CORRESP: Correspondence

Published on July 10, 2025

Proskauer Rose LLP 1001 Pennsylvania Avenue, NW Suite 600 South Washington, DC 20004-2533 | ||

July 10, 2025

VIA EDGAR

U.S. Securities and Exchange Commission

Division of Corporation Finance

Office of Finance

100 F Street, NE

Washington, DC 20549

100 F Street, NE

Washington, DC 20549

Attention: Robert Arzonetti

Re: Yukon New Parent, Inc.

Amendment No. 3 Registration Statement on Form S-4

Amendment No. 3 Registration Statement on Form S-4

Dear Mr. Arzonetti:

On behalf of Yukon New Parent, Inc. (the “Company”), set forth below are the Company’s responses to the comments provided by the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) to the Company in its letter dated July 10, 2025 with respect to the Company’s amended registration statement on Form S-4 (the “Registration Statement”) and the Company's response letter addressing the Staff's prior comments with respect to the Registration Statement filed on July 9, 2025. The Staff’s comments are set forth below in italics and are followed by the Company’s responses. Capitalized terms used below but not otherwise defined herein shall have the meanings ascribed to them in the Registration Statement. Where revisions to the Registration Statement are referenced in the below response, such revisions included in the changed pages attached as an exhibit hereto and will be included in the definitive proxy statement/prospectus filed pursuant to Rule 424 following the effectiveness of the Registration Statement.

Amendment No. 3 to the Registration Statement on Form S-4

General

1.Comment: We note your revised disclosure and response to prior comment 2. Please advise us why you believe the joint investor presentation after the announcement of the merger, including the slide relating solely to Mount Logan's illustrative ROE, does not relate to the disclosure on pages 21 and 124 and the Background of the Merger. Please revise pages 21 and 124 to further clarify how the Mount Logan board considered "the implied breakeven return on equity to shareholders of Mount Logan" in making its recommendation to approve the transaction. For example, clarify the quantification and assumptions underlying the phrase "implied breakeven," and explain whether this was one of the material factors that "favored the conclusion" of the board or whether it was a negative factor. For example, it is unclear if the "limited" opportunity for the ROE to be accretive was considered by the board as a possible risk or negative factor. With respect to the joint investor presentation, it is unclear if the merger is expected to facilitate Mount Logan raising the illustrative $10 million equity contribution, which appears to be a key assumption underlying the 26% ROE. Provide corresponding disclosure in the Background of the Merger section to the extent expected ROE opportunities were material to the discussions."

Beijing | Boca Raton | Boston | Chicago | Hong Kong | London | Los Angeles | New Orleans | New York | Paris | São Paulo | Washington, DC

Response: The Company has revised the disclosure in the "Mount Logan's Reasons for the Mergers and Recommendation of the Mount Logan Board" section of the Registration Statement in response to the Staff’s comment.

Control Persons and Principal Shareholders of Mount Logan, page 372

2.Comment: Please revise to identify the natural persons who have or share voting and/or dispositive powers over the shares held by the entities in the table.

Response: The Company has revised the disclosure in the "CONTROL PERSONS AND PRINCIPAL SHAREHOLDERS OF MOUNT LOGAN" section of the Registration Statement in response to the Staff’s comment.

* * *

2

If you have any questions or additional comments concerning the foregoing, please contact the undersigned by phone at 202.416.6828 or by email at jmahon@proskauer.com.

Sincerely,

/s/ John J. Mahon

John J. Mahon, Esq.

cc: Daniel B. Wolfe / 180 Degree Capital Corp.

Kevin M. Rendino / 180 Degree Capital Corp.

Nikita Klassen / Mount Logan Capital Inc.

