Published on June 12, 2025

Proskauer Rose LLP 1001 Pennsylvania Avenue, NW Suite 600 South Washington, DC 20004-2533 | ||

June 12, 2025

VIA EDGAR

U.S. Securities and Exchange Commission

Division of Corporation Finance

Office of Finance

100 F Street, NE

Washington, DC 20549

100 F Street, NE

Washington, DC 20549

Attention: Robert Arzonetti

Re: Yukon New Parent, Inc.

Amended Registration Statement on Form S-4

Amended Registration Statement on Form S-4

Dear Mr. Arzonetti:

On behalf of Yukon New Parent, Inc. (the “Company”), set forth below are the Company’s responses to the comments provided by the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) to the Company in its letter dated June 3, 2025 with respect to the Company’s amended registration statement on Form S-4 (the “Registration Statement”). The Staff’s comments are set forth below in italics and are followed by the Company’s responses. Capitalized terms used below but not otherwise defined herein shall have the meanings ascribed to them in the Registration Statement. Where revisions to the Registration Statement are referenced in the below response, such revisions have been included in the amended Registration Statement filed concurrently herewith.

Form S-4 Filed May 6, 2025

Management of New Mount Logan, page 22

1.Comment: Please revise your disclosure to provide a clearer overview of who will lead the combined company. In this regard, we note the reference on page 16 to New Mount Logan relying on "BCPA and Key BCPA Personnel."

Response: The Company has revised the Management of New Mount Logan disclosure on page 22 of the Registration Statement in response to the Staff’s comment to reflect that Edward (Ted) Goldthorpe is expected to serve as Chair of the Board and Chief Executive Officer of New Mount Logan. Mr. Goldthorpe is the Partner in charge of the Global Credit Business for BCPA. Henry Wang and Matthias Ederer are expected to serve as co-presidents of New Mount Logan and are partners in the Global Credit Business for BCPA. Nikita Klassen is expected to serve as the Chief Financial Officer and is a Senior Credit Controller at BCPA. David Held is expected to serve as Chief Compliance Officer and holds the same position at BCPA.

Risk Factors, page 36

2.Comment: Please disclose any material risks resulting from the deregistration of 180 Degree Capital as a business development company under the Investment Company Act of 1940. For

Beijing | Boca Raton | Boston | Chicago | Hong Kong | London | Los Angeles | New Orleans | New York | Paris | São Paulo | Washington, DC

example, it is unclear if key consequences of deregistration may involve the loss of restrictions on affiliated transactions and self-dealing, elimination of limitations on the use of leverage, etc.

Response: The Company has revised the “Risk Factors” section on page 42 of the Registration Statement in response to the Staff’s comment.

3.Comment: Please revise to address the extent to which there is a material risk that 180 Degree Capital or the combined company may not be successfully "excluded from the definition of an investment company by Section 3(c)(1) or Section 3(c)(7) of the 1940 Act," as referenced on page 10.

Response: The Company advises the Staff on a supplemental basis that it does not believe that there is a material risk that New Mount Logan would fall within the definition of “investment company” as set forth in Section 3(a)(1) under the 1940 Act. Specifically, as reflected in the pro forma condensed combined financial statements included in the Registration Statement, less than 40% of the value of the total assets of New Mount Logan are expected to consist of “investment securities,” as such term is defined under Section 3(a)(2) of the 1940 Act, after completion of the Business Combination. Accordingly, New Mount Logan will not fail the "40% test" in Section 3(1)(a)(C) of the 1940 Act. In addition, as an operating business that will continue to manage funds and other investment vehicles following the Business Combination, New Mount Logan does not intend to be, nor will it hold itself out as being, primarily engaged in the business of investing, reinvesting, or trading in securities within the meaning of Section 3(a)(1)(A) of the 1940 Act. As a result, New Mount Logan would not be required to avail itself of the exclusion from the definition of “investment company” set forth in either Sections 3(c)(1) or 3(c)(7) under the 1940 Act.

In addition, subsequent to completion of the Business Combination, while New Mount Logan will be 180 Degree Capital’s sole equity holder, 180 Degree Capital will represent less than 40% of New Mount Logan’s total assets. New Mount Logan will also meet the requirements to be deemed a “qualified purchaser,” as such term is defined under the 1940 Act and used in Section 3(c)(7) thereunder. Accordingly, we do not believe that there is a material risk that 180 Degree Capital would not be eligible to rely on the exclusion from the definition of “investment company” set forth in Section 3(c)(7) under the 1940 Act, and thus be able to effect its deregistration under the 1940 Act.

Sales of shares of New Mount Logan Common Stock after the completion, page 36

4.Comment: Please revise to disclose whether any lock-up agreements or resale restrictions apply to shares issued in the merger. Quantify the number or percentage of freely tradeable shares that could enter the market post-closing.

