Published on August 8, 2008

|

Venture

Capital for Tiny Technology

|

SECOND

QUARTER REPORT 2008

FELLOW

SHAREHOLDERS:

As

always, in adversity, there is opportunity. Currently, the United States is

beset by great economic and financial adversity: declining housing prices and

rising mortgage foreclosures; the credit and banking crisis precipitated by

the

sub-prime mortgage debacle; the slowing economy; the global bear market in

stocks; the shutdown of the market for venture capital-backed initial public

offerings (IPOs); the slowdown of merger-and-acquisition activity; the

disappearance of the auction-rate securities markets; the growing U.S. budget

deficit; the devaluation of the U.S. dollar; the slump in sales and declining

re-sale values of gas-guzzling vehicles; rising unemployment; growing

delinquencies in credit-card debt; rising industrial-commodity prices; rising

food prices; widely accepted evidence of global warming; and rising energy

prices.

Of

all of

these problems, none seems more intractable than the cost and availability

of

clean energy. But for the venture capital industry and for those seeking

commercial applications for nanotechnology, there is no greater opportunity

than

cleantech -- reducing the consumption, costs, and pollution associated with

generating energy.

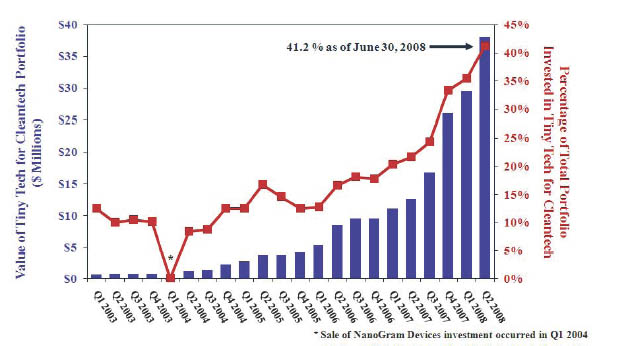

At

a time

when capital is hard to attract in most industries, it is pouring into

cleantech. And our own portfolio reflects this onslaught of capital for

cleantech. All of the nine companies in our portfolio that we classify as "Tiny

Tech for Cleantech," except Laser Light Engines, Inc., in which we recently

made

our initial investment, have completed follow-on financings subsequent to our

initial investment. Of the eight companies that have completed subsequent

financings, seven have completed financings at premiums to the prices of the

rounds of financing in which we initially participated. Thus, the value of

our

Tiny Tech for Cleantech holdings is currently $38,063,904, versus our cost

of

$21,612,011. Moreover, since we began making new investments strictly in tiny

technology in 2001, we have had no write-offs of cleantech investments, and

we

sold our shares in one such investment, NanoGram Devices Corporation, for

$2,749,955, versus our cost basis of $813,210, approximately 14 months after

our

investment. (Prior to 2001, our only investment in cleantech was in Molten

Metal

Technology, Inc., in which we completed the sale of our shares for $30,660,765,

versus our cost basis of $110,000, approximately 48 months after our

investment.)

In

the

second quarter, as a result of both new investment and appreciation in the

value

of our previous holdings, Tiny Tech for Cleantech increased from 35.5 to 41.2

percent of our portfolio. Driven by the increase in value of our Tiny Tech

for

Cleantech holdings, our net asset value per share (NAV) increased to $5.95,

its

all-time high. One of these holdings, Solazyme, was recently named most

promising U.S. green-tech firm at the sixth annual World Investment Conference

in France.

Given

the

growing employment of nanotechnology for cleantech solutions, Tiny Tech for

Cleantech may continue to grow as a percentage of our portfolio.

With

32

active companies in our portfolio, developing, making and selling a variety

of

products for a variety of markets, we are of course exposed, either directly

or

indirectly, to most of the negative forces in our economy. With respect to

some

of these negative forces, our exposure is isolated. For example, one of our

companies makes products for the home-building industry, two hold some

auction-rate securities, and some of our companies have borrowed money from

banks. With respect to other of these negative forces, most of our companies

are

or may become affected. For example, we would expect the economic slowdown

to

have some effect on most of our companies, other than the ones developing and

selling products and services for the life-sciences markets.

