425: Prospectuses and communications, business combinations

Published on July 9, 2025

Filed by Yukon New Parent, Inc.

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Filer: Yukon New Parent, Inc.

Subject Company: 180 Degree Capital Corp.

SEC File No.: 811-07074

Date: July 9, 2025

STRATEGIC COMBINATION J U LY 2025

Disclaimer and Caution About Forward-Looking Statements CAUTIONARY NOTE REGARDING FUTURE-ORIENTED FINANCIAL INFORMATION To the extent any forward-looking statements in this presentation constitute “future-oriented financial information” or “financial outlook” within the meaning of applicable Canadian securities laws, such information is being provided solely to enable a reader to assess Mount Logan Capital’s financial condition and its operational history and experience in the asset management and insurance industries. Future-oriented financial information and financial outlook, as with forward-looking statements generally, are, without limitation, based on the assumptions and subject to the risks set out above. Mount Logan Capital’s results of operations and earnings may differ materially from management’s current expectations. Such information is presented for illustrative purposes only and may not be an indication of Mount Logan Capital’s actual results of operations or earnings. Readers are cautioned that forward-looking information containing future-oriented financial information or financial outlook may not be appropriate for any other purpose, including investment decisions. No representation or warranty of any kind is or can be made with respect to the accuracy or completeness of, and no representation or warranty should be inferred from Mount Logan Capital’s projections or the assumptions underlying them. Historical statements contained in this document regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. In this regard, certain financial information contained herein has been extracted from, or based upon, information available in the public domain and/or provided by Mount Logan Capital. In particular, historical results of Mount Logan Capital should not be taken as a representation that such trends will be replicated in the future. No statement in this document is intended to be nor may be construed as a profit forecast. All amounts in this presentation are in United States dollars unless otherwise indicated. THIRD PARTY SOURCES This presentation contains information obtained by Mount Logan Capital from third parties, including but not limited to market and industry data. Market and industry data is subject to variations and cannot be verified with complete certainty due to limits on the availability and reliability of raw data at any particular point in time, the voluntary nature of the data gathering process or other limitations and uncertainties inherent in any statistical survey. Accordingly, the accuracy and completeness of this data are not guaranteed. Mount Logan Capital believes such information to be accurate but has not independently verified any of the data from third party sources referred to in this presentation or ascertained the underlying assumptions relied upon by such sources. To the extent such information was obtained from third party sources, there is a risk that the assumptions made and conclusions drawn by Mount Logan Capital based on such representations are not accurate. References in this presentation to research reports or to articles and publications should not be construed as depicting the complete findings of the entire referenced report or article. 2

Disclaimer and Caution About Forward-Looking Statements NO OFFER OR SOLICIATION This presentation is not intended to be, and shall not constitute, an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the entry into a definitive agreement for the contemplated combination of 180 Degree Capital Corp. (”180 Degree Capital”) and Mount Logan Capital Inc. (”Mount Logan”) in an all-stock transaction (the “Business Combination”), 180 Degree Capital intends to file with the U.S. Securities and Exchange Commission (“SEC”) and mail to its shareholders a proxy statement on Schedule 14A (the “Proxy Statement”). In addition, the parent company of the combined business (“New Mount Logan”) plans to file with the SEC a registration statement on Form S-4 (the “Registration Statement”) that will register the exchange of New Mount Logan shares in the Business Combination and include the Proxy Statement and a prospectus of New Mount Logan (the “Prospectus”). The Proxy Statement and the Registration Statement (including the Prospectus) will each contain important information about 180 Degree Capital, Mount Logan, New Mount Logan, the Business Combination and related matters. SHAREHOLDERS OF 180 DEGREE CAPITAL AND MOUNT LOGAN ARE URGED TO READ THE PROXY STATEMENT AND PROSPECTUS CONTAINED IN THE REGISTRATION STATEMENT AND OTHER DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SECURITIES REGULATORY AUTHORITIES AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT 180 DEGREE CAPITAL, MOUNT LOGAN, NEW MOUNT LOGAN, THE BUSINESS COMBINATION AND RELATED MATTERS. Investors and security holders may obtain copies of these documents and other documents filed with the securities regulatory authorities free of charge through the website maintained by the SEC at https://www.sec.gov or the website maintained by the Canadian securities regulators at www.sedarplus.ca. Copies of the documents filed by 180 Degree Capital are also available free of charge by accessing the Company’s investor relations website at https://ir.180degreecapital.com. 3

Disclaimer and Caution About Forward-Looking Statements CERTAIN INFORMATION CONCERING THE PARTICIPANTS 180 Degree Capital, its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in connection with the Business Combination. Information about 180 Degree Capital’s executive officers and directors is available in 180 Degree Capital’s Annual Report filed on Form N-CSR for the year ended December 31, 2023, which was filed with the SEC on February 20, 2024, and in its proxy statement for the 2024 Annual Meeting of Shareholders (“2024 Annual Meeting”), which was filed with the SEC on March 1, 2024. To the extent holdings by the directors and executive officers of 180 Degree Capital securities reported in the proxy statement for the 2024 Annual Meeting have changed, such changes have been or will be reflected on Statements of Change in Ownership on Forms 3, 4 or 5 filed with the SEC. These documents are or will be available free of charge at the SEC’s website at https://www.sec.gov. Additional information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the 180 Degree Capital shareholders in connection with the Business Combination will be contained in the Proxy Statement when such document becomes available. Mount Logan Capital, its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the shareholders of Mount Logan Capital in favor of the approval of the Business Combination. Information about Mount Logan Capital’s executive officers and directors is available in Mount Logan Capital’s annual information form dated March 13, 2025, available on its website at https://mountlogancapital.ca/investor-relations and on SEDAR+ at https://sedarplus.ca. To the extent holdings by the directors and executive officers of Mount Logan Capital securities reported in Mount Logan Capital’s annual information form have changed, such changes have been or will be reflected on insider reports filed on SEDI at https://www.sedi.ca/sedi/. Additional information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the Mount Logan Capital shareholders in connection with the Business Combination will be contained in the Prospectus included in the Registration Statement when such document becomes available. All amounts in this presentation are in United States dollars unless otherwise indicated. THIRD PARTY SOURCES This presentation contains information obtained by Mount Logan Capital and 180 Degree Capital from third parties, including but not limited to market and industry data. Market and industry data is subject to variations and cannot be verified with complete certainty due to limits on the availability and reliability of raw data at any particular point in time, the voluntary nature of the data gathering process or other limitations and uncertainties inherent in any statistical survey. Accordingly, the accuracy and completeness of this data are not guaranteed. Mount Logan Capital and 180 Degree Capital believe such information to be accurate but have not independently verified any of the data from third party sources referred to in this presentation or ascertained the underlying assumptions relied upon by such sources. To the extent such information was obtained from third party sources, there is a risk that the assumptions made and conclusions drawn by Mount Logan Capital or 180 Degree Capital, respectively based on such representations are not accurate. References in this presentation to research reports or to articles and publications should not be construed as depicting the complete findings of the entire referenced report or article. 4