Response: The Company has revised the disclosure related to the sales of shares of New Mount Logan Common Stock after the completion of the Business Combination on page 36 in the Registration Statement in response to the Staff’s comment to reflect that all of the shares issued and outstanding will be freely tradable after the Closing.

Regulations governing 180 Degree Capital's operation as a registered CEF, page 66

2

5.Comment: We note your disclosure that references limitations under the Investment Company Act of 1940, including the 300% asset coverage requirement. We also note that 180 Degree Capital will deregister as a business development company in connection with the merger. Please revise where appropriate to summarize the timeline for transitioning between regulatory regimes and clarify the extent to which the 300% requirement or 1940 Act requirements will continue to apply.

Response: The Company has revised the disclosure related to the 300% asset coverage requirement on page 67 in the Registration Statement in response to the Staff’s comment to reflect that, at Closing, shareholders of 180 Degree Capital will own shares of New Mount Logan, and New Mount Logan will not be subject to the asset coverage requirements of the 1940 Act.

Background of the Mergers, page 111

6.Comment: We note your disclosure of a "Discount Management Program." Please revise here or where appropriate to briefly describe such program and its purpose.

Response: The Company has revised the disclosure related to 180 Degree Capital's previously disclosed Discount Management Program on page 111 in the Registration Statement in response to the Staff’s comment to include the description of the program as described to shareholders in the initial press release announcing the program as well as subsequent releases.

7.Comment: Please ensure your disclosure is clear about the persons involved in negotiations or meetings. For example, where you refer to the "board" or "management," please clarify which members of the board were in attendance or otherwise list the members in attendance.

Response: The Company has revised the “Background of the Mergers” section of the Registration Statement in response to the Staff’s comment.

8.Comment: We note your disclosure that initially a NAV-for-NAV transaction was proposed but then was ultimately changed to a fixed value for Mount Logan that would be adjusted by subsequent distributions, share issuances and certain debt refinance expenses. Please expand your discussion as to clarify which party initiated the change and how this change is expected to impact the consideration for each party to the merger.

Response: The Company has revised this disclosure of the Registration Statement on page 116 in response to the Staff’s comment to include the requested clarification as well as a discussion of how that change impacts the consideration for each party to the merger.

The Mergers

Mount Logan's Reasons for the Mergers, page 120

9.Comment: You state that Mount Logan "spent several years evaluating transactions similar to the Business Combination" and concluded that this was the "best outcome" for shareholders. Please revise your disclosure to describe any alternative transactions that were considered, and why they were rejected. If no specific alternatives were formally evaluated, please disclose that fact.

3

Response: The Company has revised this disclosure of the Registration Statement on page 121 in response to the Staff’s comment to include additional discussion of historical strategic alternative efforts.

In addition, the Company advises the Staff on a supplemental basis that in addition to preliminary reviews, Mount Logan formally pursued one strategic transaction publicly, which previously received Mount Logan Board approval: a proposed business combination with Canaccord Genuity G Ventures Corp., a TSX-listed “Growth SPAC” (“G Corp”). The transaction—announced in August 2023 —would have resulted in Mount Logan combining with G Corp in exchange for newly issued equity of the post-combination public company. Key expected benefits included (i) a material increase in free float, (ii) an immediate public-company valuation referenced to Mount Logan’s net asset value, and (iii) access to the capital available in G Corp’s trust account to accelerate business growth. However, by September 2023 the parties mutually agreed to terminate the arrangement agreement because the regulatory review timeline for a Growth SPAC significantly exceeded the SPAC’s outside completion date, creating execution risk and potential dilution that the Mount Logan Board deemed unacceptable for its shareholders.

The Company further advises the Staff on a supplemental basis that the Mount Logan Board believes the proposed Business Combination with 180 Degree Capital offers Mount Logan shareholders several advantages that were not available—or were available only on less favorable terms—in the terminated G Corp transaction and other alternatives reviewed, which reasons are referenced throughout the joint proxy statement/prospectus. Mount Logan believes that the Board’s decision to confirm the proposed Business Combination in January 2025 was better informed due to the previous informal and formal transaction processes in which Mount Logan was involved, and that these processes helped establish the Business Combination as the best available outcome for Mount Logan and its shareholders.

180 Degree Capital's Reasons for the Mergers, page 124

10.Comment: We note the reference to “the Mount Logan platform” on page 124. Please revise here and where appropriate to clarify what this term is meant to cover. For example, is it restricted to Mount Logan, which has approximately $2.3 billion AUM, or does it include BCPA and its affiliates, which collectively manage approximately $40 billion of assets according to page 290.

Response: The Company has revised the “180 Degree Capital's Reasons for the Mergers” section on page 124 of the Registration Statement in response to the Staff’s comment to clarify access to additional capital for investment relates to Mount Logan's approximate $2.3 billion under management and access to investment opportunities includes Mount Logan, BCPA and the BCPA Credit Affiliates.

