | % | 93,186 | 54.4 | % | ||||||||||||||||||||

| Other invested assets - corporate loans | 17,922 | 10.7 | % | 17,820 | 10.4 | % | ||||||||||||||||||||

| Total by loan type | $ | 167,802 | 100 | % | $ | 171,435 | 100 | % | ||||||||||||||||||

The following tables summarizes the activity related to the allowance for credit losses for the six months ended June 30, 2025 and 2024:

| Asset Management | Corporate loans | Total loans | ||||||||||||

| Balance, December 31, 2024 | $ | 299 | $ | 299 | ||||||||||

| Charge-offs | — | — | ||||||||||||

| Recoveries | — | — | ||||||||||||

| Provision for credit losses | — | — | ||||||||||||

| Balance, June 30, 2025 | $ | 299 | $ | 299 | ||||||||||

| Insurance Solutions | Commercial real estate mortgage loans | Multi-family mortgage loans | Corporate loans | Total loans | ||||||||||||||||||||||

| Balance, December 31, 2024 | $ | 2,615 | $ | 3,360 | $ | 1,078 | $ | 7,053 | ||||||||||||||||||

| Charge-offs | — | — | — | — | ||||||||||||||||||||||

| Recoveries | — | — | — | — | ||||||||||||||||||||||

| Provision for credit losses | 2 | 241 | (66) | 177 | ||||||||||||||||||||||

| Balance, June 30, 2025 | $ | 2,617 | $ | 3,601 | $ | 1,012 | $ | 7,230 | ||||||||||||||||||

| Asset Management | Corporate loans | Total loans | ||||||||||||

| Balance, December 31, 2023 | $ | 299 | $ | 299 | ||||||||||

| Charge-offs | — | — | ||||||||||||

| Recoveries | — | — | ||||||||||||

| Provision for credit losses | — | — | ||||||||||||

| Balance, June 30, 2024 | $ | 299 | $ | 299 | ||||||||||

| Insurance Solutions | Commercial real estate mortgage loans | Multi-family mortgage loans | Corporate loans | Total loans | ||||||||||||||||||||||

| Balance, December 31, 2023 | $ | 632 | $ | 620 | $ | 1,541 | $ | 2,793 | ||||||||||||||||||

| Charge-offs | — | — | — | — | ||||||||||||||||||||||

| Recoveries | — | — | — | — | ||||||||||||||||||||||

| Provision for credit losses | 139 | 918 | (364) | 693 | ||||||||||||||||||||||

| Balance, June 30, 2024 | $ | 771 | $ | 1,538 | $ | 1,177 | $ | 3,486 | ||||||||||||||||||

F-17

The following tables present an analysis of past-due loans:

| June 30, 2025 | ||||||||||||||||||||||||||||||||||||||

| Asset Management | Loans 30-59 days past due | Loans 60-89 days past due | Loans 90 days or more past due | Nonaccrual loans | Current loans | Total loans | ||||||||||||||||||||||||||||||||

| Corporate loans | $ | — | $ | — | $ | — | $ | — | $ | 13,586 | $ | 13,586 | ||||||||||||||||||||||||||

| Total corporate loans | $ | — | $ | — | $ | — | $ | — | $ | 13,586 | $ | 13,586 | ||||||||||||||||||||||||||

| June 30, 2025 | ||||||||||||||||||||||||||||||||||||||

| Insurance Solutions | Loans 30-59 days past due | Loans 60-89 days past due | Loans 90 days or more past due | Nonaccrual loans | Current loans | Total loans | ||||||||||||||||||||||||||||||||

| Commercial real estate mortgage loans | $ | — | $ | — | $ | — | $ | 14,246 | $ | 50,713 | $ | 64,959 | ||||||||||||||||||||||||||

| Multi-family mortgage loans | — | — | — | 8,987 | 75,934 | 84,921 | ||||||||||||||||||||||||||||||||

| Other invested assets - corporate loans | — | — | — | — | 17,922 | 17,922 | ||||||||||||||||||||||||||||||||

