DEF 14A: Definitive proxy statements

Published on March 19, 2009

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934 (Amendment

No. )

|

Filed

by the Registrant x

|

||

|

Filed

by a Party other than the Registrant o

|

||

|

Check

the appropriate box:

|

||

|

o

|

Preliminary

Proxy Statement

|

|

|

o

|

Confidential,

for Use of the Commission Only (as permitted by

Rule 14a-6(e)(2))

|

|

|

x

|

Definitive

Proxy Statement

|

|

|

o

|

Definitive

Additional Materials

|

|

|

o

|

Soliciting

Material Pursuant to

§240.14a-12

|

|

|

Harris

& Harris Group, Inc.

|

||

|

(Name

of Registrant as Specified In Its Charter)

|

||

|

(Name

of Person(s) Filing Proxy Statement, if other than the

Registrant)

|

||

|

Payment

of Filing Fee (Check the appropriate box):

|

||

|

x

|

No

fee required.

|

|

|

o

|

Fee

computed on table below per Exchange Act

Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title

of each class of securities to which transaction

applies:

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to

Exchange Act Rule 0-11 (set forth the amount on which the filing fee

is calculated and state how it was determined):

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

(5)

|

Total

fee paid:

|

|

|

o

|

Fee

paid previously with preliminary materials.

|

|

|

o

|

Check

box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its

filing.

|

|

|

(1)

|

Amount

Previously Paid:

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing

Party:

|

|

|

(4)

|

Date

Filed:

|

|

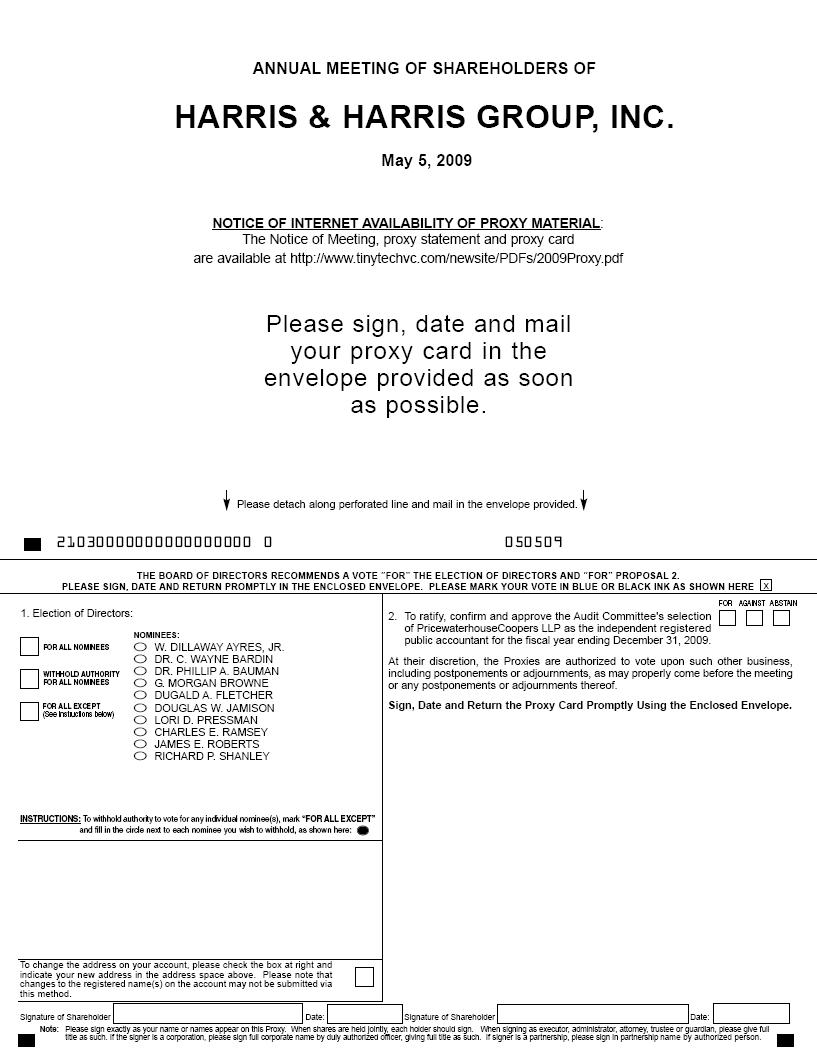

NOTICE

OF ANNUAL MEETING OF SHAREHOLDERS

TO

BE HELD MAY 5, 2009

To the

Shareholders of Harris & Harris Group, Inc.:

NOTICE IS

HEREBY GIVEN that the 2009 Annual Meeting of Shareholders of Harris & Harris

Group, Inc. (the "Company") will be held on May 5, 2009, at 3:00 p.m., local

time, at Skadden, Arps, Slate, Meagher & Flom LLP, Four Times Square

(between 42nd and

43rd

Streets), New York, New York 10036. This meeting has been called by

the Board of Directors of the Company, and this notice is being issued at its

direction. It has called this meeting for the following

purposes:

|

|

1.

|

To

elect 10 directors of the Company to hold office until the next annual

meeting of shareholders or until their respective successors have been

duly elected and qualified;

|

|

|

2.

|

To

ratify, confirm and approve the Audit Committee's selection of

PricewaterhouseCoopers LLP as the independent registered public accountant

for the fiscal year ending December 31,

2009;

|

|

|

3.

|

To

transact such other business as may properly come before the meeting or

any postponements or adjournments

thereof.

|

We

encourage you to contact us at 877-846-9832, from 9:00 a.m. to 5:00 p.m. EST, if

you have any questions.

Holders

of record of the Company's common stock as of the close of business on March 17,

2009, will be entitled to vote at the meeting.

Whether

or not you expect to be present in person at the meeting, please sign and date

the accompanying proxy card and return it promptly in the enclosed business

reply envelope, which requires no postage if mailed in the United States, so you

will be represented at the Annual Meeting. Even if you vote your

shares prior to the meeting, you still may attend the meeting and vote your

shares in person.

|

By

Order of the Board of Directors,

|

|

|

|

|

March

25, 2009

|

Sandra

M. Forman

|

|

New

York, New York

|

Secretary

|

IMPORTANT: PLEASE

MAIL YOUR PROXY CARD PROMPTLY IN THE ENCLOSED ENVELOPE.

THE

MEETING DATE IS MAY 5, 2009.

(THIS

PAGE LEFT BLANK INTENTIONALLY)

Harris

& Harris Group, Inc.

111 West

57th

Street

New York,

New York 10019

(212)

582-0900

PROXY

STATEMENT

FOR

THE

ANNUAL

MEETING OF SHAREHOLDERS

TO

BE HELD ON MAY 5, 2009

Our Board

of Directors is sending you this proxy statement to ask for your vote as a

shareholder of Harris & Harris Group, Inc. (the “Company,” “we,” “us” or

“our”) on certain matters to be voted on at our upcoming 2009 annual meeting of

shareholders (the “Annual Meeting”), which will be held on Tuesday, May 5, 2009,

at 3:00 p.m., local time, at Skadden, Arps, Slate, Meagher & Flom LLP, Four

Times Square (between 42nd and

43rd

Streets), New York, New York 10036, and at any postponements or adjournments

thereof. We are mailing this proxy statement and the accompanying

notice and proxy card, along with our Company's Annual Report for the fiscal

year ended December 31, 2008, on or about March 25, 2009.

ABOUT THE

MEETING

What

Is The Purpose Of The Annual Meeting?