11.Comment: Please revise here and where appropriate to explain how Mount Logan’s business model is “highly complementary to 180 Degree Capital’s business model.” Include a discussion of relevant, material factors regarding complementarity. For example, it is unclear to what extent the entities have significantly different geographic exposure, investor bases, type of fee-based models, type of fee generating vehicles, size or nature of portfolio businesses, use of leverage, and so forth.

4

Response: The Company has revised the “180 Degree Capital's Reasons for the Mergers” section on page 125 of the Registration Statement in response to the Staff’s comment to clarify the complementary nature of Mount Logan's and 180 Degree Capital's business models. 180 Degree Capital's business model is investing in and working with small, publicly traded companies to unlock value through constructive activism. 180 Degree Capital has historically participated in recapitalization financings through investment in common stock. 180 Degree Capital has also had opportunities in the past to invest in non-equity securities and/or lead large recapitalizations that were beyond the capital resources of the company at the time. Mount Logan’s business of providing credit solutions is a natural extension of 180 Degree Capital’s investment approach and could enable the combined company to identify and invest in opportunities that would otherwise not be available as stand-alone entities.

12.Comment: You state that the merger will enable "accelerated expansion of sourcing investments...through existing 180 Degree Capital relationships." Please revise your disclosure to clarify what type of sourcing opportunities were identified and how the Mount Logan Capital base enhances these opportunities.

Response: The Company has revised the “180 Degree Capital's Reasons for the Mergers” section on page 125 of the Registration Statement in response to the Staff’s comment to clarify that the Mount Logan capital base provides for the ability to address capital structure solutions and other opportunities that would otherwise be too large for 180 Degree Capital to participate in as a stand-alone entity.

Opinion of 180 Degree Capital's Financial Advisor, page 126

13.Comment: We note your disclosure on page 127 that Mount Logan Capital provided financial projections to the 180 Degree Capital Special Committee and its financial advisor in connection with the merger. However, the registration statement does not include these projections or a summary thereof. Please revise your disclosure to include these projections along with a description of the key assumptions underlying them.

Response: The Company has added on page 127 of the Registration Statement in response to the Staff’s comment a summary of the projections referenced on page 134 that the financial advisor to the 180 Degree Special Committee used in its analysis as presented along with the key assumptions underlying the preparation of such projections.

14.Comment: We note your disclosure on page 128 that the financial advisor to the 180 Degree Capital Special Committee reviewed certain closed-end fund merger transactions as part of the fairness opinion. Please revise the disclosure to describe the criteria used to select these transactions and explain why the selected transactions were considered comparable. If any material differences exist between the precedent transactions and the proposed merger, please explain. Similarly, we note the disclosure on page 129 that the financial advisor to 180 Degree Capital Special Committee reviewed selected public companies comparable to Mount Logan Capital Inc. Please provide equivalent disclosure for these comparable public companies. Similarly revise for Mount Logan Capital's disclosures on pages 130 and 131.

Response: The Company has revised the disclosure beginning on page 129 of the Registration Statement in response to the Staff’s comment.

5

15.Comment: We note that the majority of the implied equity values of Mount Logan addressed by the financial advisor, Fenchurch, are higher than Mount Logan's $67.4 million transaction equity value agreed upon for the merger. As non-exclusive examples, we note a $82 million to $121 million range of implied equity value for 2026 using trading comparables, a $76 million to $139 million range of implied equity value for 2025 using transactional analysis and an implied equity value of $104.5 million on January 1, 2025 using discounted cash flow. Please state whether the board of Mount Logan considered these factors in arriving at its recommendation.

Response: The Company advises the Staff on a supplemental basis that the information and analysis prepared by Fenchurch was solely for the purposes of the evaluation of the potential Business Combination by the 180 Degree Capital Special Committee, and such analysis and information was not shared with Mount Logan prior to execution of the Merger Agreement. Therefore, the board of Mount Logan did not consider these factors in arriving at its recommendation.

Regulatory Approvals and Related Matters, page 133

16.Comment: Please expand this section to clarify the status of required filings or notices and the expected timing of remaining approvals. If material, address the consequences or risks if the required approvals are delayed or not received.

Response: The Company has revised the disclosure in the Registration Statement on page 136 in response to the Staff’s comment. The Company advises the Staff that (i) an application has been filed with the Ontario Securities Commission (“OSC”) and is under review, and a consent, if granted, will be granted only after the MLC Special Meeting and after a Final Order is obtained from the Ontario Superior Court of Justice (Commercial List) approving the Arrangement; (ii) after such consent from the OSC is obtained, an application will be made to the Ministry of Public and Business Service Delivery seeking authorization for Mount Logan’s continuance out of Ontario to the state of Delaware; (iii) the Company has provided, and will continue to provide, Cboe Canada with all requested documentation in connection with the Business Combination and its consent thereto; (iv) the Company has been advised by Crown that a no objection letter was received by Crown on April 1, 2025; and (v) the Company is in active communication with the Nebraska Department of Insurance regarding the Business Combination in order to determine whether a consent will be required in respect of the Business Combination. The Company does not anticipate any delays or difficulty in making any remaining required filings or notices or in obtaining any remaining required approvals.