| Total mortgage and other invested assets - corporate loans | $ | — | $ | — | $ | — | $ | 23,233 | $ | 144,569 | $ | 167,802 | ||||||||||||||||||||||||||

| December 31, 2024 | ||||||||||||||||||||||||||||||||||||||

| Asset Management | Loans 30-59 days past due | Loans 60-89 days past due | Loans 90 days or more past due | Nonaccrual loans | Current loans | Total loans | ||||||||||||||||||||||||||||||||

| Corporate loans | $ | — | $ | — | $ | — | $ | — | $ | 13,586 | $ | 13,586 | ||||||||||||||||||||||||||

| Total corporate loans | $ | — | $ | — | $ | — | $ | — | $ | 13,586 | $ | 13,586 | ||||||||||||||||||||||||||

| December 31, 2024 | ||||||||||||||||||||||||||||||||||||||

| Insurance Solutions | Loans 30-59 days past due | Loans 60-89 days past due | Loans 90 days or more past due | Nonaccrual loans | Current loans | Total loans | ||||||||||||||||||||||||||||||||

| Commercial real estate mortgage loans | $ | — | $ | — | $ | — | $ | 10,799 | $ | 49,630 | $ | 60,429 | ||||||||||||||||||||||||||

| Multi-family mortgage loans | — | — | — | 10,969 | 82,217 | 93,186 | ||||||||||||||||||||||||||||||||

| Other invested assets - corporate loans | — | — | — | — | 17,820 | 17,820 | ||||||||||||||||||||||||||||||||

| Total mortgage and other invested assets - corporate loans | $ | — | $ | — | $ | — | $ | 21,768 | $ | 149,667 | $ | 171,435 | ||||||||||||||||||||||||||

The Company designates individually evaluated loans on nonaccrual status as collateral-dependent loans, as well as other loans that management of the Company designates as having higher risk. Collateral dependent loans are loans for which the repayment is expected to be provided substantially through the operation or sale of the collateral and the borrower is experiencing financial difficulty. These loans do not share common risk characteristics and are not included within the collectively evaluated loans for determining the allowance for credit losses.

F-18

The following represents total nonaccrual loans:

| June 30, 2025 | ||||||||||||||||||||

| Insurance Solutions | Nonaccrual loans with no allowance | Nonaccrual loans with an allowance | Total nonaccrual loans | |||||||||||||||||

| Commercial real estate mortgage loans | $ | — | $ | 14,246 | $ | 14,246 | ||||||||||||||

| Multi-family mortgage loans | — | 8,987 | 8,987 | |||||||||||||||||

| Other invested assets - corporate loans | — | — | — | |||||||||||||||||

| Total loans | $ | — | $ | 23,233 | $ | 23,233 | ||||||||||||||

| December 31, 2024 | ||||||||||||||||||||

| Insurance Solutions | Nonaccrual loans with no allowance | Nonaccrual loans with an allowance | Total nonaccrual loans | |||||||||||||||||

| Commercial real estate mortgage loans | $ | — | $ | 10,799 | $ | 10,799 | ||||||||||||||

| Multi-family mortgage loans | — | 10,969 | 10,969 | |||||||||||||||||

| Other invested assets - corporate loans | — | — | — | |||||||||||||||||

| Total loans | $ | — | $ | 21,768 | $ | 21,768 | ||||||||||||||

There were no accrued interest receivables written off for the six months ended June 30, 2025 and 2024.