At the Annual Meeting, you will be

asked to vote on the following proposals:

|

|

1.

|

To

elect 10 directors of the Company to hold office until the next annual

meeting of shareholders or until their respective successors have been

duly elected and qualified ("Election of Directors

Proposal");

|

|

|

2.

|

To

ratify, confirm and approve the Audit Committee's selection of

PricewaterhouseCoopers LLP as the independent registered public accountant

for the fiscal year ending December 31, 2009 ("Ratification of Auditor

Proposal"); and

|

|

|

3.

|

To

transact such other business as may properly come before the meeting or

any postponements or adjournments

thereof.

|

We are not aware of any other matter

that will be presented for your vote at the meeting.

Who

Is Entitled To Vote?

Only shareholders of record at the

close of business on the record date, March 17, 2009, are entitled to receive

notice of and to vote the shares of our common stock that they held on the

record date at the meeting, or any postponement or adjournment of the

meeting. Each outstanding share of common stock entitles its holder

as of the record date to cast one vote on each matter acted upon at the

meeting. As of the record date, the Company had 25,859,573 shares of

common stock outstanding. If your shares are held for your account by

a broker, bank or other institution or nominee, you may vote such shares at the

Annual Meeting only if you obtain proper written authority from your institution

or nominee that you present at the Annual Meeting.

1

How

Is A Quorum Determined?

Approval

of any of the matters submitted for shareholder approval requires that a quorum

be present. Our Bylaws provide that a majority of the shareholders

entitled to vote, represented in person or by proxy, is necessary to constitute

a quorum for the transaction of business at the Annual

Meeting. Abstentions and broker "non-votes" will be counted as shares

present at the Annual Meeting for purposes of determining the existence of a

quorum. A broker non-vote occurs when a broker holding shares for a

beneficial owner does not vote on a particular proposal because the broker does

not have discretionary voting power for that particular item and has not

received instructions from the beneficial owner or other persons entitled to

vote.

How

Can I Vote?

We

encourage you to vote your shares, either by voting in person at the Annual

Meeting or by granting a proxy (i.e., authorizing someone to vote your

shares). If you properly sign and date the accompanying proxy card

and the Company receives it in time for the Annual Meeting, the persons named as

proxies will vote the shares registered directly in your name in the manner that

you specified. If

you give no instructions on the proxy card, the shares covered by the proxy card

will be voted FOR the election of the nominees as directors and FOR the other

matters listed in the accompanying Notice. If any other matters properly come

before the Annual Meeting, the persons named on the proxies will vote upon such

matters at their discretion.

What

Does It Mean If I Receive More Than One Proxy Card?

If you receive more than one proxy

card, your shares are registered in more than one name or are registered in

different accounts. Please complete, sign and return each proxy card

to ensure that all of your shares are voted.

What

Is Required To Approve Each Proposal?

Election of

Directors. For the Election of Directors Proposal, the

directors will be elected by a plurality of the votes cast (that is, the 10

nominees who receive more affirmative votes than any other nominees will be

elected).

Ratification of

Auditor. For the Ratification of Auditor Proposal, the

proposal will be approved if a majority of the votes cast are cast in

favor.

2

Other Matters. All

other matters being submitted to a shareholder vote pursuant to the Notice of

Annual Meeting will be approved if a majority of the votes cast on a particular

matter are cast in favor of that matter.

What

Happens If I Abstain?

For

purposes of the Election of Directors Proposal, the Ratification of Auditor

Proposal and unspecified matters that come before the meeting, votes withheld or

abstentions will not be counted as votes cast on the matter and will have no

effect on the result of the vote. If your broker holds your shares in

its "street" name, the broker may vote your shares on the Election of Directors

Proposal, the Ratification of Auditor Proposal and unspecified matters that come

before the meeting even if it does not receive instructions from

you.

What

Happens If A Quorum Is Not Present At The Meeting?

If a quorum is not present at the

scheduled time of the Annual Meeting, we may adjourn the meeting, either with or

without the vote of shareholders. If we propose to have the

shareholders vote whether to adjourn the meeting, the proxy holders will vote

all shares for which they have authority in favor of the

adjournment. We may also adjourn the meeting if for any reason we

believe that additional time should be allowed for the solicitation of

proxies. An adjournment will have no effect on the business that may

be conducted at the Annual Meeting.

Who

Will Bear The Costs Of This Solicitation?

Proxies

are being solicited by Innisfree M&A Incorporated, pursuant to its standard

contract as proxy solicitor, the cost of which will be borne by us and is

estimated to be approximately $6,500 plus out-of-pocket expenses. We

will pay the cost of this solicitation of proxies by mail. Our

officers and regular employees may also solicit proxies in person or by

telephone without additional compensation. We will make arrangements

with brokerage houses, custodians, nominees and other fiduciaries to send proxy

materials to their principals, and we will reimburse these persons for related

postage and clerical expenses. It is estimated that those costs will

be nominal.

May

I Revoke My Vote?

Any proxy

given pursuant to this solicitation may be revoked by a shareholder at any time,

before it is exercised, by written notification delivered to our Secretary, by

voting in person at the Annual Meeting, or by executing another proxy bearing a

later date.

How

Many Shares Do The Company’s Principal Shareholders, Directors and Executive

Officers Own?

Set forth below is information, as of

March 17, 2009, with respect to the beneficial ownership of our common stock by

(i) each person who is known by us to be the beneficial owner of more than five

percent of the outstanding shares of the common stock, (ii) each of our

directors and nominees, (iii) each of our named executive officers (as defined

below) and (iv) all of our directors and executive officers as a

group. Except as otherwise indicated, to our knowledge, all shares

are beneficially owned and investment and voting power is held by the persons

named as owners. None of the shares owned by directors or officers

have been pledged. The information in the table below is from

publicly available information that may be as of dates earlier than March 17,

2009. At this time, we are unaware of any shareholder owning five

percent or more of the outstanding shares of common stock other than Charles E.

and Susan T. Harris. Unless otherwise provided, the address of each

holder is c/o Harris & Harris Group, Inc., 111 West 57th Street,

Suite 1100, New York, New York 10019.

3

|

Name

and Address of Beneficial

Owner

|

Amount

and Nature

of

Beneficial

Ownership(1)

|

Percentage

of Outstanding

Common

Shares Owned(2)

|

||

|

Independent

Directors:

|

||||

|

W.

Dillaway Ayres, Jr.

|

8,743

|

*

|

||

|

Dr.

C. Wayne Bardin

|

31,611

|

*

|

||

|

Dr.

Phillip A. Bauman

|

34,242(3)

|

*

|

||

|

G.

Morgan Browne

|

37,726

|

*

|

||

|

Dugald

A. Fletcher

|

28,860

|

*

|

||

|

Charles

E. Ramsey

|

44,105

|

*

|

||

|

James

E. Roberts

|

29,236

|

*

|

||

|

Richard

P. Shanley

|

10,937

|

*

|

||

|

Interested

Directors:

|

||||

|

Douglas

W. Jamison

|

328,454(4)

|

1.3

|

||

|

Lori

D. Pressman

|

11,685

|

*

|

||

|

Named

Executive Officers:

|

||||

|

Alexei

A. Andreev

|

299,141(5)

|

1.1

|

||

|

Charles

E. and Susan T. Harris

|

2,239,752(6)

|

8.3

|

||

|

Michael

A. Janse

|

286,028(7)

|

1.1

|

||

|

Daniel

B. Wolfe

|

140,388(8)

|

*

|

||

|

All

directors and executive officers as

a

group (18 persons)

|

3,841,972(9)

|

13.6

|

________________

* Less

than 1 percent.

|

(1)

|

Beneficial

ownership has been determined in accordance with Rule 13d-3 of the

Securities Exchange Act of 1934 (the "1934

Act").