In

this

unusually difficult environment, we are continuing to invest. But until the

capital markets improve, we would not expect any of our portfolio companies

to

try to move ahead with IPO plans. For the first time in a quarter since 1978,

in

the second quarter of 2008, there were no IPOs in the United States of venture

capital-backed companies. Nor did the IPO market improve in July; July was

the

worst month for IPOs globally in the last five years. And while

merger-and-acquisition activity continues, it has been subdued recently.

Companies that remain in a venture capital portfolio rather than going public

or

being acquired generate no liquidity and often require additional investment.

Thus, while we weather the storm, we expect to be making a higher percentage

of

our investments than was our wont in follow-on, as opposed to initial,

investments.

|

2001

|

|

2002

|

|

2003

|

|

2004

|

|

2005

|

|

2006

|

|

2007

|

|

YTD

6/30/08

|

|||||||||||

|

Total

Incremental Investments

|

$

|

489,999

|

$

|

6,240,118

|

$

|

3,812,600

|

$

|

14,837,846

|

$

|

16,251,339

|

$

|

24,408,187

|

$

|

20,595,161

|

$

|

10,847,095

|

|||||||||

|

No.

of New Investments

|

1

|

7

|

5

|

8

|

4

|

6

|

7

|

2

|

|||||||||||||||||

|

No.

of Follow-On Investment Rounds

|

0

|

1

|

5

|

21

|

13

|

14

|

20

|

13

|

|||||||||||||||||

|

No.

of Rounds Led

|

0

|

1

|

0

|

2

|

0

|

7

|

3

|

3

|

|||||||||||||||||

|

Average

Dollar Amount - Initial

|

$

|

489,999

|

$

|

784,303

|

$

|

437,156

|

$

|

911,625

|

$

|

1,575,000

|

$

|

2,383,424

|

$

|

1,086,441

|

$

|

1,122,250

|

|||||||||

|

Average

Dollar Amount - Follow-On

|

N/A

|

$

|

750,000

|

$

|

325,364

|

$

|

359,278

|

$

|

765,488

|

$

|

721,974

|

$

|

649,504

|

$

|

661,738

|

||||||||||

In

all

environments, we endeavor to manage the high risk inherent in our individual

investments in three ways: financial diversification, economic diversification,

and degree of liquidity on our parent-company balance sheet. With respect to

financial diversification, we do not currently have as much as five percent

of

our net assets invested on a cost basis in any one portfolio company (although

occasionally we have gone over five percent in the past and may do so again

in

the future). With respect to economic diversification, our portfolio companies

are utilizing tiny technology to develop, manufacture, and market a wide variety

of products for a variety of end-user markets. With respect to balance-sheet

liquidity, we raised enough additional capital ($14,383,497, net of offering

expenses) in the second quarter to continue to execute a long-term growth

strategy, in spite of the difficult environment in which we find ourselves.

We

wound up the second quarter with $61,425,025 in U.S. treasury securities and

no

debt.

Our

company is extremely sensitive to bear markets in stocks. Our stock has a high

beta - in other words, it is much more volatile than the general stock market.

Thus, a bear market tends to lower our stock's price, which raises our cost

of

capital as well as hurting our shareholders. A bear market tends to slow if

not

halt IPOs of venture capital-backed companies. Merger-and-acquisition activity

tends to slow, and valuations of acquisitions decline, in a bear market.

Moreover, the multiple of our stock price to our net asset value per share

(NAV)

seems to be sensitive to the level of venture capital-backed IPOs. This year,

as

IPO activity dried up (there were only five venture capital-backed IPOs in

the

entire first half), whether coincidentally or not, our stock traded at times

at

or below NAV, even as our NAV was headed to a record high at the end of the

second quarter. Of course, we are far from alone in this bear market.

Ironically, in spite of the actual decline in our market value this year, we

were included in the Russell 2000 Index after the close of the equity markets

on

June 27, 2008, on the basis of the relative increase

in our

market value!