F-19

The following table represents the portfolio of mortgage and corporate loans by origination year as of June 30, 2025 and December 31, 2024:

| Performance status as of June 30, 2025 | 2025 | 2024 | 2023 | 2022 | 2021 | Prior | Total | ||||||||||||||||||||||||||||||||||

| Asset Management | |||||||||||||||||||||||||||||||||||||||||

| Corporate loans | |||||||||||||||||||||||||||||||||||||||||

| Level 1 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 13,586 | $ | 13,586 | |||||||||||||||||||||||||||

| Level 2 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Level 3 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Level 4 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Level 5 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Total corporate loans | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 13,586 | $ | 13,586 | |||||||||||||||||||||||||||

| Insurance Solutions | |||||||||||||||||||||||||||||||||||||||||

| Commercial real estate loans | |||||||||||||||||||||||||||||||||||||||||

| Level 1 | $ | — | $ | — | $ | 4,876 | $ | — | $ | — | $ | — | $ | 4,876 | |||||||||||||||||||||||||||

| Level 2 | — | 12,720 | 12,421 | 10,840 | 3,460 | — | 39,441 | ||||||||||||||||||||||||||||||||||

| Level 3 | — | — | — | — | 4,482 | — | 4,482 | ||||||||||||||||||||||||||||||||||

| Level 4 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Level 5 | — | 6,720 | 4,079 | 1,914 | — | 3,447 | 16,160 | ||||||||||||||||||||||||||||||||||

| Total commercial real estate loans | — | 19,440 | 21,376 | 12,754 | 7,942 | 3,447 | 64,959 | ||||||||||||||||||||||||||||||||||

| Multi-family loans | |||||||||||||||||||||||||||||||||||||||||

| Level 1 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Level 2 | 11,982 | 10,533 | 7,593 | — | 9,715 | — | 39,823 | ||||||||||||||||||||||||||||||||||

| Level 3 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Level 4 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Level 5 | — | — | — | 11,427 | 21,829 | 11,842 | 45,098 | ||||||||||||||||||||||||||||||||||

| Total multi-family loans | 11,982 | 10,533 | 7,593 | 11,427 | 31,544 | 11,842 | 84,921 | ||||||||||||||||||||||||||||||||||

| Other invested assets - corporate loans | |||||||||||||||||||||||||||||||||||||||||

| Level 1 | 102 | 48 | 596 | 74 | 17,102 | — | 17,922 | ||||||||||||||||||||||||||||||||||

| Level 2 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Level 3 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Level 4 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Level 5 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Total other invested assets - corporate loans | 102 | 48 | 596 | 74 | 17,102 | — | 17,922 | ||||||||||||||||||||||||||||||||||

| Total mortgage and corporate loans | $ | 12,084 | $ | 30,021 | $ | 29,565 | $ | 24,255 | $ | 56,588 | $ | 15,289 | $ | 167,802 | |||||||||||||||||||||||||||

F-20

| Performance status as of December 31, 2024 | 2024 | 2023 | 2022 | 2021 | 2020 | Prior | Total | ||||||||||||||||||||||||||||||||||

| Asset Management | |||||||||||||||||||||||||||||||||||||||||

| Corporate loans | |||||||||||||||||||||||||||||||||||||||||

| Level 1 | $ | — | $ | — | $ | — | $ | — | $ | 13,586 | $ | — | $ | 13,586 | |||||||||||||||||||||||||||

| Level 2 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Level 3 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Level 4 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Level 5 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Total corporate loans | $ | — | $ | — | $ | — | $ | — | $ | 13,586 | $ | — | $ | 13,586 | |||||||||||||||||||||||||||

| Insurance Solutions | |||||||||||||||||||||||||||||||||||||||||

| Commercial real estate loans | |||||||||||||||||||||||||||||||||||||||||

| Level 1 | $ | — | $ | 4,910 | $ | — | $ | — | $ | — | $ | — | $ | 4,910 | |||||||||||||||||||||||||||

| Level 2 | 4,000 | 15,416 | 11,800 | 3,661 | — | — | 34,877 | ||||||||||||||||||||||||||||||||||

| Level 3 | — | — | — | 4,482 | — | — | 4,482 | ||||||||||||||||||||||||||||||||||

| Level 4 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Level 5 | 6,720 | 4,079 | 1,914 | — | — | 3,447 | 16,160 | ||||||||||||||||||||||||||||||||||

| Total commercial real estate loans | 10,720 | 24,405 | 13,714 | 8,143 | — | 3,447 | 60,429 | ||||||||||||||||||||||||||||||||||