Disclaimer and Caution About Forward-Looking Statements FORWARD-LOOKING STATEMENTS This communication, and oral statements made from time to time by representatives of 180 Degree Capital and Mount Logan, may contain statements of a forward-looking nature relating to future events within the meaning of applicable securities laws. Forward-looking statements may be identified by words such as “anticipates,” “believes,” “could,” “continue,” “estimate,” “expects,” “intends,” “will,” “should,” “may,” “plan,” “predict,” “project,” “would,” “forecasts,” “seeks,” “future,” “proposes,” “target,” “goal,” “objective,” “outlook” and variations of these words or similar expressions (or the negative versions of such words or expressions). Forward-looking statements are not statements of historical fact and reflect Mount Logan’s and 180 Degree Capital’s current views about future events. Such forward-looking statements include, without limitation, statements about the benefits of the Business Combination involving Mount Logan and 180 Degree Capital, including future financial and operating results, Mount Logan’s and 180 Degree Capital’s plans, objectives, expectations and intentions, the expected timing and likelihood of completion of the Business Combination, and other statements that are not historical facts, including but not limited to future results of operations, projected cash flow and liquidity, business strategy and other plans and objectives for future operations. No assurances can be given that the forward-looking statements contained in this presentation will occur as projected, and actual results may differ materially from those projected. Forward-looking statements are based on current expectations, estimates and assumptions that involve a number of risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, without limitation, the ability to obtain the requisite Mount Logan and 180 Degree Capital shareholder approvals; the risk that Mount Logan or 180 Degree Capital may be unable to obtain governmental and regulatory approvals required for the Business Combination (and the risk that such approvals may result in the imposition of conditions that could adversely affect New Mount Logan or the expected benefits of the Business Combination); the risk that an event, change or other circumstance could give rise to the termination of the Business Combination; the risk that a condition to closing of the Business Combination may not be satisfied; the risk of delays in completing the Business Combination; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the proposed transaction may not be fully realized or may take longer to realize than expected; the risk that any announcement relating to the Business Combination could have adverse effects on the market price of Mount Logan’s common shares or 180 Degree Capital’s common stock; unexpected costs resulting from the Business Combination; the possibility that competing offers or acquisition proposals will be made; the risk of litigation related to the Business Combination; the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect; the diversion of management time from ongoing business operations and opportunities as a result of the Business Combination; the risk of adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the Business Combination; the dilution caused by issuance of additional shares of the combined company’s capital stock in connection with the Business Combination; competition, government regulation or other actions; the ability of management to execute its plans to meet its goals; risks associated with the evolving legal, regulatory and tax regimes; changes in economic, financial, political and regulatory conditions; natural and man-made disasters; civil unrest, pandemics, and conditions that may result from legislative, regulatory, trade and policy changes; and other risks inherent in Mount Logan’s and 180 Degree Capital’s businesses. Forward-looking statements are based on the estimates and opinions of management at the time the statements are made. Readers should carefully review the statements set forth in the reports, which Mount Logan and 180 Degree Capital have filed or will file from time to time with the applicable securities regulatory authorities in Canada and the United States. Please see each company's securities filings filed with the applicable securities regulatory authorities in Canada and the United States for a more detailed discussion of the risks and uncertainties associated with each company's business and other significant factors that could affect each company's actual results. Neither Mount Logan nor 180 Degree Capital undertakes any obligation, and expressly disclaims any obligation, to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Any discussion of past performance is not an indication of future results. Investing in financial markets involves a substantial degree of risk. Investors must be able to withstand a total loss of their investment. The information herein is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of the information and opinions. The references and links to the websites www.180degreecapital.com and www.mountlogancapital.ca have been provided as a convenience, and the information contained on such websites is not incorporated by reference into this presentation. Neither 180 Degree Capital nor Mount Logan is responsible for the contents of third-party websites. 5

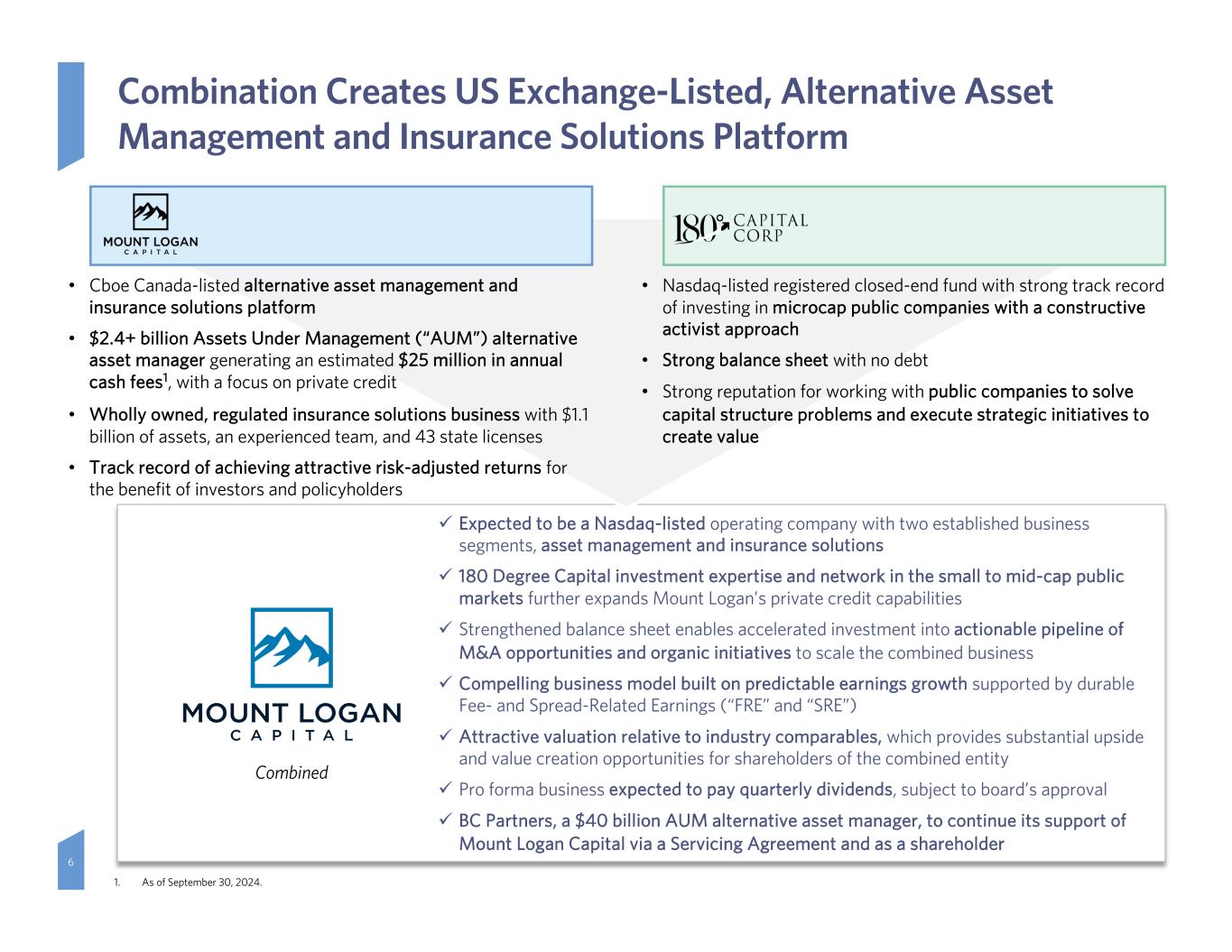

Combined ü Expected to be a Nasdaq-listed operating company with two established business segments, asset management and insurance solutions ü 180 Degree Capital investment expertise and network in the small to mid-cap public markets further expands Mount Logan’s private credit capabilities ü Strengthened balance sheet enables accelerated investment into actionable pipeline of M&A opportunities and organic initiatives to scale the combined business ü Compelling business model built on predictable earnings growth supported by durable Fee- and Spread-Related Earnings (“FRE” and “SRE”) ü Attractive valuation relative to industry comparables, which provides substantial upside and value creation opportunities for shareholders of the combined entity ü Pro forma business expected to pay quarterly dividends, subject to board’s approval ü BC Partners, a $40 billion AUM alternative asset manager, to continue its support of Mount Logan Capital via a Servicing Agreement and as a shareholder 1. As of September 30, 2024. • Nasdaq-listed registered closed-end fund with strong track record of investing in microcap public companies with a constructive activist approach • Strong balance sheet with no debt • Strong reputation for working with public companies to solve capital structure problems and execute strategic initiatives to create value • Cboe Canada-listed alternative asset management and insurance solutions platform • $2.4+ billion Assets Under Management (“AUM”) alternative asset manager generating an estimated $25 million in annual cash fees1, with a focus on private credit • Wholly owned, regulated insurance solutions business with $1.1 billion of assets, an experienced team, and 43 state licenses • Track record of achieving attractive risk-adjusted returns for the benefit of investors and policyholders Combination Creates US Exchange-Listed, Alternative Asset Management and Insurance Solutions Platform 6