The Merger Agreement

Merger Consideration, page 149

17.Comment: Please revise your disclosure to provide additional detail regarding the in-kind distribution mechanism that may be used to reduce 180 Degree Capital's NAV if its shareholders would otherwise receive more than 50% of the New Mount Logan common stock. Specifically, please clarify:

•the types of assets that may be distributed in-kind;

•the methodology for selecting and valuing such assets;

6

•whether any shareholder consent or notice is required in connection with the distribution; and

•when and how the determination will be made that a distribution is required.

Additionally, consider including a simplified numerical example to illustrate how this mechanism could affect TURN's NAV and resulting ownership percentage in the combined company.

Response: The Company has revised the “Merger Consideration” section on page 153 of the Registration Statement in response to the Staff’s comment to clarify the points listed above as well as to include a numerical example of how this mechanism would affect the ultimate merger consideration received by shareholders of 180 Degree Capital in terms of distributed assets (cash and/or freely tradable shares of publicly listed portfolio companies) and ownership of New Mount Logan.

Unaudited Pro Forma Combined Balance Sheet, page 177

18.Comment: Please revise your table on page 177 to include a subtotal for your Asset Management total assets as of December 31, 2024 and ensure mathematical accuracy of the information in the table.

Response: The Company has revised the disclosure related to the Unaudited Pro Forma Combined Balance Sheet on page 179 in the Registration Statement in response to the Staff’s comments.

19.Comment: We note your disclosure on page 179 that you present an adjustment to total equity in the amount of $(11,829). Please revise your footnotes to include an explanation and reconciliation for how this adjustment is calculated. In addition, please ensure mathematical accuracy of your pro forma information. For example, it is unclear as to how the adjustments to (i) total shareholders equity, (ii) total equity and (iii) total liabilities and equity foot.

Response: The Company has revised the disclosure related to the Unaudited Pro Forma Combined Balance Sheet on page 179 in the Registration Statement in response to the Staff’s comments.

Unaudited Pro Forma Condensed Combined Statement of Operations, page 180

20.Comment: We note your presentation of Net Income (Loss) Attributable to Mount Logan Capital Inc. Per Share of Common Shares and Weighted Average Shares of Common Shares Outstanding. Please revise your disclosures to include adjustments and footnotes explaining how you calculated the pro forma amounts compared from historical. For example, explain how you considered all of the Mount Logan RSUs that will have been vested upon completion of the merger in your calculation, adjustments and presentation.

Response: The Company has revised the Unaudited Pro Forma Condensed Combined Statement of Operations of the Registration Statement beginning on page 182 in response to the Staff’s comment to include disclosure of the adjustments and an explanation in the footnotes to show the adjustment of shares outstanding on a pro forma basis from historical amounts.

7

21.Comment: Please ensure the mathematical accuracy of the your pro forma statement of operations for all columns and rows. For example, it is unclear as to how the Income (loss) before income taxes and net income (loss) lines cross-foot and the pro forma adjustments column does not appear to foot.

Response: The Company has revised the Unaudited Pro Forma Condensed Combined Statement of Operations of the Registration Statement beginning on page 182 in response to the Staff’s comment.

Notes to Unaudited Pro Forma Condensed Combined Financial Information

Note 1 - Basis of Pro Forma Presentation, page 184

22.Comment: We note the amounts disclosed on page 185 for the change in control liabilities and business combination-related expenses of $2,107 and $5,577, respectively, differ from those disclosed in footnote 3(B) on page 186. Please explain this discrepancy and revise your disclosure to clarify accordingly.

Response: The Company has revised Note 1 - Basis of Pro Forma Presentation on page 190 and Note 3 - Pro Forma Adjustments of the Registration Statement on page 192 in response to the Staff’s comment to clarify the components of the business combination expenses by separating the amount related to retention bonuses from the other Business Combination-related expenses.

Compensation and Benefits, page 265

23.Comment: We note your disclosure that Mount Logan’s compensation arrangements with certain employees contain a significant performance-based incentive component. Please revise to disclose the terms of the performance-based incentive compensation and how it is determined. To the extent applicable, discuss any circumstances where incentive fees could be subject to clawback provisions.

Response: The Company has revised the disclosure on page 273 of the Registration Statement in response to the Staff's comment.

Results of Operations, page 270

24.Comment: Please revise to further clarify the reasons underlying the 149% increase in incentive fees, as disclosed on page 270.

Response: The Company acknowledges the Staff's comment and has addressed this comment in its response to Comment 25 below.

Asset Management Segment

Revenues, page 271

25.Comment: We note the $1.9 million increase in OCIF incentive fees from 2023 to 2024 due to improved fund performance in 2024 compared to 2023. Please expand your disclosure to provide further discussion of the factors or holdings contributing to the improved fund performance. In addition, clarify if these were realized incentives fees.