|

|

(2)

|

The

percentage of ownership is based on 25,859,573 shares of common stock

outstanding as of March 17, 2009, together with the exercisable options

for such shareholder, as applicable. In computing the

percentage ownership of a shareholder, shares that can be acquired upon

the exercise of outstanding options are not deemed outstanding for

purposes of computing the percentage ownership of any other

person.

|

|

(3)

|

Includes

5,637 shares owned by Ms. Milbry C. Polk, Dr. Bauman's wife; 100 shares

owned by Adelaide Polk-Bauman, Dr. Bauman's daughter; 100 shares owned by

Milbry Polk-Bauman, Dr. Bauman's daughter; and 100 shares owned by Mary

Polk-Bauman, Dr. Bauman's daughter. Ms. Milbry C. Polk is the

custodian for the accounts of the three

children.

|

|

(4)

|

Includes

306,811 shares that can be acquired upon the exercise of outstanding

options.

|

|

(5)

|

Includes

288,872 shares that can be acquired upon the exercise of outstanding

options.

|

|

(6)

|

Includes

1,039,559 shares owned by Mrs. Susan T. Harris, Mr. Harris's wife, 45,266

shares owned by Mr. Harris and 1,154,927 shares that can be acquired upon

the exercise of outstanding options by Mr. Harris. Mr. Harris

retired from the Company on December 31, 2008, pursuant to the Company's

Executive Mandatory Retirement Benefit

Plan.

|

|

(7)

|

Amount

represents 286,028 shares that can be acquired upon the exercise of

outstanding options.

|

|

(8)

|

Includes

133,791 shares that can be acquired upon the exercise of outstanding

options.

|

|

(9)

|

Includes

2,472,618 shares that can be acquired upon the exercise of outstanding

options.

|

4

Set forth below is the dollar range of

equity securities beneficially owned by each director and nominee as of March

17, 2009.

|

Name

of Director or Nominee

|

Dollar

Range of Equity Securities

Beneficially

Owned (1)(2)(3)

|

|

Independent Directors

|

|

|

W.

Dillaway Ayres, Jr.

|

$10,001

- $50,000

|

|

Dr.

C. Wayne Bardin

|

Over

$100,000

|

|

Dr.

Phillip A. Bauman

|

Over

$100,000

|

|

G.

Morgan Browne

|

Over

$100,000

|

|

Dugald

A. Fletcher

|

Over

$100,000

|

|

Charles

E. Ramsey

|

Over

$100,000

|

|

James

E. Roberts

|

Over

$100,000

|

|

Richard

P. Shanley

|

$10,001

- $50,000

|

|

Interested Directors

|

|

|

Douglas

W. Jamison (4)

|

Over

$100,000

|

|

Lori

D. Pressman (5)

|

$10,001

- $50,000

|

|

(1)

|

Beneficial

ownership has been determined in accordance with Rule 16a-1(a)(2) of the

1934 Act.

|

|

(2)

|

The

dollar ranges are: none, $1-$10,000, $10,001-$50,000,

$50,001-$100,000 and over $100,000.

|

|

(3)

|

The

dollar ranges are based on the price of the equity securities as of March

17, 2009.

|

|

(4)

|

Denotes

an individual who is an "interested person" as defined in the Investment

Company Act of 1940 (the "1940

Act").

|

|

(5)

|

Denotes

an individual who may be considered an "interested person" because of

consulting work performed for us.

|

5

ELECTION

OF DIRECTORS

(Proposal

No. 1)

The 10

nominees listed below have been nominated to serve as our directors until the

next annual meeting or until their respective successors are duly elected and

qualified. All nominees currently serve as

directors. Although it is not anticipated that any of the nominees

will be unable or unwilling to serve, in the unexpected event that any such

nominees should become unable or decline to serve, it is intended that votes

will be cast for substitute nominees designated by our present Board of

Directors.

THE

BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE "FOR" ALL OF THE

NOMINEES.

Nominees

Certain

information, as of March 17, 2009, with respect to each of the 10 nominees for

election at the Annual Meeting is set forth below, including their names, ages

and a brief description of their recent business experience, including present

occupations and employment, certain directorships held by each and the year in

which each became a director of the Company. All of the nominees have

agreed to serve if elected and consent to being referred to in this Proxy

Statement. The nominees for election as directors of the Company have

been divided into two groups -- interested directors and independent

directors. Interested directors are "interested persons" as defined

in the 1940 Act or persons who may be considered "interested persons" because of

consulting work done for us. All of the nominees are currently

directors of the Company. We do not have an advisory

board.

Interested

Directors

Douglas W.

Jamison. Mr. Jamison, age 39, has served as Chairman and Chief

Executive Officer since January 1, 2009; as a Managing Director since January

2004; as President and as Chief Operating Officer from January 2005 to December

31, 2008; as Treasurer from March 2005 to May 2008; as Chief Financial Officer

from January 2005 to December 2007; and as Vice President from September 2002 to

December 2004. He has been a member of our Board of Directors since

May 2007. Since January 1, 2009, he is the Chairman and Chief

Executive Officer of Harris & Harris Enterprises, Inc., a wholly owned

subsidiary of the Company, a Director since January 2005, and President from

January 1, 2005 to December 31, 2008. Mr. Jamison is a Director of

Ancora Pharmaceuticals, Inc., of Mersana Therapeutics, Inc., and of Nextreme

Thermal Solutions, Inc., privately held nanotechnology-enabled companies in

which we have investments. He is Co-Editor-in-Chief of

"Nanotechnology Law & Business." He is Co-Chair of the

Advisory Board, Converging Technology Bar Association and a member of the

University of Pennsylvania Nano-Bio Interface Ethics Advisory

Board. He was graduated from Dartmouth College (B.A.) and the

University of Utah (M.S.).

6

Lori D.

Pressman. Ms. Pressman, age 51, has served as a member of our

Board of Directors since March 2002. She has served as a consultant

to us on nanotechnology, microsystems, intellectual property and in our due

diligence work on certain prospective investments. She also acts as

an observer for us at Board meetings of certain portfolio companies in the

Boston area. She is a business consultant providing advisory services

to start-ups and venture capital companies, including certain of our

portfolio companies. She consults internationally on technology

transfer practices and metrics for non-profit and government

organizations. She was graduated from the Massachusetts Institute of

Technology (S.B., Physics) and the Columbia School of Engineering

(MSEE). She may be considered to be an "interested person" of the

Company because of the consulting work she does for us.

Independent

Directors

W. Dillaway Ayres, Jr. Mr. Ayres, age 58, has

served as a member of our Board of Directors since November 2006. He

has served as the Chief Operating Officer of Cold Spring Harbor Laboratory, a

research and educational institution in the biological sciences, since November

2000. Prior to joining Cold Spring Harbor Laboratory in 1998, Mr.

Ayres had a 20-year business career during which he worked as a corporate

executive, investment banker and entrepreneur. He was graduated from

Princeton University (A.B., English) and from the Columbia University Graduate

School of Business (M.B.A., Finance).

Dr. C. Wayne

Bardin. Dr. Bardin, age 74, has served as a member of our

Board of Directors since December 1994. Since 1996, he has served as

the President of Bardin LLC, a consulting firm to pharmaceutical

companies. His professional appointments have included: Professor of

Medicine, Chief of the Division of Endocrinology, The Milton S. Hershey Medical

Center of Pennsylvania State University, and Senior Investigator, Endocrinology

Branch, National Cancer Institute. He has also served as a consultant

to several pharmaceutical companies. He has been appointed to the

editorial boards of 15 journals. He has also served on national and

international committees and boards for the National Institutes of Health, World

Health Organization, The Ford Foundation and numerous scientific

societies. He was graduated from Rice University (B.A.), Baylor

University (M.S., M.D.), and he received a Doctor Honoris Causa from the

University of Caen, the University of Paris and the University of

Helsinki.