1. Subject to certain adjustments as detailed in the definitive Merger Agreement. 2. Based on TURN estimated NAV of $46.2 million as of January 15, 2025, which does not include transaction fees and expenses incurred related to the Business Combination. Daily estimated NAVs used for the discount calculation outside of quarter-end dates are determined as prescribed in TURN’s Valuation Procedures for Level 3 assets. Non-investment-related assets and liabilities used to determine estimated daily NAV are those reported as of the end of the prior quarter. Transaction Overview 7 • Mount Logan Capital Inc. (“Mount Logan” or “MLC”) and 180 Degree Capital Corp. (“180 Degree Capital” or “TURN”) to combine in an all-stock transaction (the “Business Combination”) • Business Combination reflects attractive valuations for each entity at close − MLC transaction equity value of approximately $67.4 million1 at signing. TURN valued at Net Asset Value (“NAV”) as of Closing (as defined in the definitive Merger Agreement)2 − Equates to pro forma ownership of approximately ~60% Mount Logan / ~40% 180 Degree Capital2 − Pro forma transaction equity value of approximately $113.6 million2 • Unanimously approved by Mount Logan and 180 Degree Capital’s Boards of Directors • Surviving entity is expected to be a Delaware corporation and will be called Mount Logan Capital Inc. (“New Mount Logan” or “New MLC”) and to be listed on the Nasdaq, trading under the ticker ‘MLCI’ − Ted Goldthorpe, MLC CEO, expected to remain CEO of the combined company − Expectation that TURN management team will join and expand public markets strategy for New MLC − MLC to transition to US GAAP reporting (from IFRS), which will simplify financial performance presentation − New MLC expected to pay a quarterly dividend, consistent with MLC’s 21 consecutive quarters paying a dividend since 2019 • 180 Degree Capital’s holdings will continue to be actively managed − Expect monetization to occur naturally, consistent with historical portfolio turnover − Capital will be re-invested into organic and inorganic growth opportunities • Voting agreements received from shareholders holding outstanding stock of approximately 23% of Mount Logan and 20% of 180 Degree Capital − Additional non-binding letters of support received from shareholders holding 9% and 7% of the outstanding stock of MLC and TURN, respectively • Closing anticipated in mid-2025, subject to customary closing conditions, including regulatory and shareholder approvals

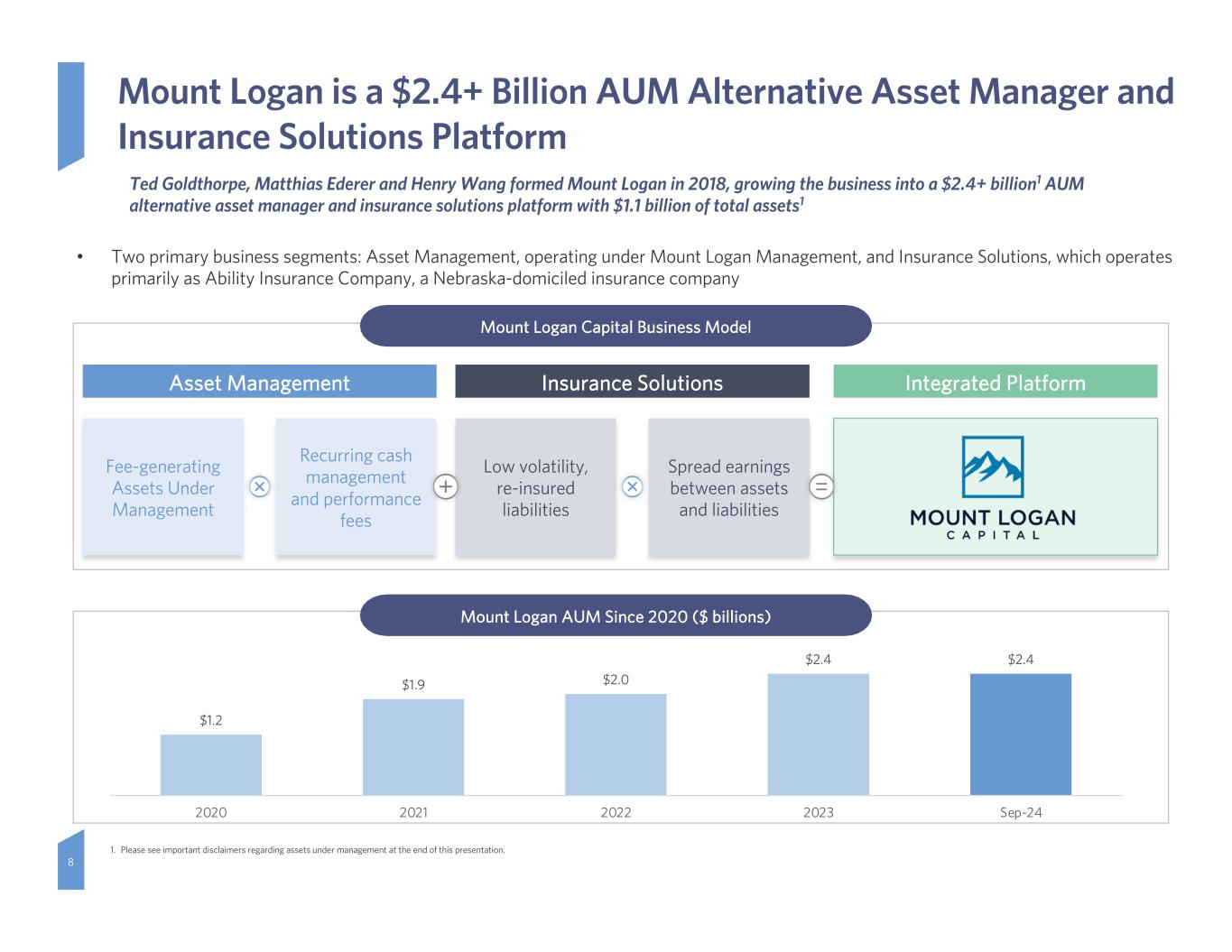

$1.2 $1.9 $2.0 $2.4 $2.4 2020 2021 2022 2023 Sep-24 8 Mount Logan AUM Since 2020 ($ billions) Mount Logan Capital Business Model Asset Management Insurance Solutions Fee-generating Assets Under Management Recurring cash management and performance fees Low volatility, re-insured liabilities Spread earnings between assets and liabilities Integrated Platform • Two primary business segments: Asset Management, operating under Mount Logan Management, and Insurance Solutions, which operates primarily as Ability Insurance Company, a Nebraska-domiciled insurance company Mount Logan is a $2.4+ Billion AUM Alternative Asset Manager and Insurance Solutions Platform Ted Goldthorpe, Matthias Ederer and Henry Wang formed Mount Logan in 2018, growing the business into a $2.4+ billion1 AUM alternative asset manager and insurance solutions platform with $1.1 billion of total assets1 1. Please see important disclaimers regarding assets under management at the end of this presentation.