| Multi-family loans | |||||||||||||||||||||||||||||||||||||||||

| Level 1 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Level 2 | 33,389 | 5,469 | — | 9,715 | — | — | 48,573 | ||||||||||||||||||||||||||||||||||

| Level 3 | — | — | 2,515 | — | — | — | 2,515 | ||||||||||||||||||||||||||||||||||

| Level 4 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Level 5 | — | — | 8,714 | 21,782 | 11,602 | — | 42,098 | ||||||||||||||||||||||||||||||||||

| Total multi-family loans | 33,389 | 5,469 | 11,229 | 31,497 | 11,602 | — | 93,186 | ||||||||||||||||||||||||||||||||||

| Other invested assets - corporate loans | |||||||||||||||||||||||||||||||||||||||||

| Level 1 | 48 | 596 | 74 | 17,102 | — | — | 17,820 | ||||||||||||||||||||||||||||||||||

| Level 2 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Level 3 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Level 4 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Level 5 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Total other invested assets - corporate loans | 48 | 596 | 74 | 17,102 | — | — | 17,820 | ||||||||||||||||||||||||||||||||||

| Total mortgage and corporate loans | $ | 44,157 | $ | 30,470 | $ | 25,017 | $ | 56,742 | $ | 11,602 | $ | 3,447 | $ | 171,435 | |||||||||||||||||||||||||||

The following represents the carrying value of collateral-dependent loans of the Company as of June 30, 2025 and December 31, 2024:

| June 30, 2025 | December 31, 2024 | |||||||||||||

| Commercial real estate mortgage loans | $ | 10,799 | $ | 10,799 | ||||||||||

The Company maintains a separate reserve for credit losses on off-balance sheet credit exposures, including unfunded loan commitments, which is included in Accrued expenses and other liabilities on the Condensed Consolidated Statements of Financial Position. The reserve for credit losses on off-balance sheet credit exposures is adjusted as a provision for credit losses in the income statement. The estimate includes consideration of the likelihood that funding will occur and an estimate of expected credit losses on commitments expected to be funded over its estimated life, utilizing the same models and approaches for the Company's other loan portfolio segments described above, as these unfunded commitments share similar risk characteristics as its loan portfolio segments. The unfunded off-balance sheet credit line commitments for Corporate Loans accounted for as held for investments (“HFI”) was $1.4 million for Asset Management and $2.7 million for Insurance Solutions as of June 30, 2025 (December 31, 2024: $1.4 million and $4.7 million, for Asset Management and Insurance Solutions, respectively)

The liability for credit losses on off-balance sheet credit exposures for these loans included in Accrued expenses and other liabilities was less than $0.1 million for both Asset Management and Insurance Solutions as of June 30, 2025 and

The liability for credit losses on off-balance sheet credit exposures for these loans included in Accrued expenses and other liabilities was less than $0.1 million for both Asset Management and Insurance Solutions as of June 30, 2025 and

F-21

December 31, 2024, respectively. Refer to Note 23. Commitments and contingencies for additional information of the Company’s investment commitments.

Note 6. Derivatives

The Company uses derivative instruments to manage interest rate risk. See Note 8. Fair value measurements for information about the fair value hierarchy for derivatives.

The following table presents the notional amount and fair value of freestanding derivative instruments:

| June 30, 2025 | December 31, 2024 | |||||||||||||||||||||||||||||||||||||

| Notional amount | Assets | Liabilities | Notional amount | Assets | Liabilities | |||||||||||||||||||||||||||||||||

| Derivatives designated as hedges | ||||||||||||||||||||||||||||||||||||||

| Interest rate swaps | $ | 187,000 | $ | — | $ | 457 | $ | 187,000 | $ | — | $ | 5,192 | ||||||||||||||||||||||||||

Derivatives designated as hedges

Cash flow hedges

The Company uses interest rate swaps to convert floating-rate interest receipts to fixed-rate interest receipts to reduce exposure to interest rate changes. The interest rate swaps will expire by October 2036. During the six months ended June 30, 2025, the Company reported losses of $0.5 million in Other Comprehensive Income (“OCI”) associated with these hedges. There were no amounts deemed ineffective during the six months ended June 30, 2025. As of June 30, 2025, $0.4 million is expected to be reclassified into expense as part as earnings within the next 12 months.