Dr. Phillip A.

Bauman. Dr. Bauman, age 53, has served as a member of our

Board of Directors since February 1998. Since 1999, he has been

Senior Attending of Orthopaedic Surgery at St. Luke's/Roosevelt Hospital Center

in Manhattan, and since 2000, he has served as an elected member of the

Executive Committee of the Medical Board of St. Luke's/Roosevelt

Hospital. Since 2005, he was a founding member and has been on the

Board of Managers for the Hudson Crossing Surgery Center. Since 1997,

he has been Assistant Professor of Orthopaedic Surgery at Columbia

University. Since 1994, he has been a Vice President of Orthopaedic

Associates of New York. He has served as a consultant to private

equity venture capital groups, including Skyline Venture Capital, a group that

specializes in venture capital related to medicine and health

care. He is an active member of the American Academy of Orthopaedic

Surgeons, the American Orthopaedic Society for Sports Medicine, the American

Orthopaedic Foot and Ankle

Society, the New York State Society of Orthopaedic Surgeons, the New York State

Medical Society and the American Medical Association. He was

graduated from Harvard College (A.B.), Harvard University (A.M., Biology) and

the College of Physicians and Surgeons at Columbia University

(M.D.).

7

G. Morgan

Browne. Mr. Browne, age 74, has served as a member of our

Board of Directors since June 1992. Since 2004, he has been President

and since 2000, a Trustee of Planting Fields Foundation, a supporting

institution of Planting Fields Arboretum State Historic Park. He is

Chairman of the OSI Pharmaceuticals Foundation which supports cancer and

diabetes patient care and science education. He was a founding

director of the New York Biotechnology Association. He was graduated

from Yale University (B.A.).

Dugald A.

Fletcher. Mr. Fletcher, age 79, was appointed Lead Independent

Director on November 2, 2006. Since 1996, he has served as a member

of our Board of Directors. Since 1984, he has served as President of

Fletcher & Company, Inc., a management consulting firm. He

is currently a Trustee of the Gabelli Growth Fund and a Director of the Gabelli

Convertible and Income Securities Fund, Inc. He was graduated from

Harvard College (A.B.) and Harvard Business School (M.B.A.).

Charles E.

Ramsey. Mr. Ramsey, age 66, has served as a member of our

Board of Directors since October 2002. Since 1997, he has been a

consultant. He is a retired founder and principal of Ramsey/Beirne

Associates, Inc., an executive search firm that specialized in recruiting top

officers for high technology companies, many of which were backed by venture

capital. He is a member of the board of directors and Chairman

Emeritus of Bridges to Community, a non-governmental organization dedicated to

construction projects in Nicaragua. As Chairman Emeritus, he serves

on the Executive, Personnel and Administration and Fund Development

Committees. He was graduated from Wittenberg University

(B.A.).

James E.

Roberts. Mr. Roberts, age 63, has served as a member of our

Board of Directors since June 1995. Since January 2006, he has been

President of AequiCap Insurance Company and since September 2007, President of

AequiCap Program Administrators. Mr. Roberts is also a senior officer

of various other AequiCap affiliated entities. From November 2002 to

October 2005, he was Executive Vice President and Chief Underwriting Officer of

the Reinsurance Division of Alea North America Company and Senior Vice President

of Alea North America Insurance Company. He was graduated from

Cornell University (A.B.).

Richard P.

Shanley. Mr. Shanley, age 62, has served as a member of our

Board of Directors since March 2007. From February 2001 to December

31, 2006, he was a partner of Deloitte & Touche LLP. During his

over 30 years of public accounting experience, he served as lead audit partner

on numerous audit engagements for public and private companies and companies

making public stock offerings. He served as lead audit partner

primarily for biotech, pharmaceutical and high-tech companies, including

companies enabled by nanotechnology. He has been actively involved on

the Biotech Council of New Jersey, the New Jersey Technology Council, the New

York Biotechnology Association, the Connecticut Venture Group, the Biotechnology

Industry Organization and the NanoBusiness Alliance. He is an active

member of the New York State Society of Certified Public Accountants and the

American Institute of Certified Public Accountants. He is currently

serving his fourth term on the New York State Society of CPA's Professional

Ethics Committee. He is a licensed Certified Public Accountant in New

York. He was graduated from Fordham University (B.S.) and Long Island

University (M.B.A. in Accounting).

8

Board of Directors and

Committees

In 2008,

there were seven meetings of the Board of Directors of the Company, and the full

Board acted five times by unanimous written consent. During 2008, no

director attended fewer than 75 percent of the total Board of Directors'

meetings and applicable committee meetings on which each director

served.

Our

policy is that at least a portion of our directors are encouraged to attend

annual meetings of shareholders. In 2008, all of the Company's

directors attended the annual meeting of shareholders.

Communications

with the Board of Directors

Shareholders

and other interested parties may contact the Board, Dugald A. Fletcher, our Lead

Independent Director, or any member of the Board by mail. To

communicate with the Board, the Lead Independent Director or any member of the

Board, correspondence should be addressed to the Board or the Board members with

whom you wish to communicate, by either name or title. All such

correspondence should be sent c/o Harris & Harris Group, Inc., 111 West 57th

Street, Suite 1100, New York, New York 10019. Such correspondence

will be forwarded to the appropriate board member or members after screening to

eliminate marketing and junk mail.

Board

Committees

The

Company's Board of Directors currently has six committees comprised of the

following members in 2008, all

of whom except Mr. Jamison are independent under the rules of the Nasdaq Global

Market and "not interested" directors for the purposes of the 1940

Act:

|

Executive

|

Audit

|

Compensation

|

|

Charles

E. Harris*

|

Richard

P. Shanley (1)

|

James

E. Roberts (1)

|

|

Douglas

W. Jamison (1)

|

W.

Dillaway Ayres

|

Dr.

Phillip A. Bauman

|

|

Dr.

C. Wayne Bardin

|

G.

Morgan Browne

|

Dugald

A. Fletcher

|

|

G.

Morgan Browne

|

Dugald

A. Fletcher

|

Charles

E. Ramsey

|

|

Charles

E. Ramsey

|

James

E. Roberts

|

|

|

*

Chairman until December 31, 2008.

(1)

Denotes the Chairman of the

Committee.

|

||

9

|

Nominating

|

Valuation

|

Independent Directors

|

|

Dr.

C. Wayne Bardin(1)

|

G.

Morgan Browne (1)

|

Dugald

A. Fletcher

(1)

|

|

W.

Dillaway Ayres

|

W.

Dillaway Ayres

|

W.

Dillaway Ayres

|

|

Dr.

Phillip A. Bauman

|

Dr.

C. Wayne Bardin

|

Dr.

C. Wayne Bardin

|

|

Richard

P. Shanley

|

Dr.

Phillip A. Bauman

|

Dr.

Phillip A. Bauman

|

|

Dugald

A. Fletcher

|

G.

Morgan Browne

|

|

|

Charles

E. Ramsey

|

Charles

E. Ramsey

|

|

|

James

E. Roberts

|

James

E. Roberts

|

|

|

Richard

P. Shanley

|

Richard

P. Shanley

|

(1) Denotes the Chairman of

the Committee.

Executive Committee. The Executive Committee

may meet from time to time between regular meetings of the Board of Directors

for strategic planning and to exercise the authority of the Board to the extent

provided by law. The Executive Committee did not meet as a separate

committee and did not act by unanimous written consent in 2008.

Audit Committee. The Audit Committee (i)

oversees all material aspects of our accounting and financial reporting

processes, internal control and audit functions; (ii) monitors the independence

and performance of our independent registered public accountants; (iii) provides

a means for open communication among our independent registered public

accountants, financial and senior management, and the Board; and (iv) oversees

compliance by us with legal and regulatory requirements.