Mount Logan’s Experienced Management Team 9 Senior management have experience establishing and growing large-scale credit platforms at best-in-class institutions. Mount Logan’s management team will continue to operate the business on a go-forward basis § Currently Partner in charge of the Global Credit Business at BC Partners (launched credit arm in Feb 2017) § Previously President of Apollo Investment Corporation and the Chief Investment Officer of Apollo Investment Management § Previously at Goldman Sachs for 13 years, most recently running the Bank Loan Distressed Investing Desk Ted Goldthorpe CEO & Chairman of the Board § Partner at BC Partners, joined as part of the creation of BC Partners Credit in 2017 § Previously a Partner at Stonerise Capital Partners where he spent more than five years § Spent several years at Goldman Sachs in its Special Situations Group and Investment Banking Division Henry Wang Co-President § Currently the Chief Financial Officer and Secretary of Mount Logan Capital Inc. § Over 14 years of experience in the financial services industry, at Silicon Valley Bank, Galaxy Digital (TSX: GLXY), and American Express (NYSE: AXP) § Spent six years at Pricewaterhouse Coopers LLP providing audit and consulting services in various roles § Chartered Professional Accountant (Canada) Nikita Klassen CFO & Corporate Secretary

Mount Logan Leadership’s Shared History 10 Leadership of Mount Logan invested together successfully at Goldman Sachs in the Special Situations Group (“SSG”) and Distressed Investing Group. The trio co-founded Mount Logan and BC Partners Credit, which they continue to lead today - 2.0% 4.0% 6.0% 8.0% 10.0% 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 U.S High Yield Default Rate U.S Leveraged Loan Default Rate Financials investing at tail end of Asian Crisis and start of tech bust. Focus on liquid credit across variety of industries after burst of tech bubble and subsequent wave of defaults Built out illiquid credit and structured equity businesses in SSG: Canada SSG, distress for control, mid cap PE Post GFC focus on liquid capital structures (mega LBOs, large bankruptcies & liquidations, stressed & distressed) Mr. Goldthorpe ran illiquid credit businesses for Apollo including the U.S. Opportunistic Credit business which grew substantially Inception of Mount Logan and BC Partners CreditLiquid Credit Illiquid Credit Liquid Credit Illiquid Credit

BC Partners, a large, global alternative asset manager, provides administrative services to Mount Logan Capital BC Partners Support via Servicing Agreement 11 Mount Logan benefits from BC Partners' scale as a global alternative asset manager, as explained below › BC Partners was founded in 1986 and is a global alternative asset manager focused on private equity, private credit, and real estate › BC Partners manages over $40 billion of assets › BC Partners Credit was launched in February 2017 by Mount Logan’s senior management 1 BC Partners’ Credit arm and Mount Logan share a senior management team › BC Partners Credit management, employees and Mount Logan board members own a significant portion of Mount Logan shares 2 Mount Logan’s infrastructure is supported by BC Partners through a Servicing Support Agreement › BC Partners’ Servicing Support Agreement provides administrative services to Mount Logan, leveraging BC Partners’ infrastructure and scale 3

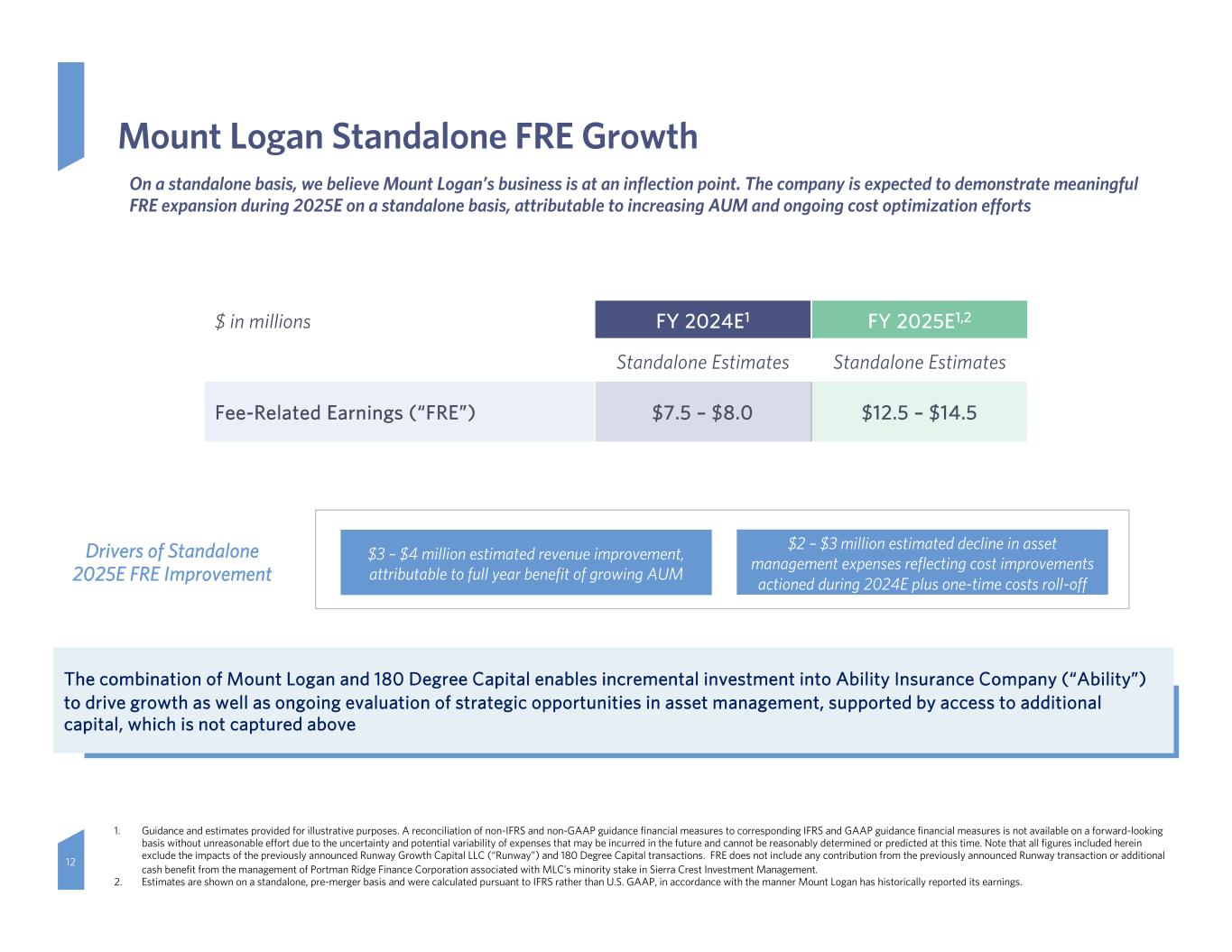

Mount Logan Standalone FRE Growth 12 On a standalone basis, we believe Mount Logan’s business is at an inflection point. The company is expected to demonstrate meaningful FRE expansion during 2025E on a standalone basis, attributable to increasing AUM and ongoing cost optimization efforts The combination of Mount Logan and 180 Degree Capital enables incremental investment into Ability Insurance Company (“Ability”) to drive growth as well as ongoing evaluation of strategic opportunities in asset management, supported by access to additional capital, which is not captured above $ in millions FY 2024E1 FY 2025E1,2 Standalone Estimates Standalone Estimates Fee-Related Earnings (“FRE”) $7.5 – $8.0 $12.5 – $14.5 $3 – $4 million estimated revenue improvement, attributable to full year benefit of growing AUM $2 – $3 million estimated decline in asset management expenses reflecting cost improvements actioned during 2024E plus one-time costs roll-off Drivers of Standalone 2025E FRE Improvement 1. Guidance and estimates provided for illustrative purposes. A reconciliation of non-IFRS and non-GAAP guidance financial measures to corresponding IFRS and GAAP guidance financial measures is not available on a forward-looking basis without unreasonable effort due to the uncertainty and potential variability of expenses that may be incurred in the future and cannot be reasonably determined or predicted at this time. Note that all figures included herein exclude the impacts of the previously announced Runway Growth Capital LLC (“Runway”) and 180 Degree Capital transactions. FRE does not include any contribution from the previously announced Runway transaction or additional cash benefit from the management of Portman Ridge Finance Corporation associated with MLC’s minority stake in Sierra Crest Investment Management. 2. Estimates are shown on a standalone, pre-merger basis and were calculated pursuant to IFRS rather than U.S. GAAP, in accordance with the manner Mount Logan has historically reported its earnings.