Joshua A. Apfelroth / Proskauer Rose LLP

Michael E. Ellis / Proskauer Rose LLP

Kenneth E. Young / Dechert LLP

Stephen R. Pratt / Dechert LLP

3

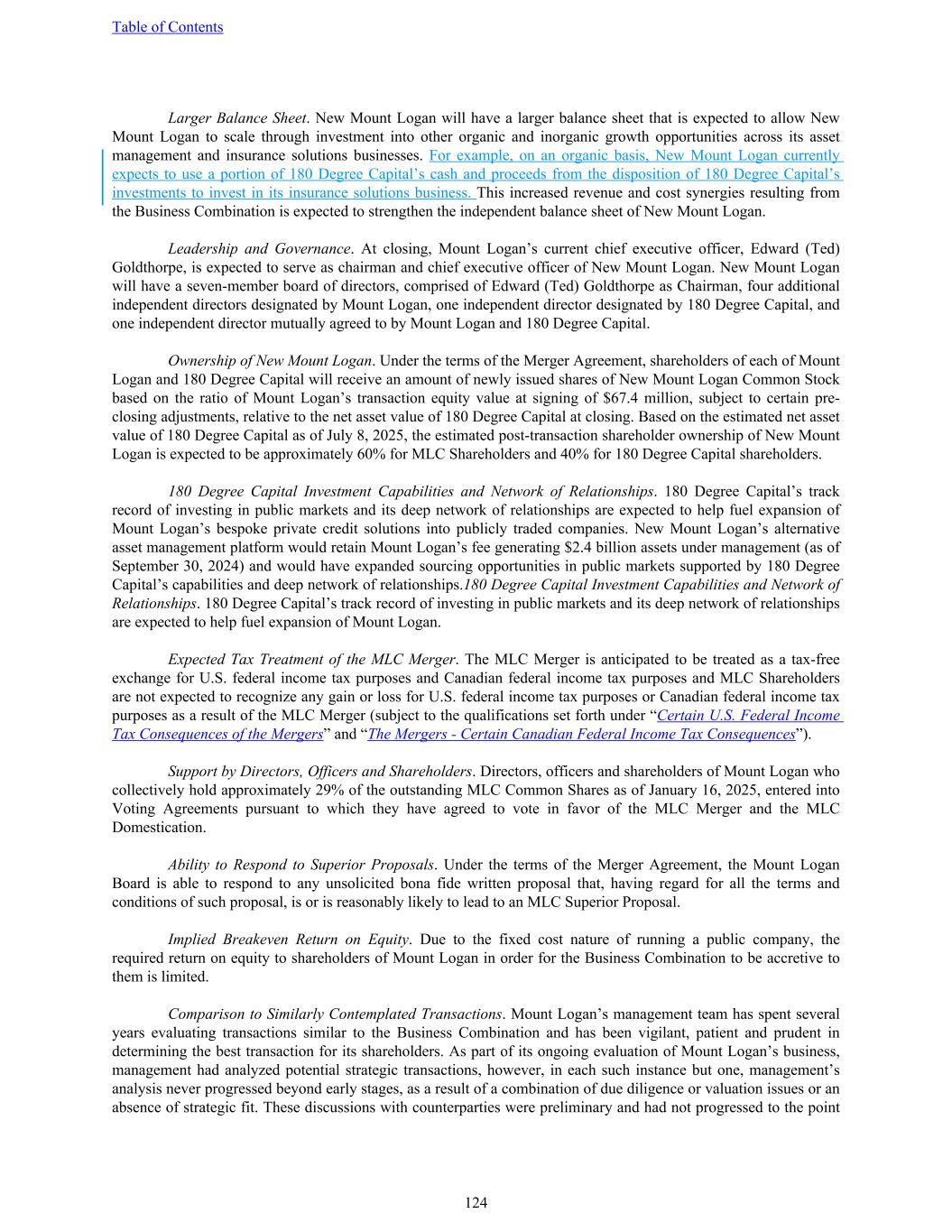

Larger Balance Sheet. New Mount Logan will have a larger balance sheet that is expected to allow New Mount Logan to scale through investment into other organic and inorganic growth opportunities across its asset management and insurance solutions businesses. For example, on an organic basis, New Mount Logan currently expects to use a portion of 180 Degree Capital’s cash and proceeds from the disposition of 180 Degree Capital’s investments to invest in its insurance solutions business. This increased revenue and cost synergies resulting from the Business Combination is expected to strengthen the independent balance sheet of New Mount Logan. Leadership and Governance. At closing, Mount Logan’s current chief executive officer, Edward (Ted) Goldthorpe, is expected to serve as chairman and chief executive officer of New Mount Logan. New Mount Logan will have a seven-member board of directors, comprised of Edward (Ted) Goldthorpe as Chairman, four additional independent directors designated by Mount Logan, one independent director designated by 180 Degree Capital, and one independent director mutually agreed to by Mount Logan and 180 Degree Capital. Ownership of New Mount Logan. Under the terms of the Merger Agreement, shareholders of each of Mount Logan and 180 Degree Capital will receive an amount of newly issued shares of New Mount Logan Common Stock based on the ratio of Mount Logan’s transaction equity value at signing of $67.4 million, subject to certain pre- closing adjustments, relative to the net asset value of 180 Degree Capital at closing. Based on the estimated net asset value of 180 Degree Capital as of July 8, 2025, the estimated post-transaction shareholder ownership of New Mount Logan is expected to be approximately 60% for MLC Shareholders and 40% for 180 Degree Capital shareholders. 180 Degree Capital Investment Capabilities and Network of Relationships. 180 Degree Capital’s track record of investing in public markets and its deep network of relationships are expected to help fuel expansion of Mount Logan’s bespoke private credit solutions into publicly traded companies. New Mount Logan’s alternative asset management platform would retain Mount Logan’s fee generating $2.4 billion assets under management (as of September 30, 2024) and would have expanded sourcing opportunities in public markets supported by 180 Degree Capital’s capabilities and deep network of relationships.180 Degree Capital Investment Capabilities and Network of Relationships. 