The Audit

Committee operates pursuant to a written charter approved by our Board of

Directors. A current copy of the Audit Committee Charter of the

Company is available on our website

(http://www.tinytechvc.com/newsite/PDFs/Audit.pdf). The Audit

Committee Charter sets out the responsibilities, authority and duties of the

Audit Committee. The Audit Committee met four times and did not act

by unanimous written consent in 2008. The Audit Committee has

selected, and a majority of the Board of Directors has ratified,

PricewaterhouseCoopers LLP as the Company's independent registered public

accounting firm for the fiscal year ending December 31, 2009, subject to

shareholder approval.

Audit

Committee's Pre-Approval Policies

In 2008,

the Audit Committee of the Company has pre-approved all audit and non-audit

services provided by PwC to us. The Audit Committee's Pre-Approval

Policies and Procedures provide that the Audit Committee (or the Chairman

pursuant to delegated authority) must pre-approve all auditing services and

permitted non-audit services and that all such requests to provide services must

be submitted to the Audit Committee or the Chairman, as the case may be, by both

the independent auditor and the Chief Financial Officer.

The Audit

Committee has determined that the provision of non-audit services that were

provided during 2008 is compatible with maintaining PwC's independence in

performing audit services for the Company.

10

Audit

Committee Report

Our Audit

Committee presents the following report:

The Audit

Committee of the Company has performed the following functions: (i) the Audit

Committee reviewed and discussed the audited financial statements of the Company

with management, (ii) the Audit Committee discussed with the independent

auditors the matters required to be discussed by the Statements on Auditing

Standards No. 61, as amended, as adopted by the Public Company Accounting

Oversight Board in Rule 3200T, (iii) the Audit Committee received the written

disclosures and the letter from the independent auditors required by applicable

requirements of the Public Company Accounting Oversight Board regarding the

independent auditor's communications with the Audit Committee concerning

independence, and has discussed with the auditors the auditors' independence,

and (iv) based on the review and discussions, the Audit Committee recommended to

the Board of Directors of the Company that the audited financial statements be

included in the Company's Annual Report on Form 10-K for the past fiscal

year.

Respectfully,

Members

of the Audit Committee

Richard

P. Shanley (Chairman)

Dugald A.

Fletcher

W.

Dillaway Ayres

G. Morgan

Browne

James E.

Roberts

Compensation Committee. The Compensation

Committee (the "Committee") annually reviews and approves corporate goals and

objectives relevant to total compensation -- that is, changes in components of

total compensation, including base salary, bonus and equity incentive plan

compensation -- of the Chief Executive Officer and other executive officers,

evaluates their performance against these goals and objectives, and, based on

its evaluation, sets their total compensation. The Committee is

composed entirely of Independent Directors, as defined in the 1940 Act and under

the NASDAQ listing standards. Each of the committee members is also a

“non-employee director” as defined in Section 16 of the 1934 Act, and is an

“outside director,” as defined by Section 162(m) of the Internal Revenue Code of

1986 (the "Code"). The Committee also annually reviews benefits for

all employees. The details of the processes and procedures involved

in the establishment of executive compensation and benefits are described in the

Compensation Discussion & Analysis ("CD&A") beginning on page

17. The Committee met five times and acted by unanimous written

consent once in 2008.

The

Company's full Board ultimately makes the final decisions regarding the Chief

Compliance Officer's compensation as required by Rule 38a-1 under the 1940 Act

and also approves grants under the Equity Incentive Plan made by the Committee

for all employees.

11

The

Compensation Committee Charter is available on the Company's website

(http://www.tinytechvc.com/newsite/PDFs/Compensation.pdf).

Role

of Compensation Consultant

In 2008,

the Committee engaged Johnson Associates to advise it on relevant executive pay

and related issues. Mr. Roberts, the Chairman of the Committee, and

Ms. Forman, in her role as Director of Human Resources, provided information to

Johnson Associates regarding the role of each employee, our perceived

competition and the Committee's goals with respect to compensation in general

and specifically the granting of long-term and short-term equity incentive

awards. Mr. Jamison, our Chief Executive Officer, also participated

in conversations with Johnson Associates regarding the granting of long-term and

short-term equity incentive awards. During 2008, Johnson Associates

assisted the Committee by:

|

|

·

|

Reviewing

the Company's competitive market data with respect to private venture

capital firms, public companies with similar market capitalizations and

compliance professionals;

|

|

|

·

|

Providing

recommendations for the option awards granted to employees in 2008 and

proposing awards for grants in 2009;

and

|

|

|

·

|

Reviewing

the CD&A.

|

Compensation

Committee Interlocks and Insider Participation

There

were no Compensation Committee interlocks or insider participation on the

Committee in 2008.

All

members of the Committee are independent directors and none of the members are

present or past employees of the Company. No member of the Committee:

(i) has had any relationship with us requiring disclosure under Item 404 of

Regulation S-K under the 1934 Act; or (ii) is an executive officer of another

entity, at which one of our executive officers serves on the board of

directors.

Compensation Committee Report on

Executive Compensation

Our

Compensation Committee presents the following report:

The

Committee has reviewed and discussed the CD&A with management and has

recommended to the Board of Directors that the CD&A be included in this

Proxy Statement.

Respectfully,

Members

of the Compensation Committee

James E.

Roberts (Chairman)

Dugald A.

Fletcher

Charles

E. Ramsey

Dr.

Phillip A. Bauman

12

Nominating Committee. The Nominating Committee

acts as an advisory committee to the Board by identifying individuals qualified

to serve on the Board as directors and on committees of the Board, and to

recommend that the Board select the Board nominees for the next annual meeting

of shareholders. The Nominating Committee met once and did not act by

unanimous written consent in 2008.

The

Nominating Committee will consider director candidates recommended by

shareholders. In considering candidates submitted by shareholders,

the Nominating Committee will take into consideration the needs of the Board and

the qualifications of the candidate. The Nominating Committee may

also take into consideration the number of shares held by the recommending

shareholder and the length of time that such shares have been

held. To have a candidate considered by the Nominating Committee, a

shareholder must submit the recommendation in writing and must

include:

|

|

·

|

The

name of the shareholder and evidence of the person's ownership of shares

of the Company, including the number of shares owned and the length of

time of ownership;

|

|

|

·

|

The

name of the candidate, the candidate's resume or a listing of his or her

qualifications to be a director of the Company and the person's consent to

be named as a director if selected by the Nominating Committee and

nominated by the Board; and

|

|

|

·

|

If

requested by the Nominating Committee, a completed and signed director's

questionnaire.

|

The

shareholder recommendation and information described above must be sent to the

Company's Corporate Secretary, c/o Harris & Harris Group, Inc., 111 West

57th Street, Suite 1100, New York, New York 10019, and must be received by the

Corporate Secretary not less than 120 days prior to the anniversary date of the

Company's most recent annual meeting of shareholders or, if the meeting has

moved by more than 30 days, a reasonable amount of time before the

meeting.

The

Nominating Committee believes that the minimum qualifications for serving as a

director of the Company are that a nominee demonstrate, by significant

accomplishment in his or her field, an ability to make a meaningful contribution

to the Board's oversight of the business and affairs of the Company and have a

reputation for honest and ethical conduct. In addition, the

Nominating Committee examines a candidate's specific experience and skills, time

availability in light of other commitments, potential conflicts of interest and

independence from management and the Company. The Nominating

Committee also seeks to have the Board represent a diversity of

experience. We do not pay any third party a fee to assist in the

process of identifying and evaluating candidates. The Nominating

Committee evaluates all candidates for the Board based on the above

qualifications, regardless of whether the candidate was nominated by an officer,

Board member or shareholder.