In

closing, we are very appreciative of the patience and support of our fellow

shareholders. Bear markets burn out eventually, and in their aftermath, it

always turns out that great new companies rise from the ashes. We are in the

business of trying to identify, invest in, and develop such companies. The

world

looked pretty gloomy in 1978 too, the last time there were no venture

capital-backed IPOs for an entire quarter. In the aftermath of the current

bear

market, we are betting that cleantech companies will be in the vanguard of

the

next IPO market.

|

|

|

|

Charles

E. Harris

|

Douglas

W. Jamison

|

Daniel

B. Wolfe

|

|

Chairman

and Chief Executive Officer

|

President

and Chief Operating Officer

|

Chief

Financial Officer

|

|

Managing

Director

|

Managing

Director

|

Managing

Director

|

|

|

|

|

Michael

A. Janse

|

Alexei

A. Andreev

|

|

|

Executive

Vice President

|

Executive

Vice President

|

|

|

Managing

Director

|

Managing

Director

|

|

|

August

7, 2008

|

This

letter may contain statements of a forward-looking nature relating to future

events. These forward-looking statements are subject to the inherent

uncertainties in predicting future results and conditions. These statements

reflect the Company's current beliefs, and a number of important factors could

cause actual results to differ materially from those expressed in this letter.

Please see the Company's Annual Report on Form 10-K for the fiscal year ended

December 31, 2007, the Company's report on Form 10-Q for the quarter ended

June

30, 2008 and subsequent filings, filed with the Securities and Exchange

Commission, for a more detailed discussion of the risks and uncertainties

associated with the Company's business, including but not limited to the risks

and uncertainties associated with venture capital investing and other

significant factors that could affect the Company's actual results. Except

as

otherwise required by Federal securities laws, Harris & Harris Group,

Inc.®,

undertakes no obligation to update or revise these forward-looking statements

to

reflect new events or uncertainties. The reference to the website

www.TinyTechVC.com has been provided as a convenience, and the information

contained on such website is not incorporated by reference into this

letter.

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

STATEMENTS OF ASSETS AND

LIABILITIES

|

ASSETS

|

June

30, 2008

|

December

31, 2007

|

||||||

|

(Unaudited)

|

|||||||

|

Investments,

in portfolio securities at value

|

|||||||

|

(cost:

$88,459,760 and $82,677,528, respectively)

|

$

|

92,335,524

|

$

|

78,110,384

|

|||

|

Investments,

in U.S. Treasury obligations at value

|

|||||||

|

(cost:

$60,984,874 and $59,552,933, respectively)

|

61,425,025

|

60,193,593

|

|||||

|

Cash

and cash equivalents

|

688,119

|

330,009

|

|||||

|

Restricted

funds

|

53,871

|

2,667,020

|

|||||

|

Receivable

from portfolio company

|

21,500

|

524

|

|||||

|

Interest

receivable

|

573,686

|

647,337

|

|||||

|

Prepaid

expenses

|

263,363

|

488,667

|

|||||

|

Other

assets

|

425,895

|

455,798

|

|||||

|

Total

assets

|

$

|

155,786,983

|

$

|

142,893,332

|

|||

LIABILITIES

& NET ASSETS

|

Accounts

payable and accrued liabilities

|

$

|

1,996,853

|

$

|

4,515,463

|

|||

|

Deferred

rent

|

11,290

|

14,525

|

|||||

|

Total

liabilities

|

2,008,143

|

4,529,988

|

|||||

|

Net

assets

|

$

|

153,778,840

|

$

|

138,363,344

|

|||

|

Net

assets are comprised of:

|

|||||||

|

Preferred

stock, $0.10 par value, 2,000,000 shares authorized; none

issued

|

$

|

0

|

$

|

0

|

|||

|

Common

stock, $0.01 par value, 45,000,000 shares authorized at 6/30/08

and

12/31/07; 27,688,313 issued at 6/30/08 and 25,143,313 issued

at

12/31/07

|

276,884

|

251,434

|

|||||

|

Additional

paid in capital

|

178,252,063

|

160,927,691

|

|||||

|

Accumulated

net realized loss

|

(25,660,491

|

)