Embedded derivatives

The Company has embedded derivatives which are required to be separated from their host contracts and reported as derivatives. Host contracts include reinsurance agreements structured on a modco or funds withheld basis. The fair value of the embedded derivative liability is $32.8 million and $34.8 million as of June 30, 2025 and December 31, 2024, respectively.

Credit risk

The Company may be exposed to credit-related losses in the event of counterparty nonperformance on derivative financial instruments. Generally, the current credit exposure of the Company’s derivative contracts is the fair value at the reporting date less any collateral received from the counterparty.

The Company manages credit risk related to derivatives by entering into transactions with creditworthy counterparties. Where possible, the Company maintains collateral arrangements and uses master netting agreements that provide for a single net payment from one counterparty to another at each due date and upon termination. The Company has also established counterparty exposure limits, where possible, in order to evaluate if there is sufficient collateral to support the net exposure. Collateral arrangements typically require the posting of collateral in connection with its derivative instruments. Collateral agreements often contain posting thresholds, some of which may vary depending on the posting party’s financial strength ratings.

There is no difference between the current presentation of the fair value of the interest rate swaps and the presentation of fair value of the interest rate swaps after the application of any right of offset, as of June 30, 2025.

Note 7. Variable interest entities

Consolidated VIEs include CLOs managed by the Company. The assets of consolidated VIEs are not available to creditors of the Company, and the investors in these consolidated VIEs have no recourse against the assets of the Company.

F-22

Revenues of consolidated VIEs - Insurance Solutions

The following summarizes the Condensed Consolidated Statements of Operations activity of the consolidated VIEs:

| For the three months ended June 30, | 2025 | 2024 | ||||||||||||

| Investment income | $ | 4,075 | $ | 4,765 | ||||||||||

| Investment expense | (239) | (243) | ||||||||||||

| Net investment income | 3,836 | 4,522 | ||||||||||||

| Unrealized gain/(loss) on investments | (464) | (974) | ||||||||||||

| Realized gain/(loss) on investments | 177 | 416 | ||||||||||||

| Net gains (losses) from investment activities | (287) | (558) | ||||||||||||

| Net revenues of consolidated variable interest entities | $ | 3,549 | $ | 3,964 | ||||||||||

| For the six months ended June 30, | 2025 | 2024 | ||||||||||||

| Investment income | $ | 8,109 | $ | 9,413 | ||||||||||

| Investment expense | (375) | (342) | ||||||||||||

| Net investment income | 7,734 | 9,071 | ||||||||||||

| Unrealized gain/(loss) on investments | (789) | (1,027) | ||||||||||||

| Realized gain/(loss) on investments | 237 | 599 | ||||||||||||

| Net gains (losses) from investment activities | (552) | (428) | ||||||||||||

| Net revenues of consolidated variable interest entities | $ | 7,182 | $ | 8,643 | ||||||||||

Unconsolidated VIEs

The Company has variable interests in VIEs which it was determined not to be the primary beneficiary. The Company’s variable interests include equity interests, loans, and beneficial interests in CLOs and other entities, which are recorded in Investments in the Condensed Consolidated Statements of Financial Position. The following table presents the maximum exposure to losses relating to these VIEs for which the Company has a variable interest, but that it is not the primary beneficiary. The Company has exposure beyond the carrying value of its variable interests due to unfunded commitments on loans.