13

The

Nominating Committee operates pursuant to a written charter approved by our

Board of Directors. The Nominating Committee Charter sets out the

responsibilities, authority and duties of the Nominating

Committee. The Nominating Committee Charter is available on our

website (http://www.tinytechvc.com/newsite/PDFs/Nominating.pdf).

Valuation Committee. The Valuation Committee

has the full power and authority of the Board in reviewing and approving the

valuation of our securities for reporting purposes, pursuant to our Valuation

Procedures that were established and approved by the Board of

Directors. The Valuation Committee met six times and did not act by

unanimous written consent in 2008.

Independent Directors

Committee. The Independent

Directors Committee has the responsibility of proposing corporate governance and

long-term planning matters to the Board of Directors, overseeing compliance and

making the required determinations pursuant to the 1940 Act. All of

the Independent Directors are members of the committee. The

Independent Directors Committee met four times and did not act by unanimous

written consent in 2008.

Executive

Officers

Our

executive officers who are not nominees for directors are set forth

below. Information relating to our executive officers who are

nominees for directors is set forth under "Election of Directors –

Nominees." Our executive officers are elected to serve until they

resign or are removed, or are otherwise disqualified to serve, or until their

successors are elected and qualified.

Daniel B.

Wolfe. Mr. Wolfe, age 32, has served as President and Chief

Operating Officer since January 1, 2009, as Chief Financial Officer and as a

Managing Director since January 2008 and as Treasurer since May

2008. He served as Principal from January 2007 to January 2008, as

Senior Associate from January 2006 to January 2007, and as Vice President from

July 2004 to January 2008. Since January 1, 2009, he is President and

a Director of Harris & Harris Enterprises, Inc., a wholly owned subsidiary

of the Company. He is a director of Laser Light Engines, Inc., and of

SiOnyx, Inc., privately held nanotechnology-enabled companies in which we have

investments. Prior to joining us, he served as a consultant to

Nanosys, Inc. (from 2002 to 2004), to CW Group (from 2001 to 2004) and to

Bioscale, Inc. (from January 2004 to June 2004). He was graduated

from Rice University (B.A., Chemistry), where his honors included the Zevi and

Bertha Salsburg Memorial Award in Chemistry and the Presidential Honor Roll, and

from Harvard University (A.M., Ph.D., Chemistry), where he was an NSF

Predoctoral Fellow.

At our

request, Mr. Wolfe was interim Chief Executive Officer of Evolved Nanomaterial

Sciences, Inc. ("ENS"), one of our portfolio companies, from July 1, 2007, to

September 28, 2007. ENS filed for Chapter 7 bankruptcy on September

30, 2007.

Alexei A.

Andreev. Mr. Andreev, age 37, has served as an Executive Vice

President and as a Managing Director since March 2005. From 2002 to

March 2005, he was an Associate with Draper Fisher Jurvetson, a venture capital

firm. He is a director of CSwitch, Inc., of D-Wave Systems, Inc., and

of Xradia, Inc., privately held nanotechnology-enabled companies in which we

have investments. He was graduated with honors in

Engineering/Material Sciences (B.S.), in Solid State Physics (Ph.D.) from Moscow

Steel and Alloys Institute and from Stanford Graduate School of Business

(M.B.A.).

14

Michael A.

Janse. Mr. Janse, age 40, has served as an Executive Vice

President and as a Managing Director since April 2007. From January

2007 to April 2007, he was a Principal with ARCH Venture Partners and was an

Associate from June 2002 to January 2007, following earlier roles as an intern

and then consultant. He concentrated on investment opportunities in

advanced semiconductor products, nanotechnology, and novel

materials. He is a director of Adesto Technologies Corp., of

Innovalight, Inc., and of Laser Light Engines, Inc., privately held

nanotechnology-enabled companies in which we have investments. He was

graduated from Brigham Young University (B.S., Chemical Engineering) and The

University of Chicago (M.B.A.).

Sandra Matrick Forman,

Esq. Ms. Forman, age 43, has served as General Counsel, as

Chief Compliance Officer and as Director of Human Resources since August 2004,

and as our Corporate Secretary since January 1, 2009. From 2001 to

2004, she was an Associate at Skadden, Arps, Slate, Meagher & Flom LLP,

in the Investment Management Group. She was graduated from New York

University (B.A.), where her honors included National Journalism Honor Society,

and from the University of California Los Angeles (J.D.), where her honors

included Order of the Coif and membership on the Law Review. She is

currently a member of the working group for the National Venture Capital

Association model documents.

Misti Ushio. Ms.

Ushio, age 37, has served as a Vice President and Associate since May 2007. From

June 2006 to May 2007, Ms. Ushio was a Technology Licensing Officer at Columbia

University. From May 1996 to May 2006, she was employed by Merck

& Co., Inc., most recently as a Senior Research Biochemical Engineer

with the Bioprocess R&D group. She is a member of the Nanotechnology

Institute Corporate Advisory Group of Philadelphia, Pennsylvania. She

was graduated from Johns Hopkins University (B.S., Chemical Engineering), Lehigh

University (M.S., Chemical Engineering) and University College London (Ph.D.,

Biochemical Engineering).

Patricia N. Egan. Ms. Egan,

age 34, has served as Chief Accounting Officer, as a Vice President and as

Senior Controller since June 2005. From June 2005 to December 2005,

from August 2006 to March 2008 and from May 2008 to December 31, 2008, she

served as an Assistant Secretary. Since January 2006, she has served

as Treasurer and as Secretary of Harris & Harris Enterprises, Inc., a wholly

owned subsidiary of the Company. From 1996 to 2005, she served as a

Manager at PricewaterhouseCoopers LLP in its financial services group. She was

graduated from Georgetown University (B.S., Accounting), where her honors

included the Othmar F. Winkler Award for Excellence in Community

Service. She is a Certified Public Accountant.

15

Mary P. Brady. Ms. Brady, age 47, has

served as a Vice President and as Controller since November

2005. From November 2005 to March, 2008, she served as an Assistant

Secretary. From 2003 through 2005, she served as a senior accountant

at Clarendon Insurance Company in its program accounting group. She

was graduated Summa Cum Laude from Lehman College (B.S.,

Accounting). She is a Certified Public Accountant.

Related Party

Transactions

In the ordinary course of business, the

Company enters into transactions with portfolio companies that may be considered

related party transactions. Other than these transactions, for the

fiscal year ended December

31, 2008, there were no transactions, or

proposed transactions, exceeding $120,000 in which the registrant was or is a

participant in which any related person had or will have a direct or indirect

material interest.

In order

to ensure that the Company does not engage in any prohibited transactions with

any persons affiliated with the Company, the Company has implemented procedures,

which are set forth in the Company's Compliance Manual. Our Audit

Committee must review in advance any "related party" transaction, or series of

similar transactions, to which the Company or any of its subsidiaries was or is

to be a party, in which the amount involved exceeds $120,000 and in which such

related party had, or will have, a direct or indirect material

interest. The Board of Directors reviews these procedures on an

annual basis.

In

addition, the Company's Code of Conduct for Directors and Employees ("Code of

Conduct"), which is signed by all employees and directors on an annual basis,

requires that all employees and directors avoid any conflict, or the appearance

of a conflict, between an individual's personal interests and the interests of

the Company. Pursuant to the Code of Conduct, which is available on

our website at http://www.tinytechvc.com/newsite/PDFs/ Conduct.pdf, each

employee and director must disclose any conflicts of interest, or actions or

relationships that might give rise to a conflict, to the Chief Compliance

Officer. The Independent Directors Committee is charged with

monitoring and making recommendations to the Board of Directors regarding

policies and practices relating to corporate governance. If there

were any actions or relationships that might give rise to a conflict of

interest, such actions or relationships would be reviewed and pre-approved by

the Board of Directors.