|

(15,483,766

|

)

|

|||

|

Accumulated

unrealized appreciation (depreciation) of investments

|

4,315,915

|

(3,926,484

|

)

|

||||

|

Treasury

stock, at cost (1,828,740 shares at 6/30/08 and 12/31/07)

|

(3,405,531

|

)

|

(3,405,531

|

)

|

|||

|

Net

assets

|

$

|

153,778,840

|

$

|

138,363,344

|

|||

|

Shares

outstanding

|

25,859,573

|

23,314,573

|

|||||

|

Net

asset value per outstanding share

|

$

|

5.95

|

$

|

5.93

|

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

|

|

Three

Months Ended June 30,

|

Six

Months Ended June 30,

|

||||||||||||

|

2008

|

2007

|

2008

|

2007

|

||||||||||

|

Investment

income:

|

|||||||||||||

|

Interest

from:

|

|||||||||||||

|

Fixed-income

securities

|

$

|

464,456

|

$

|

637,701

|

$

|

1,040,758

|

$

|

1,290,199

|

|||||

|

Miscellaneous

income

|

3,169

|

0

|

3,169

|

0

|

|||||||||

|

Total

investment income

|

467,625

|

637,701

|

1,043,927

|

1,290,199

|

|||||||||

|

Expenses:

|

|||||||||||||

|

Salaries,

benefits and stock-based compensation

|

2,461,802

|

2,644,284

|

4,895,097

|

5,179,050

|

|||||||||

|

Administration

and operations

|

283,361

|

357,178

|

585,216

|

738,043

|

|||||||||

|

Professional

fees

|

201,866

|

335,067

|

340,098

|

517,262

|

|||||||||

|

Rent

|

59,748

|

58,813

|

117,602

|

118,320

|

|||||||||

|

Directors’

fees and expenses

|

79,169

|

112,157

|

184,315

|

253,353

|

|||||||||

|

Depreciation

|

13,819

|

15,908

|

27,804

|

31,221

|

|||||||||

|

Custodian

fees

|

6,143

|

5,961

|

12,696

|

11,735

|

|||||||||

|

Total

expenses

|

3,105,908

|

3,529,368

|

6,162,828

|

6,848,984

|

|||||||||

|

Net

operating loss

|

(2,638,283

|

)

|

(2,891,667

|

)

|

(5,118,901

|

)

|

(5,558,785

|

)

|

|||||

|

Net

realized gain (loss) from investments:

|

|||||||||||||

|

Realized

gain (loss) from investments

|

3,912

|

(8,213

|

)

|

(5,010,958

|

)

|

(8,887

|

)

|

||||||

|

Income

tax expense

|

668

|

0

|

46,866

|

84,905

|

|||||||||

|

Net

realized gain (loss) from investments

|

3,244

|

(8,213

|

)

|

(5,057,824

|

)

|

(93,792

|

)

|

||||||

|

Net

decrease (increase) in unrealized depreciation on

investments:

|

|||||||||||||

|

Change

as a result of investment sales

|

0

|

0

|

5,014,653

|

0

|

|||||||||

|

Change

on investments held

|

3,

989,748

|

(1,193,764

|

)

|

3,227,746

|

(4,831,227

|

)

|

|||||||

|

Net

decrease (increase) in unrealized depreciation on

investments

|

3,

989,748

|

(1,193,764

|

)

|

8,242,399

|

(4,831,227

|

)

|

|||||||

|

Net

increase (decrease) in net assets resulting from

operations

|

$

|

1,354,709

|

$

|

(4,093,644

|

)

|

$

|

(1,934,326

|

)

|

$

|

(10,483,804

|

)

|

||

|

Per

average basic and diluted outstanding share

|

$

|

0.06

|

$

|

(0.19

|

)

|

$

|

(0.08

|

)

|

$

|

(0.49

|

)

|

||

|

Average

outstanding shares

|

23,622,210

|

21,721,591

|

23,468,392

|

21,500,810

|

|||||||||