180 Degree Capital’s track record of investing in public markets and its deep network of relationships are expected to help fuel expansion of Mount Logan. Expected Tax Treatment of the MLC Merger. The MLC Merger is anticipated to be treated as a tax-free exchange for U.S. federal income tax purposes and Canadian federal income tax purposes and MLC Shareholders are not expected to recognize any gain or loss for U.S. federal income tax purposes or Canadian federal income tax purposes as a result of the MLC Merger (subject to the qualifications set forth under “Certain U.S. Federal Income Tax Consequences of the Mergers” and “The Mergers - Certain Canadian Federal Income Tax Consequences”). Support by Directors, Officers and Shareholders. Directors, officers and shareholders of Mount Logan who collectively hold approximately 29% of the outstanding MLC Common Shares as of January 16, 2025, entered into Voting Agreements pursuant to which they have agreed to vote in favor of the MLC Merger and the MLC Domestication. Ability to Respond to Superior Proposals. Under the terms of the Merger Agreement, the Mount Logan Board is able to respond to any unsolicited bona fide written proposal that, having regard for all the terms and conditions of such proposal, is or is reasonably likely to lead to an MLC Superior Proposal. Implied Breakeven Return on Equity. Due to the fixed cost nature of running a public company, the required return on equity to shareholders of Mount Logan in order for the Business Combination to be accretive to them is limited. Comparison to Similarly Contemplated Transactions. Mount Logan’s management team has spent several years evaluating transactions similar to the Business Combination and has been vigilant, patient and prudent in determining the best transaction for its shareholders. As part of its ongoing evaluation of Mount Logan’s business, management had analyzed potential strategic transactions, however, in each such instance but one, management’s analysis never progressed beyond early stages, as a result of a combination of due diligence or valuation issues or an absence of strategic fit. These discussions with counterparties were preliminary and had not progressed to the point Table of Contents 124