| June 30, 2025 | December 31, 2024 | |||||||||||||||||||||||||

| Carrying amount | Maximum exposure to loss | Carrying amount | Maximum Exposure to Loss | |||||||||||||||||||||||

| Asset Management | ||||||||||||||||||||||||||

| Variable interests | $ | — | $ | — | $ | 29 | $ | 29 | ||||||||||||||||||

| Variable interests in related parties | 26,372 | 27,785 | 21,004 | 22,417 | ||||||||||||||||||||||

| Total Asset Management | $ | 26,372 | $ | 27,785 | $ | 21,033 | $ | 22,446 | ||||||||||||||||||

| Insurance Solutions | ||||||||||||||||||||||||||

| Variable interests | $ | 17,223 | $ | 17,223 | $ | 17,689 | $ | 17,689 | ||||||||||||||||||

| Variable interests in related parties | 16,888 | 16,888 | 19,333 | 19,333 | ||||||||||||||||||||||

| Total Insurance Solutions | $ | 34,111 | $ | 34,111 | $ | 37,022 | $ | 37,022 | ||||||||||||||||||

| Total | $ | 60,483 | $ | 61,896 | $ | 58,055 | $ | 59,468 | ||||||||||||||||||

Note 8. Fair value measurements

The following tables summarize the valuation of assets and liabilities measured at fair value by fair value hierarchy. Investments classified as Equity Method for which the FVO has not been elected have been excluded from the table below.

F-23

| Fair Value Measurements | ||||||||||||||||||||||||||||||||

| June 30, 2025 | Level 1 | Level 2 | Level 3 | NAV | Total | |||||||||||||||||||||||||||

| Financial assets | ||||||||||||||||||||||||||||||||

| Asset Management | ||||||||||||||||||||||||||||||||

| Equity securities | $ | 1,042 | $ | — | $ | 5,849 | $ | — | $ | 6,891 | ||||||||||||||||||||||

| Total financial assets — Asset Management | $ | 1,042 | $ | — | $ | 5,849 | $ | — | $ | 6,891 | ||||||||||||||||||||||

| Insurance Solutions | ||||||||||||||||||||||||||||||||

| Debt securities: | ||||||||||||||||||||||||||||||||

| U.S. government and agency | $ | — | $ | 6,135 | $ | — | $ | — | $ | 6,135 | ||||||||||||||||||||||

| U.S. state, territories and municipalities | $ | — | $ | 5,334 | $ | — | $ | — | $ | 5,334 | ||||||||||||||||||||||

| Other government and agency | — | 2,363 | — | — | 2,363 | |||||||||||||||||||||||||||

| Corporate | — | 216,281 | 5,067 | — | 221,347 | |||||||||||||||||||||||||||

| Asset and mortgage-backed securities | — | 340,568 | 15,113 | — | 355,681 | |||||||||||||||||||||||||||

| Corporate loans | — | 27,975 | 134,741 | — | 162,716 | |||||||||||||||||||||||||||

| Equity securities | 237 | 2,612 | 3,000 | 1,927 | 7,776 | |||||||||||||||||||||||||||

| Other invested assets | — | 888 | 3,163 | 302 | 4,353 | |||||||||||||||||||||||||||

| Total financial assets — Insurance Solutions | $ | 237 | $ | 602,155 | $ | 161,083 | $ | 2,229 | $ | 765,704 | ||||||||||||||||||||||

| Corporate loans of consolidated VIEs | — | — | 128,806 | — | 128,806 | |||||||||||||||||||||||||||

| Equity of consolidated VIEs | — | — | 247 | — | 247 | |||||||||||||||||||||||||||

| Total financial assets including consolidated VIEs | $ | 237 | $ | 602,155 | $ | 290,136 | $ | 2,229 | $ | 894,757 | ||||||||||||||||||||||

| Total financial assets | $ | 1,279 | $ | 602,155 | $ | 295,985 | $ | 2,229 | $ | 901,648 | ||||||||||||||||||||||

| Financial liabilities | ||||||||||||||||||||||||||||||||

| Asset Management | ||||||||||||||||||||||||||||||||

| Debt obligations | — | — | 132 | — | 132 | |||||||||||||||||||||||||||

| Total financial liabilities — Asset Management | $ | — | $ | — | $ | 132 | $ | — | $ | 132 | ||||||||||||||||||||||