8

Response: The Company has revised the disclosure on page 311 of the Registration Statement in response to the Staff's comment.

Assets Under Management, page 275

26.Comment: Please revise to include a roll-forward of assets under management by fee generating vehicle showing inflows, outflows, market/asset appreciation, and if material the effects of foreign currency translation. In addition, include discussion, quantification and trends in your fee rates or weighted average fee rates by vehicle over the periods presented.

Response: The Company has revised the disclosure on pages 283 and 315 of the Registration Statement in response to the Staff's comment including the addition of the roll-forward of assets under management by vehicle and included a discussion fee rates.

Management's Discussion and Analysis of Financial Condition

Liquidity and Capital Resources, page 277

27.Comment: Please revise the discussion of Mount Logan’s liquidity outlook to address the negative cash flows from operations and investing activities.

Response: The Company has revised the disclosure on page 288 of the Registration Statement in response to the Staff's comment regarding its liquidity disclosures and has made additional clarifying disclosures accordingly.

Certain Relationships and Related Person, page 289

28.Comment: We note the statement on page 289 that BCPA owns a minority interest in Mount Logan, as well as the statement on page 290 that Mount Logan’s senior management team "is comprised of substantially the same personnel as the senior management team of BCPA." Please advise us why BCPA is not reflected in the ownership table on page 313. Additionally, please revise this section to disclose, with quantification, the material terms of the Servicing, Staffing, Senior Management and other agreements. In this regard, please file such agreements as exhibits.

Response: The Company has revised the disclosure on page 330 of the Registration Statement in response to the Staff's comment to quantify the amounts paid under the Servicing Agreement.

Additionally, the Company advises the Staff on a supplemental basis that there have been no amounts paid under the Staffing Agreement. Additionally, as stated on page 330 in of the Registration Statement, a BCPA affiliate owns a minority interest in Mount Logan, however the interest is below the 5% threshold to be included on the beneficial ownership table on page 361. The Servicing Agreement and Staffing Agreement have been filed as Exhibits 10.4 and 10.12 to the Registration Statement. There are no senior management employment agreements.

Management's Discussion and Analysis of Financial Condition

Results of Operations, page 302

29.Comment: We note your statement that owing to the structure and objectives of 180 Degree Capital's business you generally expect to experience net investment losses and seek to generate

9

increases in net assets from operations through long-term appreciation. Please revise, where appropriate, to clarify the reasons for expected net investment losses and how in light of net investment losses, increases in net assets from operations can be achieved.

Response: The Company has revised the disclosure on page 344 of the Registration Statement in response to the Staff’s comment to clarify that 180 Degree Capital generally seeks to generate increases in its net assets from operations through net investment gains generated from long-term appreciation and monetization of its investments.

30.Comment: We note you attribute the increase in investment income for the year ended December 31, 2024 to receipt of board fees. Please revise, where appropriate, to discuss in more detail these board fees. Address the following:

•Generally discuss whether or not board fees are contractually governed and how they are determined, including the timing and amounts.

•Clarify whether 180 Degree Capital employees, such as Mr. Rendino, receive any other payments outside of those remitted to 180 Degree Capital in their roles as Board members of your portfolio companies.

•Generally discuss the form and quantify the portions of board fees that are paid in cash and stock grants.

•Clarify whether the board fees are subject to clawback and under what circumstances if so.

Response: The Company has revised the disclosure on page 344 of the Registration Statement in response to the Staff’s comment to address the points above and clarify that the 1940 Act restricts the ability of affiliates, including officers, to receive fees or remuneration for any services, including serving on boards of directors, from any company in which 180 Degree Capital has an investment. As such, all remuneration for such services is paid directly to 180 Degree Capital and, in the case of equity-based compensation, such affiliate assigns all economic benefit from such equity-based compensation to 180 Degree Capital at the time of such grant.

31.Comment: We note the statement on page 300 that 180 Degree Capital “does not believe the increase or decrease in the value of its investments materially impacts its day-to-day operations or its daily liquidity.” Please revise to clarify what factors do materially impact 180 Degree Capital’s liquidity.

Response: The Company has revised the disclosure on page 341 of the Registration Statement in response to the Staff’s comment to clarify that while 180 Degree Capital’s daily liquidity may fluctuate based on the increase or decrease in the value of its investments, it does not believe such fluctuations materially impact its day-to-day operations owing to its holdings of primarily freely tradable common stock of publicly listed companies. In addition, 180 Degree Capital does not have any debt or senior securities outstanding as of March 31, 2025.

32.Comment: We note your disclosure on page 303 that professional fees increased 75.1% for the year ended December 31, 2024 as compared with the year ended December 31, 2023, primarily as a result of an increase in legal expenses related to the proposed Business Combination. Please revise here or where appropriate to discuss details regarding the nature of the professional fees.

10

In addition, include quantification disaggregation expense amounts relating to the business combination activities as opposed to normal, recurring professional fees, if any.