Section 16(a) Beneficial

Ownership Reporting Compliance

Section

16(a) of the 1934 Act requires our officers and directors, and persons who own

more than 10 percent of our common stock, to file reports (including a year-end

report) of ownership and changes in ownership with the Securities and Exchange

Commission (“SEC”) and to furnish the Company with copies of all reports

filed.

Based

solely on a review of the forms furnished to us, or written representations from

certain reporting persons, we believe that all persons who were subject to

Section 16(a) in 2008 complied with the filing requirements.

16

EXECUTIVE

COMPENSATION

Compensation Discussion

& Analysis

Overview

This Compensation Discussion &

Analysis ("CD&A") describes the material elements of compensation awarded

to, earned by, or paid to our principal executive officer, principal financial

officer and the three most highly paid executive officers (other than the

principal executive officer and the principal financial officer) serving as such

at the end of 2008 (the "named executive officers"), who in 2008 held the

following roles:

|

|

·

|

Charles

E. Harris, Chairman, Chief Executive Officer and a Managing

Director;

|

|

|

·

|

Douglas

W. Jamison, President, Chief Operating Officer and a Managing

Director;

|

|

|

·

|

Daniel

B. Wolfe, Chief Financial Officer and a Managing

Director;

|

|

|

·

|

Alexei

A. Andreev, an Executive Vice President and a Managing Director;

and

|

|

|

·

|

Michael

A. Janse, an Executive Vice President and a Managing

Director.

|

This

CD&A focuses on the information contained in the following tables and

related footnotes and narrative for primarily the last completed fiscal

year. We also describe compensation actions taken before or after the

last completed fiscal year to the extent it enhances the understanding of our

executive compensation for the last completed fiscal year. Pursuant

to our Compensation Committee's written charter, the Committee oversees the

design and administration of our executive compensation program. The

Committee ensures that the total compensation paid to our executive officers is

fair, reasonable and competitive.

Compensation

Program Objectives and Philosophy

In General. The objectives of the

Company's compensation program are to:

|

|

·

|

attract,

motivate and retain employees by providing market-competitive compensation

while preserving company resources;

|

|

|

·

|

maintain

our leadership position as a venture capital firm specializing in

nanotechnology and microsystems;

and

|

|

|

·

|

align

management's interests with shareholders'

interests.

|

To

achieve the above objectives, the Committee designed a total compensation

program in 2008 for our named executive officers composed of a base salary, a

bonus opportunity and equity awards in the form of stock options. The

Committee believes that the equity component of compensation is a crucial

component of our compensation package. Short-term and long-term

vesting stock options are utilized for short-term and long-term incentive, and

to make the Company's compensation program more competitive, particularly with

compensation programs of private partnerships that, unlike the Company, are able

to award carried interests taxable as long-term gains and to permit

co-investments in deals. Such private partnerships also are more

easily able to pay cash bonuses because of their fee structure and because they

do not have the expenses associated with being publicly traded. Our

executive compensation programs and related data are reviewed throughout the

year and on an annual basis by the Committee to determine whether the

compensation program is providing its intended results.

17

The

Committee believes that retention is especially important for a company of our

size (11 employees) and the specialized nature of our business. Our

employees have been selected and trained to support our focus on investment in

companies enabled by nanotechnology and microsystems, and the administration

necessary to comply with the specialized regulatory environment required of a

business development company. Our nanotechnology focus requires

highly specialized scientific knowledge. There are relatively few

individuals who have both such scientific knowledge and venture capital

experience. Additionally, our business development company structure

requires specialized management, administrative, legal and financial knowledge

of our specific regulatory regime. Because there are very few

business development companies, it would be difficult to find replacements for

certain executive, legal and financial positions.

Competitive

Market. For our investment team members, the competition for

retention and recruitment is primarily private venture capital firms, hedge

funds, venture-backed nanotechnology companies and, to a lesser extent,

investment banking firms. Venture capital funds commonly pay at least

20 percent of the profits (including capital gains), or carried interest, of

each newly raised fund to the management firm, which awards interests to its

partners and employees. For our legal and accounting professionals,

in addition to the foregoing, the competition is other public companies without

regard to industry, asset management companies and legal and accounting

firms. The Company does not have a readily identifiable peer group,

because most business development companies are not early stage venture capital

companies, and most other early stage venture capital companies are not publicly

traded. Thus, we do not emphasize the use of peer comparison groups

in the design of our compensation program. As one factor in

determining compensation, we utilize compensation comparables, on an individual

basis, to the extent that they seem appropriately analogous, as provided to the

Committee by an independent compensation consultant.

Compensation Process. On an annual basis, the

Committee reviews and approves each element of compensation for each of our

executive officers, taking into consideration the recommendation of our Chief

Executive Officer (for compensation other than his own, which for Mr. Harris was

subject to an employment agreement as discussed below) in the context of the

Committee's compensation philosophy, to ensure that the total compensation

program and the weight of each of its elements meets the overall objectives

discussed above. For the Chief Compliance Officer, the Committee

recommends her compensation to the full Board, for approval by at least a

majority of the non-interested directors (as defined in Section 2(a)(19) of the

1940 Act).

In 2008,

an independent compensation consultant, Johnson Associates, supplied the

Committee with market data on all positions. The information provided

for 2008-2009 was for private equity firms, venture capital firms and investment

management firms, and was adjusted to reflect compensation for a venture capital

firm with $100 – $200 million in assets under management. Data was

also provided for public companies with comparable market

capitalizations. Further data was provided for 1940 Act compliance

personnel (collectively, the "Identified Group"). The independent

consultant did not identify the names of companies included in the Indentified

Group. The Committee considers recommendations from the Chief

Executive Officer regarding salaries, along with factors such as individual

performance, current and potential impact on Company performance, reputation,

skills and experience. When determining compensation, the Committee

considers the importance of retaining certain key officers whose replacement

would be challenging owing to the Company's status as a 1940 Act company and

owing to its nanotechnology specialty. The Committee also considers

the highly specialized nature of certain positions in determining overall

compensation. In 2008, a key factor in compensation was the increasing

importance of retention of key employees owing to the retirement of Mr. Harris

on December 31, 2008, pursuant to the Company’s Executive Mandatory Retirement

Plan.

18

When

addressing executive compensation matters, the Committee generally meets outside

the presence of all executive officers except our Chief Executive Officer and

our General Counsel, each of whom leaves the meeting when his/her compensation

is reviewed.

Regulatory

Considerations. The 1940 Act permits business development

companies to either pay out up to 20 percent of net income after taxes through

the implementation of a profit-sharing plan or issue up to 20 percent of shares

issued and outstanding through implementation of a stock option

plan. The exercise price of stock options may not be less than the

current market value at the date of issuance of the options.

We have

applied for exemptive relief from the SEC to permit us to issue restricted stock

to employees pursuant to the Harris & Harris Group, Inc. 2006 Equity

Incentive Plan (the "Stock Plan") and to permit non-employee directors to

participate in the Stock Plan. Until such time as we receive such

exemptive relief and such provisions are approved by shareholders, we will not

issue any shares of restricted stock, and our non-employee directors will not

participate in the Stock Plan.

The

Company has been informed that the SEC has commenced its review of the exemptive

application, and we have received and responded to formal written

comments. We cannot, however, evaluate whether or when an order

regarding our application for the relief requested may be granted.