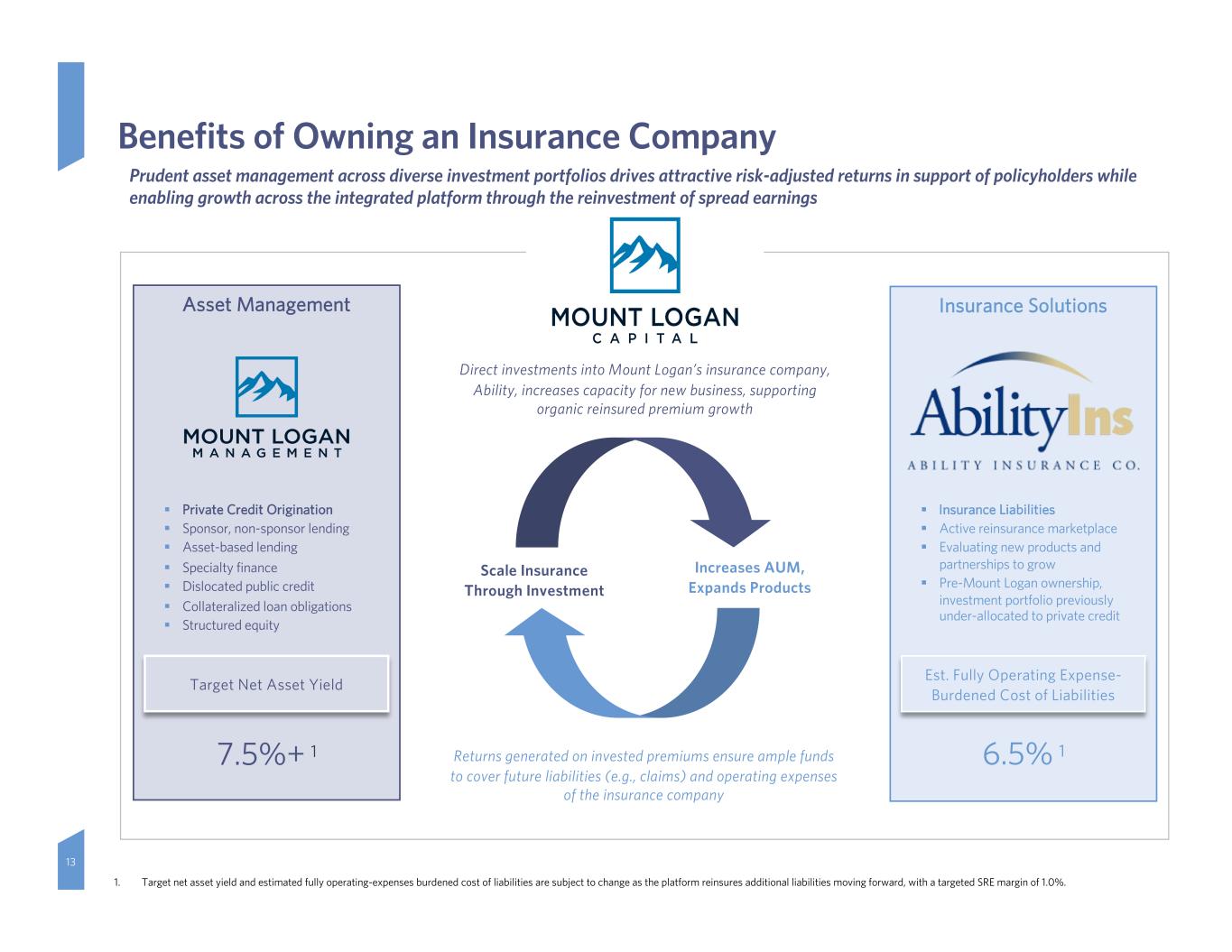

Asset Management 7.5%+ 1 Target Net Asset Yield § Private Credit Origination § Sponsor, non-sponsor lending § Asset-based lending § Specialty finance § Dislocated public credit § Collateralized loan obligations § Structured equity Increases AUM, Expands Products Direct investments into Mount Logan’s insurance company, Ability, increases capacity for new business, supporting organic reinsured premium growth Insurance Solutions 6.5% 1 Est. Fully Operating Expense- Burdened Cost of Liabilities § Insurance Liabilities § Active reinsurance marketplace § Evaluating new products and partnerships to grow § Pre-Mount Logan ownership, investment portfolio previously under-allocated to private credit Benefits of Owning an Insurance Company Prudent asset management across diverse investment portfolios drives attractive risk-adjusted returns in support of policyholders while enabling growth across the integrated platform through the reinvestment of spread earnings 13 1. Target net asset yield and estimated fully operating-expenses burdened cost of liabilities are subject to change as the platform reinsures additional liabilities moving forward, with a targeted SRE margin of 1.0%. Scale Insurance Through Investment Returns generated on invested premiums ensure ample funds to cover future liabilities (e.g., claims) and operating expenses of the insurance company