Response: The Company has revised the disclosure on page 345 of the Registration Statement in response to the Staff’s comment and included disaggregation information for the increase in professional fees related to the proposed Business Combination for the year ended December 31, 2024 as compared to December 31, 2023, as well as the three month period ended March 31, 2025 as compared to March 31, 2024.

Mount Logan Capital Inc.

Notes to Consolidated Financial Statements

Note 2. Basis of Presentation

Goodwill, page F-21

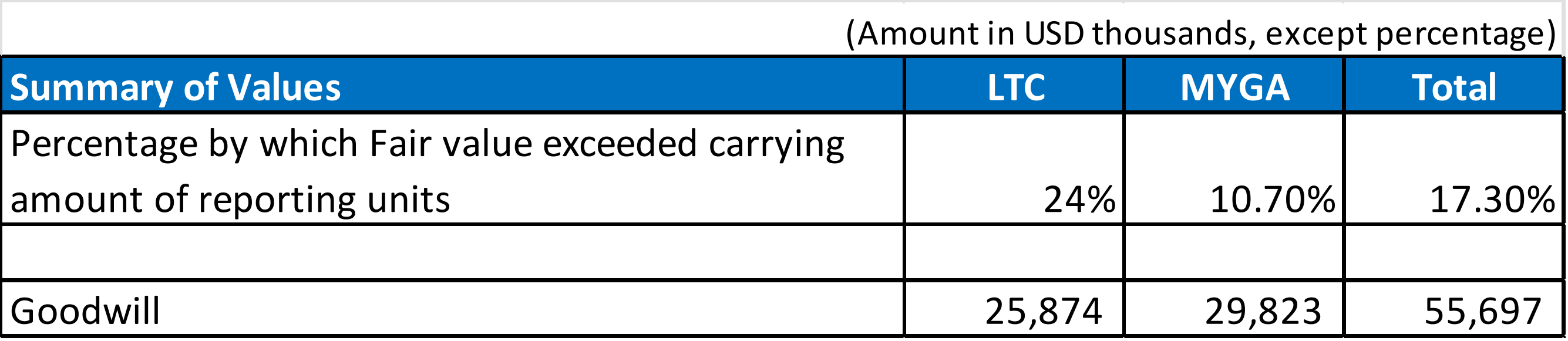

33.Comment: We note goodwill of $55,697 relating to your Insurance Solutions reportable segment, which includes two reporting units: long-term care insurance (“LTC”) and multi-year guaranteed annuity products (“MYGA”). We also note your disclosure on page F-83 that you have a concentration of revenue from the MYGA product line, which are assumed solely from two insurance companies, ACL and SSL. Further, we note that you made a decision to no longer assume business from ACL and SSL as of June 30, 2024. Please provide us with a summary of your goodwill impairment analysis, specifically as it relates to your MYGA reporting unit. Please include the following details in your response:

•the percentage by which fair value exceeded carrying value as of the date of the most recent test;

•the amount of goodwill allocated to the reporting units;

•a description of the methods and key assumptions used and how the key assumptions were determined, including those assumptions relating to your revenue from the MYGA product line after June 30, 2024; and

•tell us your consideration to disclose these, and other, relevant factors and details as part of your critical accounting policies and estimates disclosures.

Response: The Company has revised the disclosure on page 295 of the Registration Statement in response to the Staff’s comment to include a critical accounting estimate regarding goodwill impairment.

The Company advises the Staff on a supplemental basis that per requirements within ASC 350, Mount Logan performed an annual goodwill impairment review as of October 1, 2024, which includes the two reporting units: long-term care insurance (“LTC”) and multi-year guaranteed annuity products (“MYGA”) within Mount Logan’s Insurance Solutions reportable segment.

The cessation of assuming MYGA contracts from ACL and SSL as of June 30, 2024 did not terminate the existing MYGA contracts with the individual holders; however, Mount Logan concluded this was a qualitative indicator that would require Mount Logan to perform a quantitative impairment test. As the existing portfolio of MYGA contracts are long-dated and Ability plans to assume new contracts in the future with new providers, which, for example, went

11

into effect in May 2025 starting with National Security Group wherein Mount Logan will assume a 90% quota share coinsurance of MYGA policies, Mount Logan considered these existing and future strategies in its quantitative tests for both periods presented.

The table below summarizes the percentage by which fair value exceeded the carrying amount of reporting units as of October 1, 2024 and allocation of Goodwill between reporting units.

The valuation techniques and significant assumptions applied in the goodwill impairment testing are described below.

When determining if a reporting unit is impaired, Mount Logan compares its fair value to the reporting unit’s carrying value. The fair value of reporting units is determined from a projection of future cash flows & operating results derived from both the in-force business and new business expected in the future. This approach requires assumptions including premium growth rates, capital requirements, interest rates, mortality, morbidity, policyholder behavior, and discount rates.