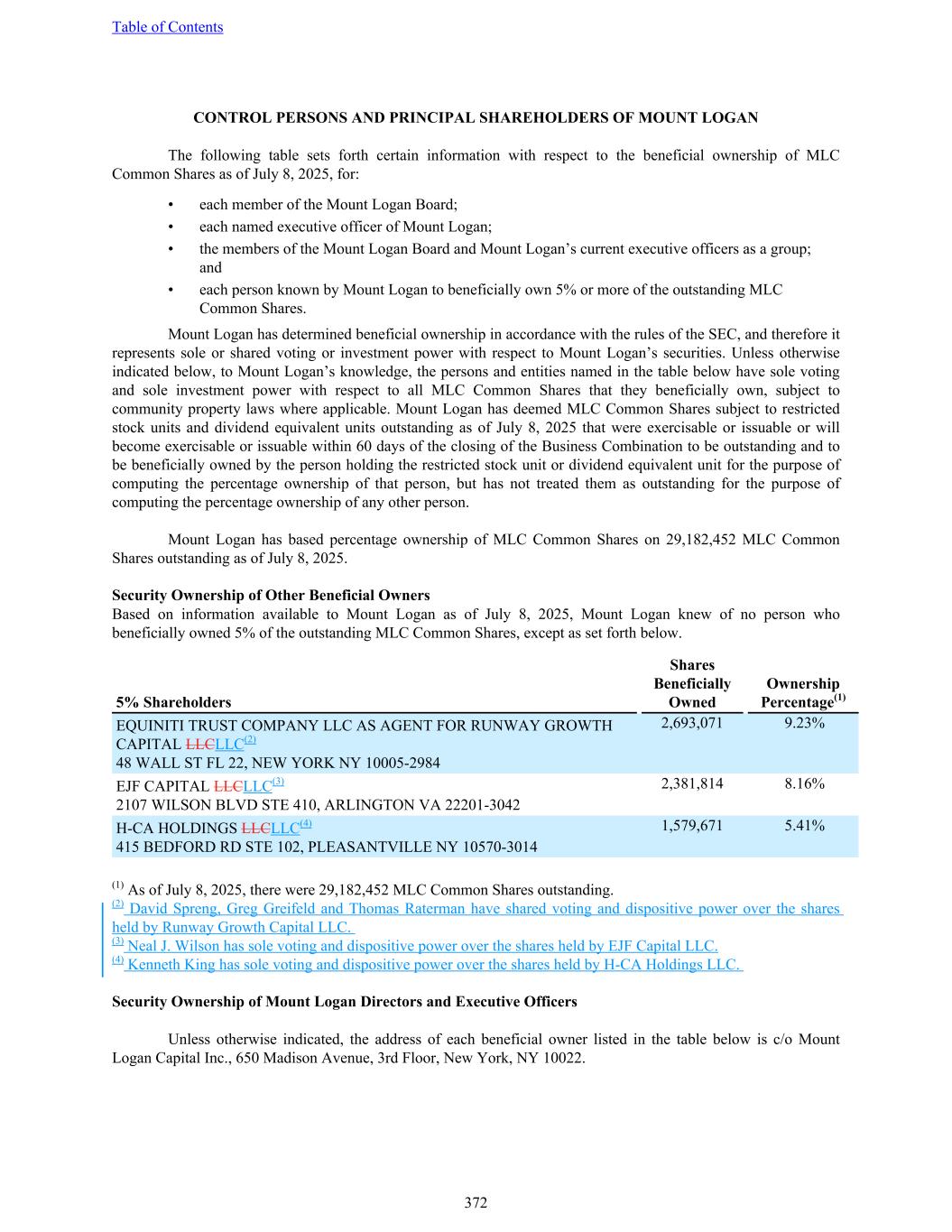

CONTROL PERSONS AND PRINCIPAL SHAREHOLDERS OF MOUNT LOGAN The following table sets forth certain information with respect to the beneficial ownership of MLC Common Shares as of July 8, 2025, for: • each member of the Mount Logan Board; • each named executive officer of Mount Logan; • the members of the Mount Logan Board and Mount Logan’s current executive officers as a group; and • each person known by Mount Logan to beneficially own 5% or more of the outstanding MLC Common Shares. Mount Logan has determined beneficial ownership in accordance with the rules of the SEC, and therefore it represents sole or shared voting or investment power with respect to Mount Logan’s securities. Unless otherwise indicated below, to Mount Logan’s knowledge, the persons and entities named in the table below have sole voting and sole investment power with respect to all MLC Common Shares that they beneficially own, subject to community property laws where applicable. Mount Logan has deemed MLC Common Shares subject to restricted stock units and dividend equivalent units outstanding as of July 8, 2025 that were exercisable or issuable or will become exercisable or issuable within 60 days of the closing of the Business Combination to be outstanding and to be beneficially owned by the person holding the restricted stock unit or dividend equivalent unit for the purpose of computing the percentage ownership of that person, but has not treated them as outstanding for the purpose of computing the percentage ownership of any other person. Mount Logan has based percentage ownership of MLC Common Shares on 29,182,452 MLC Common Shares outstanding as of July 8, 2025. Security Ownership of Other Beneficial Owners Based on information available to Mount Logan as of July 8, 2025, Mount Logan knew of no person who beneficially owned 5% of the outstanding MLC Common Shares, except as set forth below. 5% Shareholders Shares Beneficially Owned Ownership Percentage(1) EQUINITI TRUST COMPANY LLC AS AGENT FOR RUNWAY GROWTH CAPITAL LLCLLC(2) 48 WALL ST FL 22, NEW YORK NY 10005-2984 2,693,071 9.23% EJF CAPITAL LLCLLC(3) 2107 WILSON BLVD STE 410, ARLINGTON VA 22201-3042 2,381,814 8.16% H-CA HOLDINGS LLCLLC(4) 415 BEDFORD RD STE 102, PLEASANTVILLE NY 10570-3014 1,579,671 5.41% (1) As of July 8, 2025, there were 29,182,452 MLC Common Shares outstanding. (2) David Spreng, Greg Greifeld and Thomas Raterman have shared voting and dispositive power over the shares held by Runway Growth Capital LLC. (3) Neal J. Wilson has sole voting and dispositive power over the shares held by EJF Capital LLC. (4) Kenneth King has sole voting and dispositive power over the shares held by H-CA Holdings LLC. Security Ownership of Mount Logan Directors and Executive Officers Unless otherwise indicated, the address of each beneficial owner listed in the table below is c/o Mount Logan Capital Inc., 650 Madison Avenue, 3rd Floor, New York, NY 10022. Table of Contents 372