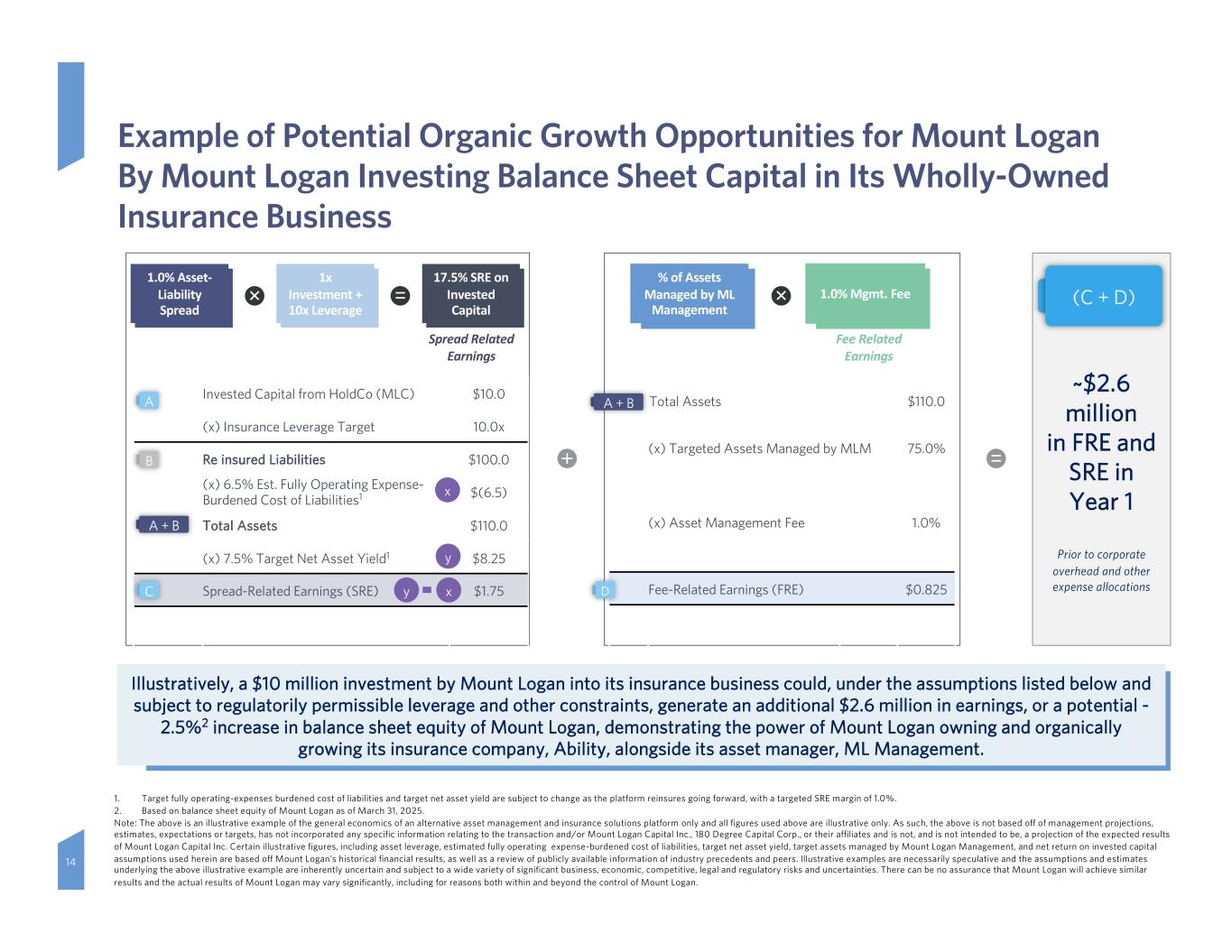

~$2.6 million in FRE and SRE in Year 1 Prior to corporate overhead and other expense allocations Spread Related Earnings 1.0% Asset- Liability Spread 1.0% Asset- Liability Spread 1.0% Asset- Liability Spread 1x Investment + 10x Leverage 17.5% SRE on Invested Capital Invested Capital from HoldCo (MLC) $10.0 (x) Insurance Leverage Target 10.0x Re insured Liabilities $100.0 (x) 6.5% Est. Fully Operating Expense- Burdened Cost of Liabilities1 $(6.5) Total Assets $110.0 (x) 7.5% Target Net Asset Yield1 $8.25 Spread-Related Earnings (SRE) $1.75 Fee Related Earnings % of Assets Managed by ML Management % of Assets Managed by ML Management 1.0% Mgmt. Fee Total Assets $110.0 (x) Targeted Assets Managed by MLM 75.0% (x) Asset Management Fee 1.0% Fee-Related Earnings (FRE) $0.825 A B A + B C D (C + D) Example of Potential Organic Growth Opportunities for Mount Logan By Mount Logan Investing Balance Sheet Capital in Its Wholly-Owned Insurance Business A + B 14 x y y x 1. Target fully operating-expenses burdened cost of liabilities and target net asset yield are subject to change as the platform reinsures going forward, with a targeted SRE margin of 1.0%. 2. Based on balance sheet equity of Mount Logan as of March 31, 2025. Note: The above is an illustrative example of the general economics of an alternative asset management and insurance solutions platform only and all figures used above are illustrative only. As such, the above is not based off of management projections, estimates, expectations or targets, has not incorporated any specific information relating to the transaction and/or Mount Logan Capital Inc., 180 Degree Capital Corp., or their affiliates and is not, and is not intended to be, a projection of the expected results of Mount Logan Capital Inc. Certain illustrative figures, including asset leverage, estimated fully operating expense-burdened cost of liabilities, target net asset yield, target assets managed by Mount Logan Management, and net return on invested capital assumptions used herein are based off Mount Logan’s historical financial results, as well as a review of publicly available information of industry precedents and peers. Illustrative examples are necessarily speculative and the assumptions and estimates underlying the above illustrative example are inherently uncertain and subject to a wide variety of significant business, economic, competitive, legal and regulatory risks and uncertainties. There can be no assurance that Mount Logan will achieve similar results and the actual results of Mount Logan may vary significantly, including for reasons both within and beyond the control of Mount Logan. Illustratively, a $10 million investment by Mount Logan into its insurance business could, under the assumptions listed below and subject to regulatorily permissible leverage and other constraints, generate an additional $2.6 million in earnings, or a potential - 2.5%2 increase in balance sheet equity of Mount Logan, demonstrating the power of Mount Logan owning and organically growing its insurance company, Ability, alongside its asset manager, ML Management.