We have

also designed our Stock Plan with the intention that awards made thereunder

generally will qualify as performance-based compensation under Section 162(m) of

the Code, but we reserve the right to pay amounts thereunder that do not qualify

as such performance-based compensation if we determine such payments to be

appropriate in light of our compensation objectives from time to

time. Section 162(m) of the Code generally disallows a tax deduction

to publicly held companies for compensation paid to their chief executive

officer or any of their three other most highly compensated executive officers

(other than the chief financial officer), to the extent that compensation

exceeds $1 million per covered officer in any fiscal year. However,

if compensation qualifies as performance-based, the limitation does not

apply.

19

Our

status as a regulated investment company under Subchapter M of the Code makes

the deductibility of our compensation arrangements a much less important factor

for the Committee to consider than it would be if we were an operating

company. Under Subchapter M, the Company cannot deduct operating

expenses from its long-term capital gains, which are its most significant form

of income. The Company presently has more operating expenses than it

can deduct for tax purposes, even before equity compensation.

Compensation

Components

The principal elements of our executive

compensation program for 2008 are base salary, bonus, equity and other benefits

and perquisites. The Committee believes that each element is

essential to achieve the Company's objectives as set forth above. The

Committee is mindful of keeping cash compensation expenses at as low a level of

total operating expenses as is consistent with maintaining the Company's

competitiveness versus private venture capital funds while meeting the expenses

of complying with the regulatory requirements of a publicly traded

company. Therefore, the equity component of compensation is key to

keeping overall compensation competitive, while making prudent use of the

Company's resources.

Base Salaries. We

recognize the need to pay our named executive officers, and other employees, a

competitive annual base salary. We review base salaries for our named

executive officers annually. In 2008, the Committee compared salary

ranges for all executive officers against the Identified Group. Base

salaries are generally adjusted annually for inflation and also based on changes

in the marketplace and an executive's individual performance, salary position

among peers, career growth potential and/or a change in

responsibilities. Other than Mr. Harris, whose salary was set

pursuant to his employment agreement as described below, all of the named

executive officers are Managing Directors and are paid the same base

salary.

Effective January 1, 2008, the base

salary of Daniel B. Wolfe was increased from $210,000 in 2007 to $274,770 in

2008, because of his promotion from Vice President to Chief Financial Officer

and a Managing Director. This increase puts his base salary on parity

with the other Managing Directors.

All other named executive officers

received cost of living adjustments in 2008. There presently are no

contemplated increases in base salary for any of the named executive officers in

2009, other than cost-of-living adjustments.

Bonuses. We have

been informed by the Committee’s independent compensation consultant that

historically our overall compensation has not always been competitive for our

named executive officers because we have not always paid bonuses. If

the named executive officers, however, do not receive sufficient cash from the

exercise and sale of stock options in a year to provide market-competitive total

compensation, as determined by the Committee, and based on advice from the

independent compensation consultant, the Committee may pay the named executive

officers cash bonuses. In 2008, the named executive officers,

exclusive of Mr. Harris who retired on December 31, 2008, each received a

$75,000 bonus based on data obtained from the compensation

consultant. The Committee believes that retention of key employees is

crucial because of the specialized nature of our business as described more

fully below. Additionally, the Committee has considered that, owing

to the retirement of Mr. Harris, the importance of retaining the other team

members has increased. Based on market conditions, our cash position

and the size of our assets, the Committee may exercise its discretion not to

award bonuses that are market competitive.

20

In 2008, we learned from the

compensation consultant that current market conditions and the credit crisis

have reduced the overall compensation paid to the employees of the Identified

Group, and bonuses were determined accordingly. If such market

conditions continue throughout 2009, our total compensation may be more

competitive in 2009, even without cash bonuses or the exercise of stock

options.

Equity Incentive

Awards.

In General

Commencing

in 2006, we have provided the opportunity for our named executive officers and

other employees to earn long-term and short-term equity incentive

awards. Equity incentive awards in the form of options potentially

generate cash for the Company that can be used for portfolio company investments

and for working capital.

Long-Term

Equity Incentive Awards

The

long-term equity incentive awards provide employees with the incentive to stay

with us for long periods of time, which in turn provides us with greater

stability. In 2008, all options granted expired in nine to ten years

and were considered long-term equity incentive awards. Long-term

equity incentive awards are meant to substitute for carried interest that our

investment professionals would receive were they employed by private-sector

venture capital firms, which typically pay at least 20 percent of profits before

any taxes. Further, that carried interest is usually in the form of

long-term capital gains, not ordinary income. The Committee believes

that strategically timed awards of restricted stock are also important to

ensuring the retention, stability and desired succession of executive talent,

but the Company is not permitted to grant awards of restricted stock unless the

Company receives an exemptive order from the SEC to do so. On July

11, 2006, we filed an application with the SEC to obtain such exemptive relief

(as described above) and the Company has responded to comments from the SEC on

the application. If we receive the exemptive relief, the Committee

will not grant any awards of restricted stock unless an amended or new Stock

Plan providing for restricted stock awards is approved by

shareholders. It is currently anticipated that such awards would be

long term.

Short-Term

Equity Incentive Awards

Short-term

equity incentive awards help to motivate employees in the short

term. Without cash bonuses or cash retained through the exercise and

sale of short-term options, the Committee's independent compensation consultant

has advised that certain key positions are not competitive when compared with

the Identified Group. Short-term equity incentive awards also permit

each executive officer to increase his/her ownership in Company stock, pursuant

to minimum share ownership guidelines established by our

Board. Short-term vesting periods also have the potential of

generating cash for the Company in the short term, through the purchase of stock

in the course of the exercise of options that can be used for making venture

capital investments and for working capital. In 2009, it is

anticipated that 75 percent of option awards will be short-term awards that

expire within two years.

21

Awards

Under the Stock Plan

In

accordance with the Stock Plan, which was approved by shareholders at the 2006

Annual Meeting of Shareholders, the Committee can issue options from time to

time for up to 20 percent of the total shares of stock issued and

outstanding. Thus, the number of shares of stock able to be reserved

for the grant of awards under the Stock Plan will automatically increase (or

decrease) with each increase (or decrease) in the number of shares of stock

issued and outstanding. The Board intends to increase the number of

shares reserved for stock option grants (currently 5,171,915) from time to time

as the number of outstanding shares increases. The Committee may

grant awards under the Stock Plan to the full extent permitted at the time of

each grant in order to compete with the Identified Group by retaining the

specially qualified and trained personnel that have been carefully recruited and

developed for the Company's specialized business. Because our primary

competitors are organized as private partnerships, they do not have the overhead

of a publicly traded company. As a consequence, unlike the Company,

they can afford for cash compensation to be a larger percentage of their total

expenses. Unlike us, they are not prohibited from paying out at least

20 percent of their profits to key employees, primarily in the form of long-term

capital gains. They also, unlike us, are permitted to grant their

employees co-investment rights.

Under the

Stock Plan, no more than 25 percent of the shares of stock reserved for the

grant of the awards under the Stock Plan may be restricted stock awards at any

time during the term of the Stock Plan. If any shares of restricted

stock are awarded, such awards will reduce on a percentage basis the total

number of shares of stock for which options may be awarded. If we do

not receive exemptive relief from the SEC to issue restricted stock, all shares

granted under the Stock Plan must be subject to stock options. If we

were to receive such exemptive relief and were to issue the full 25 percent of

the shares of stock reserved for grant under the Stock Plan as restricted stock,

no more than 75 percent of the shares granted under the Stock Plan could be

subject to stock options. No more than 1,000,000 shares of our common

stock may be made subject to awards under the Stock Plan to any individual in

any year.

On March

19, 2008, the Committee and the full Board of Directors of the Company approved

a grant of individual Non-Qualified Stock Option ("NQSO") awards for certain

officers and employees of the Company. Options to purchase a total of 348,032

shares of stock were granted with vesting periods ranging from March 2009 to

March 2012 and with an exercise price of $6.18, which was the closing volume