| Insurance Solutions | ||||||||||||||||||||||||||||||||

| Ceded reinsurance - embedded derivative | — | 32,789 | — | — | 32,789 | |||||||||||||||||||||||||||

| Interest rate swaps | — | 457 | — | — | 457 | |||||||||||||||||||||||||||

| Total financial liabilities — Insurance Solutions | $ | — | $ | 33,245 | $ | — | $ | — | $ | 33,245 | ||||||||||||||||||||||

| Total financial liabilities | $ | — | $ | 33,245 | $ | 132 | $ | — | $ | 33,377 | ||||||||||||||||||||||

| Fair Value Measurements | ||||||||||||||||||||||||||||||||

| December 31, 2024 | Level 1 | Level 2 | Level 3 | NAV | Total | |||||||||||||||||||||||||||

| Financial assets | ||||||||||||||||||||||||||||||||

| Asset Management | ||||||||||||||||||||||||||||||||

| Equity securities | $ | 1,777 | $ | — | $ | 499 | $ | — | $ | 2,276 | ||||||||||||||||||||||

| Total financial assets — Asset Management | $ | 1,777 | $ | — | $ | 499 | $ | — | $ | 2,276 | ||||||||||||||||||||||

| Insurance Solutions | ||||||||||||||||||||||||||||||||

| Debt securities: | ||||||||||||||||||||||||||||||||

| U.S. government and agency | $ | — | $ | 8,075 | $ | — | $ | — | $ | 8,075 | ||||||||||||||||||||||

| U.S. state, territories and municipalities | — | 5,252 | — | — | 5,252 | |||||||||||||||||||||||||||

| Other government and agency | — | 2,369 | — | — | 2,369 | |||||||||||||||||||||||||||

| Corporate | — | 226,249 | — | — | 226,249 | |||||||||||||||||||||||||||

| Asset and mortgage-backed securities | — | 364,875 | 8,641 | — | 373,516 | |||||||||||||||||||||||||||

| Corporate loans | — | — | 114,734 | — | 114,734 | |||||||||||||||||||||||||||

| Equity securities | 310 | 11,134 | 2,918 | 2,042 | 16,404 | |||||||||||||||||||||||||||

| Other invested assets | — | — | 4,575 | — | 4,575 | |||||||||||||||||||||||||||

| Total financial assets — Insurance Solutions | $ | 310 | $ | 617,954 | $ | 130,868 | $ | 2,042 | $ | 751,174 | ||||||||||||||||||||||

| Corporate loans of consolidated VIEs | — | — | 125,757 | — | 125,757 | |||||||||||||||||||||||||||

| Equity securities of consolidated VIEs | — | — | 141 | — | 141 | |||||||||||||||||||||||||||

| Total financial assets including consolidated VIEs | $ | 310 | $ | 617,954 | $ | 256,766 | $ | 2,042 | $ | 877,072 | ||||||||||||||||||||||

| Total financial assets | $ | 2,087 | $ | 617,954 | $ | 257,265 | $ | 2,042 | $ | 879,348 | ||||||||||||||||||||||

F-24

| Fair Value Measurements | ||||||||||||||||||||||||||||||||

| December 31, 2024 | Level 1 | Level 2 | Level 3 | NAV | Total | |||||||||||||||||||||||||||

| Financial liabilities | ||||||||||||||||||||||||||||||||

| Asset Management | ||||||||||||||||||||||||||||||||

| Debt obligations | $ | — | $ | — | $ | 1,471 | $ | — | $ | 1,471 | ||||||||||||||||||||||

| Total financial liabilities — Asset Management | $ | — | $ | — | $ | 1,471 | $ | — | $ | 1,471 | ||||||||||||||||||||||

| Insurance Solutions | ||||||||||||||||||||||||||||||||

| Ceded reinsurance - embedded derivative | $ | — | $ | 34,770 | $ | — | $ | — | $ | 34,770 | ||||||||||||||||||||||