To calculate fair value of the insurance business, Mount Logan discounted projected earnings from in-force contracts and valued new business growing at expected plan levels, consistent with the periods used for forecasting long term businesses, in addition to considering a terminal value for the value of new business beyond five years at Mount Logan’s long-term growth rate. In arriving at its projections, Mount Logan considered past experience, economic trends such as interest rates, capital requirements and market trends. Capital requirements were based on a risk-based capital (RBC) ratio of 350.0%. Excess capital above this requirement was added to the fair value of the reporting units, consistent with market participant treatment. Mount Logan's key assumptions for the new MYGA business were the (i) discrete premium growth rate, (ii) interest rate, and (iii) capital requirements. (i) The discrete MYGA premium growth rate in the fair value calculations which were based on maintaining management’s target RBC ratio of 350%. RBC of 350% maintained based on performance of investment portfolio and additional capital contribution. We assumed a higher growth rate in initial years with declining growth in the later years as we continue to scale the business. (ii) Interest rates assumptions are based on prevailing market rates at the valuation date. (iii) Capital requirements assumed per management’s target RBC ratio of 350%.

Discount rates assumed in determining the carrying value for applicable reporting units was based on a cost of equity of 17.5% and 23.5% on an after-tax basis for LTC and MYGA, respectively. Capital Asset Pricing Model (CAPM) was used to estimate the cost of equity. The cost of equity was derived using a yield of 20-year U.S. treasury bonds and by adding an equity risk premium. Further, the cost of equity also considers 100 basis points and 700 basis points of execution risk to account for risk of achieving the planned forecast for LTC and MYGA business, respectively.

12

Note 14. Future policy benefits and related reinsurance recoverable, page F-64

34.Comment: We note your presentation of “effect of actual variances from expected experience” within your summary of changes in future policy benefits on page F-65. To the extent material, please revise your disclosure to include a comparison and discussion of actual experience attributable mortality, morbidity and lapses compared to what was expected for the period. For example, to the extent that there are significant favorable and/or unfavorable offsetting impacts, consider quantifying or providing accompanying information to further discuss those effects of actual experience versus expected.

Response: The Company advises the Staff on a supplemental basis that it does not believe the effect of actual variances from expected experience is material, and the Company has included such prospectively beginning in the notes to the financial statements of Mount Logan for the three month period ending March 31, 2025, in Note 13. Future policy benefits and related reinsurance recoverable on page F-127.

The Company further advises the Staff on a supplemental basis that as noted in Mount Logan's notes to its financial statements for the years ending December 31, 2024, and December 31, 2023, in 2024, the underlying cash flow assumptions were reviewed with respect to mortality, lapse, morbidity incidence and morbidity termination. The resulting assumption updates resulted in an $8.6 million or 1.1% increase in the liability for future policy benefits, mainly as a result of unfavorable mortality experience. The effect of actual variances from expected experience observed a $13.8 million or 1.8% increase in the liability for future policy benefits, mainly due to lower than expected future premium receipts and higher claims.

In 2023, the underlying cash flow assumptions were reviewed with respect to mortality, lapse, morbidity incidence and morbidity termination. The review did not result in any assumption updates. The effect of actual variances from expected experience observed a $12.1 million or 1.5% increase in the liability for future policy benefits, mainly due to lower than expected future premium receipts and higher claims.

Note 25. Capital management and regulatory requirements

Insurance capital requirements, page F-82

35.Comment: We note your disclosure that the minimum RBC ratio for Ability is 200% and Ability must have a ratio in excess of 300% to be able to reinsure new business. Further, we note that Ability was in excess of the minimum requirement at December 31, 2024. Please revise to disclose the actual ratio at December 31, 2024.

Response: The Company advises the Staff on a supplemental basis that the RBC ratio as of December 31, 2024, was 325.098%, and Mount Logan has included this annually calculated RBC ratio prospectively in Note 24. Capital management and regulatory requirement on page F-145 to Mount Logan's financial statements for the three month period ended March 31, 2025.

36.Comment: Your disclosure states that Regulatory action is triggered beginning at 200% RBC and below. Please revise your disclosure, where appropriate in the filing, to provide additional details about the regulatory actions, timeline and process that could be triggered if you fall below the required ratio.

13

Response: The Company advises the Staff on a supplemental basis the Company has included such disclosure prospectively under Insurance regulation in the business section on page 264 of Mount Logan's financial statements for the three month period ended March 31, 2025.

Note 26. Concentration of Risks

Insurance Solutions, page F-83

37.Comment: We note your disclosure that you historically have had a concentration of revenue from your MYGA product line, which are assumed solely from ACL and SSL. Further, we note that you have made a decision to no longer assume business from ACL and SSL as of June 30, 2024. Please revise your disclosure to provide more details regarding this concentration of your revenue, including quantification by financial statement period. Refer to ASC 275-10-50-18(b). Include disclosure of this concentration risk elsewhere in the filing, such as Risk Factors, as appropriate.