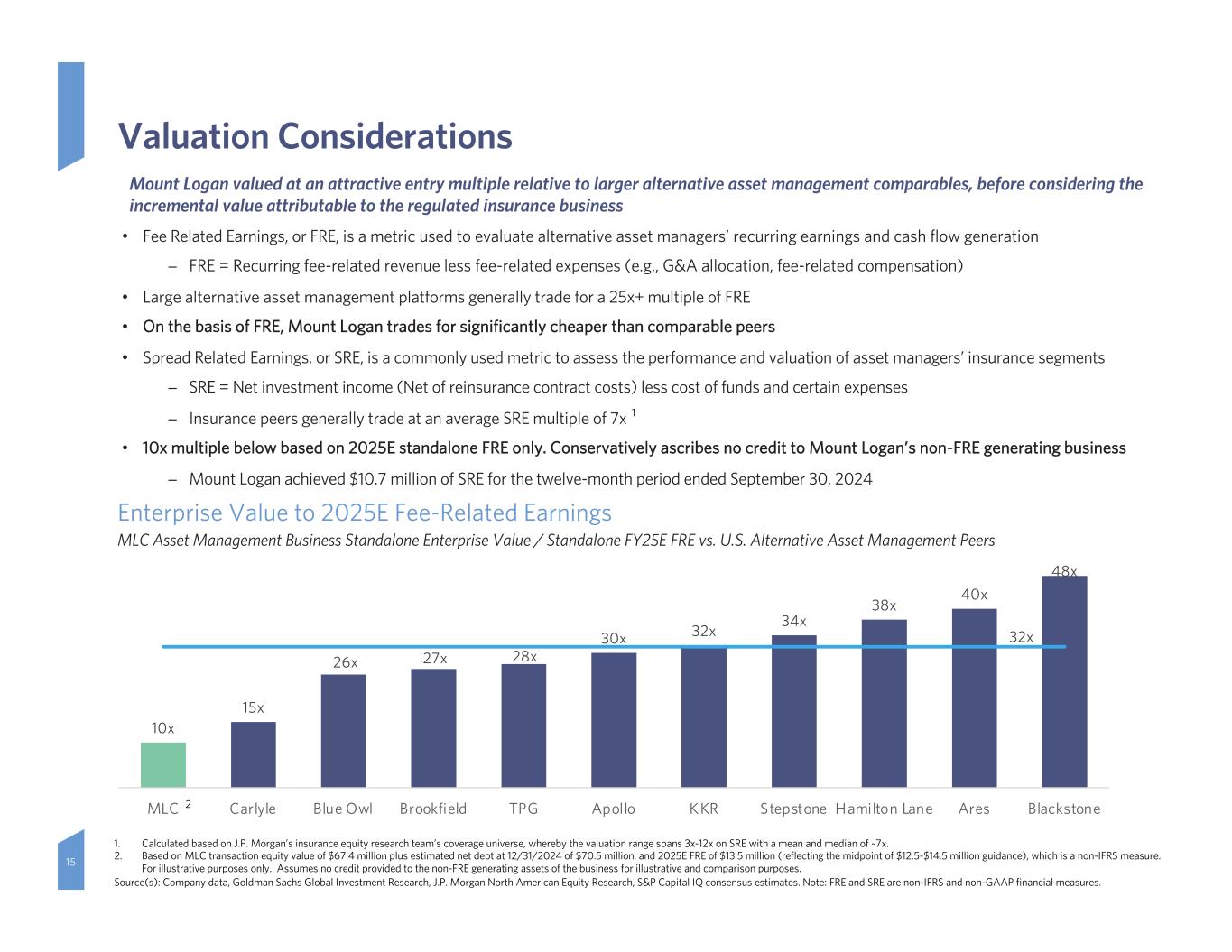

10x 15x 26x 27x 28x 30x 32x 34x 38x 40x 48x 32x MLC Carlyle Blue Owl Brookfield TPG Apollo KKR Stepstone Hamilton Lane Ares Blackstone Valuation Considerations Mount Logan valued at an attractive entry multiple relative to larger alternative asset management comparables, before considering the incremental value attributable to the regulated insurance business 15 • Fee Related Earnings, or FRE, is a metric used to evaluate alternative asset managers’ recurring earnings and cash flow generation – FRE = Recurring fee-related revenue less fee-related expenses (e.g., G&A allocation, fee-related compensation) • Large alternative asset management platforms generally trade for a 25x+ multiple of FRE • On the basis of FRE, Mount Logan trades for significantly cheaper than comparable peers • Spread Related Earnings, or SRE, is a commonly used metric to assess the performance and valuation of asset managers’ insurance segments – SRE = Net investment income (Net of reinsurance contract costs) less cost of funds and certain expenses – Insurance peers generally trade at an average SRE multiple of 7x • 10x multiple below based on 2025E standalone FRE only. Conservatively ascribes no credit to Mount Logan’s non-FRE generating business – Mount Logan achieved $10.7 million of SRE for the twelve-month period ended September 30, 2024 Enterprise Value to 2025E Fee-Related Earnings MLC Asset Management Business Standalone Enterprise Value / Standalone FY25E FRE vs. U.S. Alternative Asset Management Peers 1. Calculated based on J.P. Morgan’s insurance equity research team’s coverage universe, whereby the valuation range spans 3x-12x on SRE with a mean and median of ~7x. 2. Based on MLC transaction equity value of $67.4 million plus estimated net debt at 12/31/2024 of $70.5 million, and 2025E FRE of $13.5 million (reflecting the midpoint of $12.5-$14.5 million guidance), which is a non-IFRS measure. For illustrative purposes only. Assumes no credit provided to the non-FRE generating assets of the business for illustrative and comparison purposes. Source(s): Company data, Goldman Sachs Global Investment Research, J.P. Morgan North American Equity Research, S&P Capital IQ consensus estimates. Note: FRE and SRE are non-IFRS and non-GAAP financial measures. 1 2

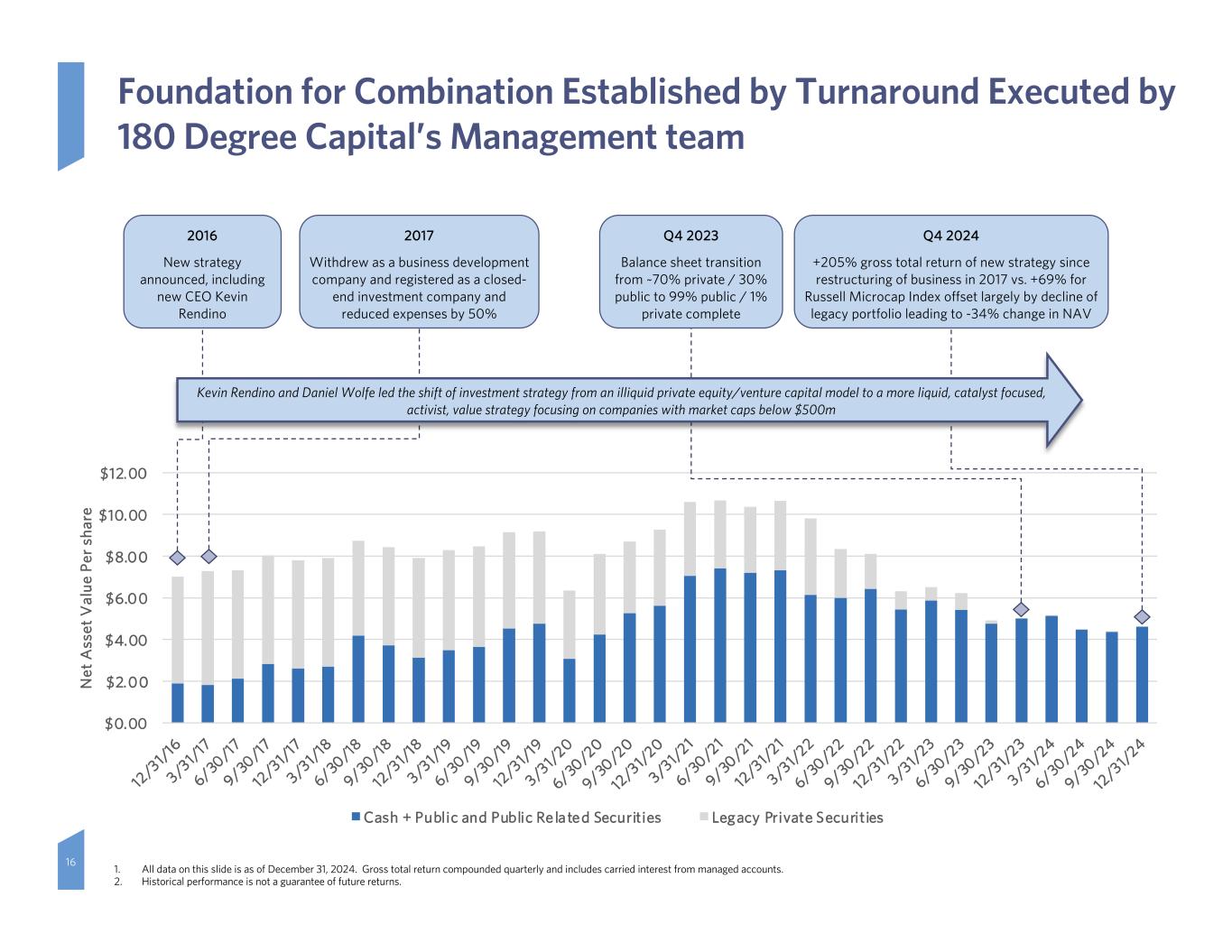

1. All data on this slide is as of December 31, 2024. Gross total return compounded quarterly and includes carried interest from managed accounts. 2. Historical performance is not a guarantee of future returns. 16 $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 12 /31/ 16 3/31/ 17 6/30/17 9/30/17 12 /31/ 17 3/31/ 18 6/30/18 9/30/18 12 /31/ 18 3/31/ 19 6/30/19 9/30/19 12 /31/ 19 3/31/ 20 6/30/20 9/30/20 12 /31/ 20 3/31/ 21 6/30/21 9/30/21 12 /31/ 21 3/31/ 22 6/30/22 9/30/22 12 /31/ 22 3/31/ 23 6/30/23 9/30/23 12 /31/ 23 3/31/ 24 6/30/24 9/30/24 12 /31/ 24 N et A ss et V al u e P er s h ar e Cash + Public and Public Re lated Securities Legacy Private Securities Q4 2024 +205% gross total return of new strategy since restructuring of business in 2017 vs. +69% for Russell Microcap Index offset largely by decline of legacy portfolio leading to -34% change in NAV 2016 New strategy announced, including new CEO Kevin Rendino 2017 Withdrew as a business development company and registered as a closed- end investment company and reduced expenses by 50% Kevin Rendino and Daniel Wolfe led the shift of investment strategy from an illiquid private equity/venture capital model to a more liquid, catalyst focused, activist, value strategy focusing on companies with market caps below $500m Q4 2023 Balance sheet transition from ~70% private / 30% public to 99% public / 1% private complete Foundation for Combination Established by Turnaround Executed by 180 Degree Capital’s Management team