Response: The Company has revised the disclosure on page F-146 of the Registration Statement in response to the Staff’s comment to clarify that Mount Logan's MYGA business including that as specified in Note 27 of MLC’s Annual Financial Statements, Subsequent Events, Mount Logan has entered a new reinsurance treaty with National Security Group to expand its current MYGA portfolio which will continue to increase and diversify the base of individual holders.

The Company advises the Staff on a supplemental basis that the MYGA product line is not recognized as a source of revenue as the products are accounted for as investment contracts and reported as liabilities in the Consolidated Statements of Financial Position. Per the guidance in ASC 275-10-50-16, Mount Logan is not vulnerable to risk of a near-term severe impact because the MYGA contracts are long-dated and diversified across numerous individual holders. While Mount Logan will no longer assume business from ACL and SSL as of June 30, 2024, the Company will continue to earn investment income from the cash proceeds received on the underlying MYGA Products. As noted in Note 27, Subsequent Events, Ability entered a new reinsurance treaty for additional MYGA contracts with National Security Group. Such reinsurance treaty will grow the MYGA portfolio and continue to diversify the base of individual holders.

38.Comment: We note your tabular presentation quantifying the investment concentration risk of your Insurance Solutions segment. We also note that Other represents 29% and 30% of the investment concentration risk as of December 31, 2024 and 2023, respectively. Please revise your disclosure to provide additional qualitative and quantitative details regarding the composition of Other. Refer to ASC 275-10-50-18(d).

Response: The Company advises the Staff on a supplemental basis that Mount Logan does not believe the investment concentration risk within "Other" is material. For reference, “Other” mainly includes investments domiciled in the Cayman Islands which represents 25% & 27% of the total investment concentration risk as of December 31, 2024 and 2023, respectively. There are various other countries such as Bermuda and the United Kingdom where the concentration is equal to or less than 1%. The Company further advises the Staff that it has revised this disclosure on a prospective basis beginning with Mount Logan's financial statements for the period ending March 31, 2025.

14

Board Fees From Portfolio Companies, page F-101

39.Comment: Please revise to include a more detailed description of board fees such that investors may understand the nature and terms of this revenue generating activity, as well as the related forms of payment (i.e. stock grants, cash, etc.). For example, include discussion of how the transaction price is measured and determined for stock grants received.

Response: The Company advises the Staff on a supplemental basis that it has included additional disclosure in response to the Staff's comment number 30 on page 344 of the Registration Statement. In addition, 180 Degree Capital will include similar disclosure on a prospective basis in future filings on Form N-CSR and Form N-CSRS in the accompanying notes to its financial statements that can be found on page F-231.

Signatures, page II-6

40.Comment: Given the structure of the merger with both existing entities becoming subsidiaries of the registrant, advise us why you believe the correct entities and individuals are included on the signature page. In this regard, we note the statements on page i that the entities and officers and directors assume no responsibility for the accuracy or completeness of disclosure, which appears to be an inappropriate disclaimer. Please revise or advise.

Response: The Company has revised the signature page of the Registration Statement in response to the Staff’s comment. In addition, the Company advises the Staff on a supplemental basis that that it believes that New Mount Logan (a.k.a., “Yukon New Parent, Inc.”), as the named registrant and the sole issuer of securities pursuant to the Registration Statement, is the appropriate entity to execute the Registration Statement. The Company further notes that New Mount Logan has not disclaimed any disclosures included in the Registration Statement.

General

41.Comment: We note that 180 Degree Capital has published a presentation on its website relating to the proposed merger that includes statements suggesting shareholders could realize a 20+% return from combining asset management with an insurance business. With a view to clarifying disclosure, please advise us of the related assumptions underlying the anticipated return. Please also advise us whether these materials constitute written communications, for example, under Rule 425 of the Securities Act.

Response: The Company advises the Staff on a supplemental basis that slide 14 of such presentation presents an example of how capital provided from a parent company (e.g., New Mount Logan) into a wholly-owned insurance business could generate a 20%+ return on such investment for the parent company based on the assumptions listed in the slide rather than a 20%+ return for 180 Degree Capital shareholders. The presentation referenced in the above comment has previously been filed with the SEC in accordance with Rule 425 under the Securities Act under accession numbers 0000893739-25-000002 and 0002051820-25-000004 for 180 Degree Capital and the Company, respectively.

* * *

15

If you have any questions or additional comments concerning the foregoing, please contact the undersigned by phone at 202.416.6828 or by email at jmahon@proskauer.com.

Sincerely,

/s/ John J. Mahon

John J. Mahon, Esq.

cc: Daniel B. Wolfe / 180 Degree Capital Corp.

Kevin M. Rendino / 180 Degree Capital Corp.

Nikita Klassen / Mount Logan Capital Inc.

Joshua A. Apfelroth / Proskauer Rose LLP

Michael E. Ellis / Proskauer Rose LLP

Kenneth E. Young / Dechert LLP

Stephen R. Pratt / Dechert LLP

16