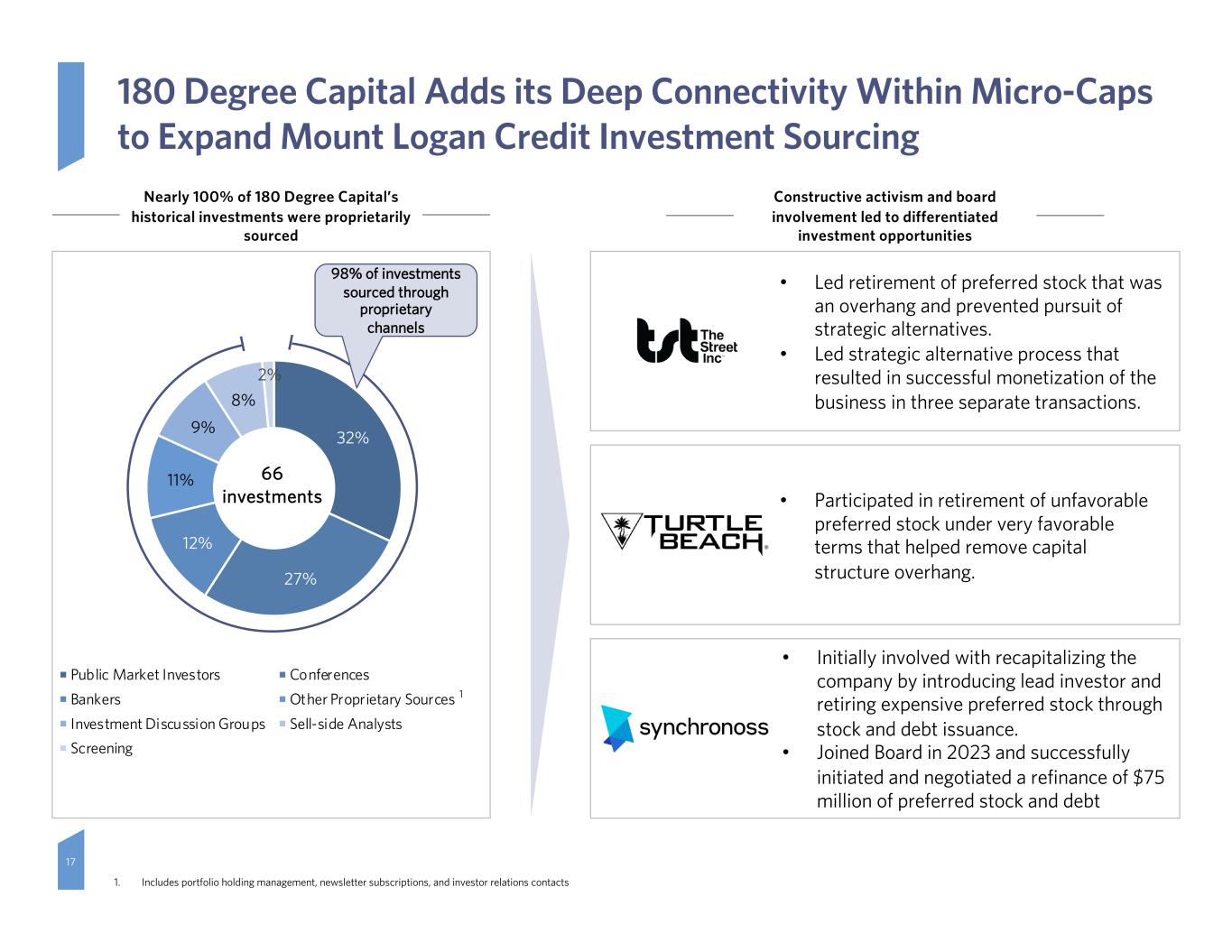

17 180 Degree Capital Adds its Deep Connectivity Within Micro-Caps to Expand Mount Logan Credit Investment Sourcing Nearly 100% of 180 Degree Capital’s historical investments were proprietarily sourced 66 investments 98% of investments sourced through proprietary channels 1 Constructive activism and board involvement led to differentiated investment opportunities • Led retirement of preferred stock that was an overhang and prevented pursuit of strategic alternatives. • Led strategic alternative process that resulted in successful monetization of the business in three separate transactions. • Participated in retirement of unfavorable preferred stock under very favorable terms that helped remove capital structure overhang. • Initially involved with recapitalizing the company by introducing lead investor and retiring expensive preferred stock through stock and debt issuance. • Joined Board in 2023 and successfully initiated and negotiated a refinance of $75 million of preferred stock and debt 32% 27% 12% 11% 9% 8% 2% Public Market Investors Conferences Bankers Other Proprietary Sources Investment Discussion Groups Sell-side Analysts Screening 1. Includes portfolio holding management, newsletter subscriptions, and investor relations contacts

18 We believe Mount Logan provides 180 Degree Capital shareholders the benefit of an established operating vehicle built for the next phase of growth in the sought-after segments of asset management and insurance solutions Entrenched asset management and insurance solutions business formed in 2018 with a strong, stable management team, which is well positioned to take advantage of the attractive market environment ✔ Support from BC Partners, an asset management firm established in 1986 with more than $40 billion of assets under management, underpins Mount Logan’s infrastructure and ability to scale through an existing servicing agreement ✔ Increased scale and further diversification of 180 Degree Capital’s business, as well as expectation of increased liquidity in New Mount Logan’s public equity float, which we expect will unlock significant value for shareholders after transaction close ✔ Expansion of Mount Logan’s private credit and opportunistic investment sourcing in the public markets supported by 180 Degree Capital’s capabilities and deep network of relationships ✔ Mount Logan-180 Degree Capital Combination Thesis Strong pro forma balance sheet supports near-term organic investment into the insurance platform, which is expected to catalyze AUM, FRE and SRE growth, while maintaining focus on minimizing policyholder risk and maximizing investor returns ✔

Endnote Regarding Assets Under Management: Assets under management primarily consists of the below: 1. The gross assets of Lending Fund II and the collateral balance of 2018-1 CLO as of September 30, 2024 of which Mount Logan Management LLC (“MLM”) is the investment advisor and collateral manager, respectively; 2. The gross assets of Logan Ridge Finance Corporation as of September 30, 2024, of which MLM is the investment advisor; 3. The fair market value of investment assets of Ability Insurance Company (“Ability”), excluding reinsurance assets, as of September 30, 2024; 4. The gross assets of Opportunistic Credit Interval Fund as of September 30, 2024, of which MLM is the investment advisor; 5. The gross assets of Alternative Credit Income Fund (“AltCIF”) of which Sierra Crest Investment Management LLC (“Sierra Crest”) is the investment advisor. MLM and Mount Logan Capital Inc. (“MLC”) do not provide any investment advisory services to AltCIF; however, the net economic benefit of the advisory contract is conveyed to MLC via: (i) an 8.0% secured promissory note and (ii) a services agreement; 6. 24.99% of the gross assets of Portman Ridge Finance Corporation (“Portman”), which is managed by Sierra Crest. MLC and MLM do not provide any investment advisory services to Portman Ridge; and 7. The fair value of the investment assets of the sleeve of First Trust Private Credit Fund, as of September 30, 2024, of which such sleeve MLM is sub-advisor. For the avoidance of doubt, the AUM measure can include assets for which MLM does not have investment discretion, including assets sub-advised by investment managers not affiliated with MLM or certain assets for which MLM may earn only servicing fees, rather than management or advisory fees. Our definition of AUM is not based on any definition of assets under management contained in our governing documents or in any fund management agreements. We consider multiple factors for determining what should be included in our definition of AUM. Multiple factors are considered on whether to include in AUM which include but are not limited to: (1) the ability to influence the investment decisions for existing and available assets; (2) the ability to generate income from the underlying assets in our funds; and (3) the AUM measures that are used internally or which MLC believes are used by other investment managers. Given the differences in the investment strategies and structures among other alternative investment managers, this calculation of AUM may differ from the calculations employed by other investment managers and, as a result, this measure may not be directly comparable to similar measures presented by other investment managers. 19